Understanding The Maritime Tax Landscape

3 Mins Read

Published on: 20 October 2023

Last Updated on: 24 January 2025

toc impalement

Seatax UK, a comprehensive term that encompasses various taxes and fees related to maritime activities, plays a significant role in the United Kingdom’s maritime industry. This article explores the world of Seatax UK, shedding light on the different components, regulations, and their impact on the maritime sector.

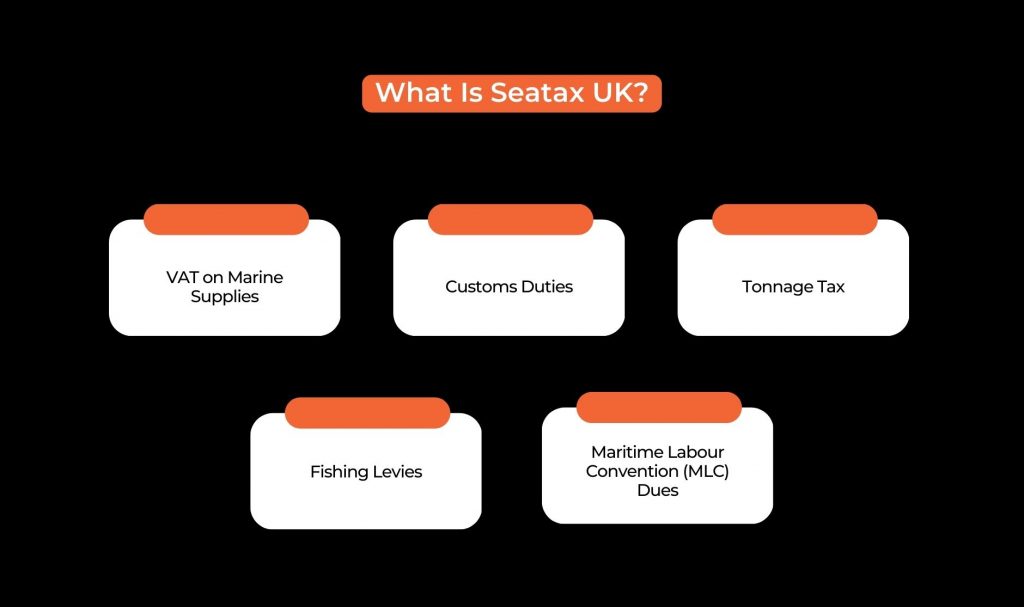

What Is Seatax UK?

Seatax UK is a collective term used to describe the various taxes and levies associated with maritime activities in the UK. These taxes primarily revolve around shipping, fishing, and other marine-related industries. The most notable components of Seatax include:

- VAT on Marine Supplies: Value-Added Tax (VAT) is applicable to the purchase of marine supplies, including fuel, equipment, and maintenance services for ships. The standard rate of VAT is 20%, although some supplies may be eligible for reduced rates, depending on their purpose.

- Customs Duties: Customs duties apply to the import and export of goods related to the maritime industry. The UK’s departure from the EU has led to changes in customs procedures, affecting the shipping and trading of maritime goods.

- Tonnage Tax: The UK has a tonnage tax regime that allows shipping companies to pay tax based on the net tonnage of their vessels rather than their profits. This system provides stability and tax incentives to the shipping industry, promoting the growth of the UK’s merchant fleet.

- Fishing Levies: Fisheries and fishing activities are subject to specific levies and regulations. These may include licensing fees, quotas, and conservation measures aimed at ensuring sustainable fishing practices.

- Maritime Labour Convention (MLC) Dues: UK-registered vessels and their owners are subject to MLC dues, which fund the certification and inspection services provided to maintain international labor standards for seafarers.

Related: The Tax Benefits Of Your 401(k) Plan: Is 401k Tax Deductible?

Impact On The Maritime Industry

Seatax plays a significant role in shaping the UK’s maritime industry:

- Economic Impact: Seatax generates revenue for the UK government, which is used for various purposes, including maintaining ports, ensuring safety at sea, and regulating the maritime sector.

- Incentives for Shipping Companies: The tonnage tax system has been instrumental in attracting shipping companies to register in the UK, boosting the country’s merchant fleet and supporting the maritime economy.

- Environmental Regulation: Seatax can also serve as a tool for encouraging sustainable practices within the maritime sector, including cleaner and more efficient vessel operations.

- Challenges and Adaptation: The UK’s departure from the EU has introduced complexities and challenges for businesses involved in maritime trade, necessitating adaptations to new customs procedures and trade regulations.

Tax treaties

Another important point that one needs to remember is the role of taxation treaties. In other words, tax treaties are laws or pacts decided between states. This also plays a major role as it determines the overall taxation.

Then again, factoring these in really complicates the overall understanding of maritime taxation laws. Hence, making it one of the most important details that you could go for.

Therefore, if you are looking to understand maritime tax, you need to understand the role of international relationships between countries play and how they affect the overall ecosystem to a great extent.

Conclusion

Seatax is a complex yet crucial aspect of the UK’s maritime industry. It encompasses various taxes, fees, and regulations that affect shipping, fishing, and related maritime activities. Understanding the components of Seatax and their impact on the industry is essential for businesses and individuals involved in maritime affairs. As the maritime sector continues to evolve and adapt to changing regulations, staying informed about Seatax is critical for success and compliance in this dynamic environment.

Do leave us feedback if you like this piece of content, and please follow us for more such content on business and wealth management. Thank you, and have a great day ahead.

Read Also:

Comments Are Closed For This Article