Form 940 – How To File? And Is It Important?

18 August 2023

5 Mins Read

toc impalement

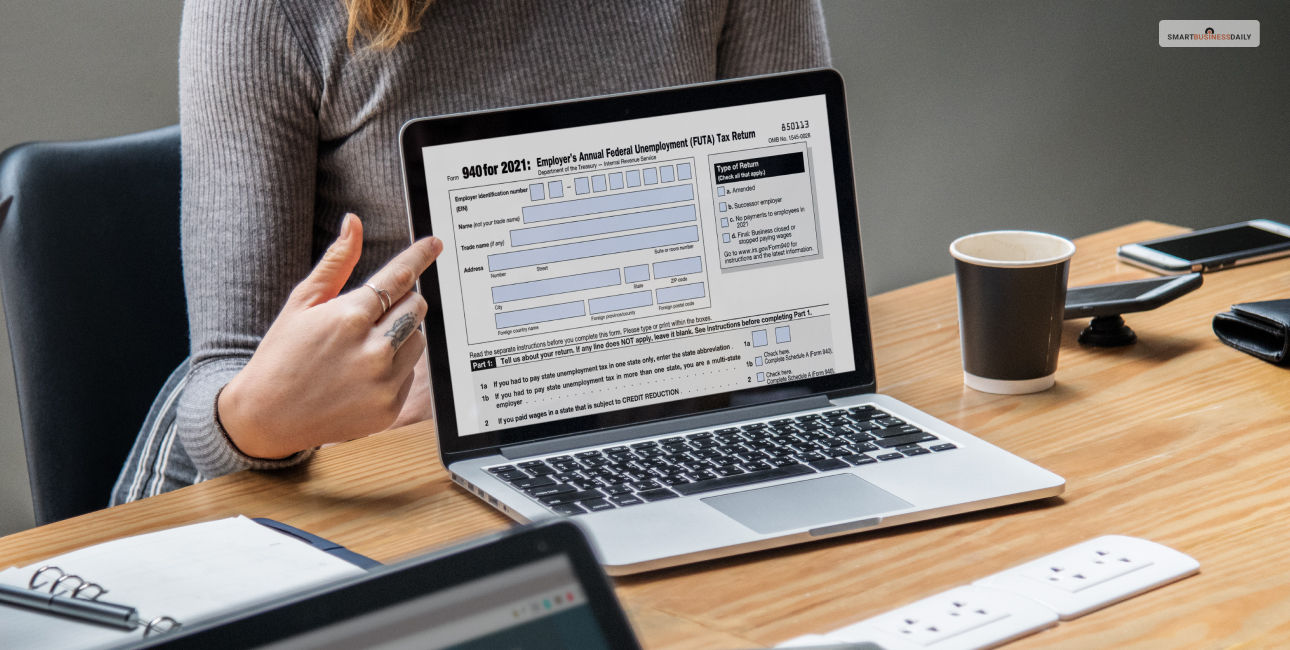

Are you an employer who needs to pay a federal unemployment tax? Then, you might have to complete Form 940 and file it with the IRS each year. It is mainly used to report FUTA payments made during the course of a financial year. There might be an outstanding FUTA payment as well.

FUTA is the abbreviation for Federal Unemployment Tax Act. Businesses mostly pay this tax, and employee wages are not sacrificed here. Moreover, FUTA taxes assist in covering unemployment expenses. If you want to gain a complete idea of Form number 940 and FUTA tax, delve deep into the article.

What Is Form 940?

If you are liable to pay FUTA taxes, the IRS Form 940 must be paid. It is the tax form one must pay every year, although there might be quarterly deposits to FUTA tax. It is quite different other tax forms, owing to a variety of reasons.

Employers might have to report the distinction between the unemployment taxes they have already paid and the previous year’s owed amount. In order to understand how the 940 Form works, you might have to check other relevant details.

Does Everybody Have To File This Form?

As per the IRS, one must make FUTA payments as well as file Form 940 in case any of this is true:

- During an entire year, you paid your employees a wage of more than $1,500 or equivalent.

