Why Your Credit Score Matters More Than You Think

3 Mins Read

Published on: 28 April 2023

Last Updated on: 17 February 2025

toc impalement

In the world of finance, a good credit score is essential for many aspects of life, including getting a loan, renting an apartment, or even finding a job.

However, many individuals underestimate the importance of having a good credit score or fail to understand why it matters so much.

In this blog post, we will discuss the underlying reasons why your credit score matters more than you think and why it should be a higher priority in your financial life.

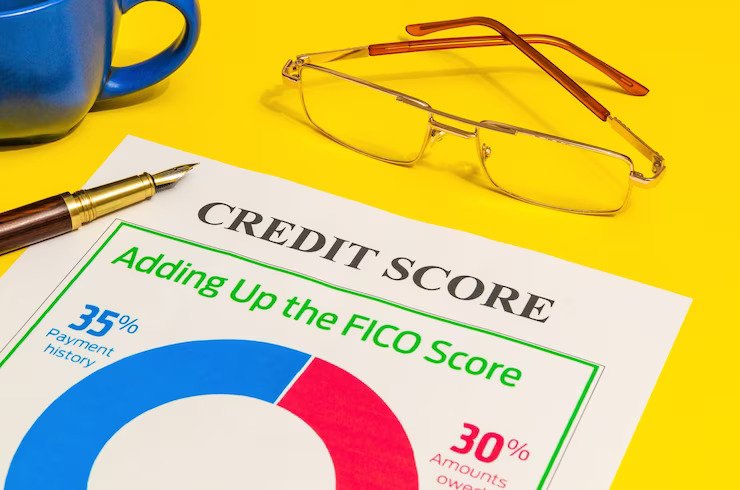

Some credit companies use a complex algorithm to calculate your credit score, which is based on multiple factors, including payment history, length of credit history, amount of debt, and available credit. When applying for a loan or other type of financial product, lenders usually do a credit card eligibility checker to assess your creditworthiness.

If a potential lender finds that you have a low credit score, they may be reluctant to lend money to you or offer unfavorable terms and conditions such as higher interest rates and shorter repayment periods.

Here’s why credit score matters more than you think:

1. It Affects Your Ability to Get a Loan

A low credit score can be a major obstacle to getting approved for a loan, as lenders tend to view borrowers with poor credit scores as less reliable and more of an overall financial risk. As mentioned earlier, having a low credit score will also likely result in unfavorable terms and conditions that can cost you more money over time.

2. It Can Affect Your Ability to Rent a Home or Apartment

Many landlords also use credit checks to determine whether or not a potential tenant is reliable enough to pay their rent on time every month. If your credit score falls below the landlord’s criteria, you may be denied the opportunity to rent a home or apartment.

3. It Can Affect Your Chances of Getting a Job

Many employers also conduct credit checks on applicants as part of the hiring process, as they want to ensure that their employees are responsible and financially stable. Having a low credit score could be viewed as a negative factor and could ultimately disqualify you from being hired.

Similarly, if you’re looking to start a business, your credit history can impact your ability to secure funding or establish vendor relationships. Running a business credit check before applying for loans or credit lines can help you understand where you stand and take steps to improve your financial profile if needed.

4. It Can Affect Your Insurance Rates

Many insurance companies also use your credit score as one factor when determining the premium rates for their products. Having a low credit score could result in higher premiums and could cost you hundreds of dollars every year.

5. It Can Affect Your Chances of Low-Interest Rates

A good credit score can also give you access to lower interest rates from lenders and other financial institutions, which could potentially save you thousands of dollars over the life of a loan or investment. Moreover, having a good credit score can open the door to more lending opportunities and better terms.

In Conclusion

Your credit score plays a critical role in your financial health and personal life. It can impact your ability to get approved for loans, credit cards, and even job applications.

By understanding how credit scores work and actively taking steps to improve them, you can set yourself up for a financially stable future. Make it a priority to monitor your credit score regularly, pay bills on time, keep credit utilization low, and dispute errors on your credit report. These simple steps can make a big difference in your overall financial well-being.

Read Also:

Comments Are Closed For This Article