Finding The Best Car Insurance For Your Situation

5 Mins Read

Published on: 26 August 2021

Last Updated on: 15 January 2025

toc impalement

You will find that when it comes to renewing car insurance, many people are lazy and do not shop around to get the best deal. They wait for their renewal notice and then go with the same firm, even when that insurance company would increase the price.

The truth is, you can make some excellent savings when you shop around for car insurance and compare all the offerings available from the many insurance companies in Thailand. Below are some tips to help you get the best deal possible and ensure you save money on your car insurance premiums this year.

Ask Your Current Insurer For A Renewal Quote

One of the first things you will want to determine is how much your current insurance company will charge to renew your policy. They will often not give you the best price in the first quote you receive, but it will give you an idea of the charges you are looking at, whether you choose first-class or second-class (ประกันภัย รถยนต์ 2). Once you have an idea of the cost you are looking at, you can start your search for other insurance providers to compare costs.

Find Reputable Insurance Companies

You will want to make a list of potential companies you can contact regarding car insurance, which will help you with your search. Once you have as many reputable companies on your list as you can find, you will then want to do some digging into their online reputations.

You can get a lot of information about a company by looking at their online reviews on independent websites and see how previous customers thought about their interactions with the companies in question. You can use this to whittle down your list until you have a handful of insurance providers left, and then you can contact them and ask them for a quote.

Asking For A Quote

You will not need to contact the companies left on your list, one at a time asks them for a quote for your car insurance. They will have set questions that they ask, such as:

- How old is your vehicle?

- Have you had any insurance claims in the last three years?

- How long have you been driving?

- Where did you get your driving license?

- Has the vehicle been in any accidents?

- What is the value of your vehicle?

When you have answered all the questions each company has, they will then give you an accurate quote for your car insurance. However, you may have questions for them, so ensure you ask everything you want to know. It is also worth keeping in mind you will get a better deal if you pay for your insurance outright rather than paying for it monthly. You will want to get each company to email the car insurance quote to you, making going through them later an easier task.

Making Your Decision

Once you have contacted all the companies and have received their quotes, you can then sit down and compare them to see which one is the best. Do not rush your decision, and before deciding which one to use, head back to your existing insurance provider and see if they can match or beat any of the quotes you have received.

With the tips mentioned above, you should be able to decide which quote is best and choose your car insurance provider for the next year.

If you want to switch your car insurance provider, then make sure to follow our guide by going here.

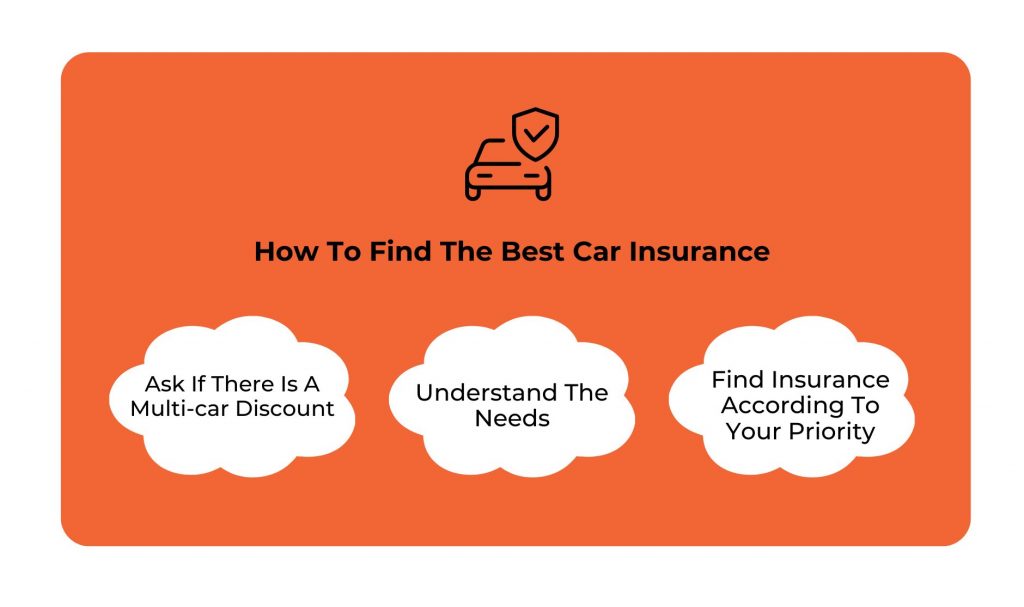

How To Find The Best Car Insurance

We have discussed three of the most important aspects of finding the best car insurance for yourself. However, we are not done yet. In fact, we are yet to go over some points.

Points that will teach you how to find the best car insurance on a budget. These points are easy to follow and can really help you understand what you need.

Therefore, let’s go as we take you on a journey to understand some tips and tricks for finding the right car insurance for yourself and your family.

Ask If There Is A Multi-car Discount

The foremost thing that you need to do is to ask about the overall extent of the coverage and if the company is willing to provide a multi-car discount in case you are insuring more than one car.

This is very important as it can help you save up some extra moolah. Not only that, but this is a standard practice that almost all modern insurance companies offer.

Understand The Needs

The second thing that you need to understand is your own needs. The insurance broker would generally try to sell you the most expensive and extensive insurance that they have. That is their job. However, you need to be smart and stay true to yourself.

Sit with your family or financial advisor and assess your needs and wants. This will help you understand what you actually want or need in life. Hence, ensure that you have clarity and proceed accordingly.

Find Insurance According To Your Priority

Priorities differ. That is okay. However, they should not differ so much that it creates a problem for you. Sit and do your research and assess your priorities. This will not be an easy or a straightforward task.

Understand what kind of coverage you want and the total money you want to or can spend on it. These two are very important details that you need to figure out. Otherwise, you will run into trouble.

Subsequently, find the insurance company that fits your bill and proceed accordingly. This will help you approach the topic with more sense of clarity.

The Final Note

In the end, you need to remember that finding the right car insurance for yourself is not a straight road. Therefore, you cannot approach the section in a headstrong manner. In fact, you need to have some sense of flexibility in order to find the right one for you.

Therefore, ensure that you are ready for all the legwork that comes your way. Otherwise, you will not be able to learn how to find the best car insurance for yourself. Do let us know if you liked this piece of content and keep following our page for more such content.

Read Also:

Comments Are Closed For This Article