- There was at least an employee for some portion in a day in 20 weeks or more. It can either be a part-time or full-time endeavor.

However, you do not have to worry about filling out the 940 Form if you only hire independent contractors. The reason is that, then, you don’t have to pay unemployment taxes on the wages. Then, you might have to fill out Form 1099-NEC for every single contractor.

When To Fill Out Form 940?

FUTA payments are due on each calendar quarter. Contrastingly, one might have to submit the 940 Form once every year. It remains due on 31st January of each year. However, if the said date is a holiday or a weekend, employers might file the form on the coming business day.

Failing to do so might charge a penalty of over 5%, which will increase every month. While the form is due only once every year, payments must be made throughout the year. Businesses that owe $500 annually in FUTA taxes should make quarterly payments to steer clear of penalties.

To file a Form 940 and make online payments, employers might use the IRS EFW system or Electronic Funds Withdrawal. In case they mail the documents, the IRS address is dependent on their location. Further, their mode of paying the tax is also a significant consideration.

That being said, the filing addresses might alter from time to time. Thus, it is significant to track the IRS web page prior to mailing the 940 Form.

Steps To Fill Out The 940 Form

The 940 Form is a 2-page form presented by the IRS. At first, you have to fill out certain basic data about your business. This will include your EIN or employer identification number, business name, and address. Remember, you cannot write a different tax identification number in the section of EIN.

Step 1

The first step includes the IRS telling you how many states you actually pay unemployment taxes. In-Line 1A, you will specify if you pay the taxes in just one state, whereas Line 1B is dedicated to multi-state employers. On checking the boxes in Lines 2 and 1B, fill out Schedule A in Form 940.

Step 2

Step 2 is for calculating the FUTA tax liabilities. In Line 3, you might have to specify what payments you make to employees. On the other hand, you have to state your FUTA-exempt payments on Line 4. In lines 6 to 8, you might have to calculate the total taxable wages in FUTA.

Step 3

You might have to make adjustments that are considered in your state’s rule for unemployment taxes. If you have already recorded your FUTA wages in the past section, multiply 0.0054 from Line 7. Whatever amount you get, write it down in Line 9. Crawl back again to Part 4.

If they aren’t already mentioned on the worksheet, make sure you calculate all your adjustments and note them down.

Step 4

In Line 12, you might have to add Lines 8 to 11 and then calculate your entire FUTA tax. In Line 13, the form might ask you to fill out FUTA payments you have already made this year. Lines 14 as well as 15 determine if you have an outstanding balance to pay.

Step 5

Remember the amount you wrote down in Line 12? If the amount exceeds $500, use 16A-D boxes and report the FUTA liabilities you own for every quarter. Ensure that all these additions must be clearly stated in Line 12 to refrain from penalties.

How Is Form 940 Different From Form 941?

The foremost difference between Forms 940 and 941 is their reported tax liability. While the former reports FUTA taxes, Form 941 is all about income tax, Medicare tax, and Social Security Tax withholdings. Additionally, the 940 form is filed once every year, whereas you need to report Form 941 quarterly.

Secondly, the deadline for filing both these forms is different. January 31 is the due date for Form 940. On the other hand, the dates for filing Form 941 vary since it is filed quarterly. Both these forms are related to payroll taxes but have different taxes reported.

Thus, it is necessary for employers to ensure that they file the right form precisely. Also, it is significant to act right on time if employers want to refrain from paying fines or penalties by the IRS.

The Bottom Line

Form 940 is a crucial form that every employer must fill out. With the above-mentioned steps, it is not a challenge to fill it out. However, if you are unsure about reporting your taxes correctly in the form, seek help from professionals.

It is the duty of the employer to keep track of any unemployment taxes. So, that was all about Form 940. Liked what you read? Keep following us and discover some amazing content that is highly relevant for almost all niches.

Also, don’t forget to drop your comments below and let us know what you think about it.

Read Also:

Comments Are Closed For This Article