SurePayroll – Best Usages, Features, And Alternatives

July 5, 2023

toc impalement

- Small business payroll processing is made easy through SurePayroll. Employers can pay their employees on time.

- The SurePayroll is affordable and comes to $20 per month.

- Centralized human resource and business forms are available on this platform.

If you are a small business struggling to process the payment of your employees on time, then you can use SurePayroll. Small companies hiring domestic services can use this platform to pay their employees.

SurePayroll can be a good payroll processing platform for smaller-sized businesses. This payroll processing platform allows tax filing, onboarding, compliance, benefits administration, analytics, and reporting.

On the downside, there is no flat payment option, and users must provide their information to get a pricing quote. Review this article for a quick review of this payroll processing platform before using it.

What Is Surepayroll?

SurePayroll is a payroll processing platform that offers some features similar to some of its market competitors. The venue emerged in the 2000s, and it has been offering payroll solutions to different businesses ever since. However, currently, it is one of the subsidiaries of the Paychex Flex payroll platform. Paychex Flex acquired this platform in 2011.

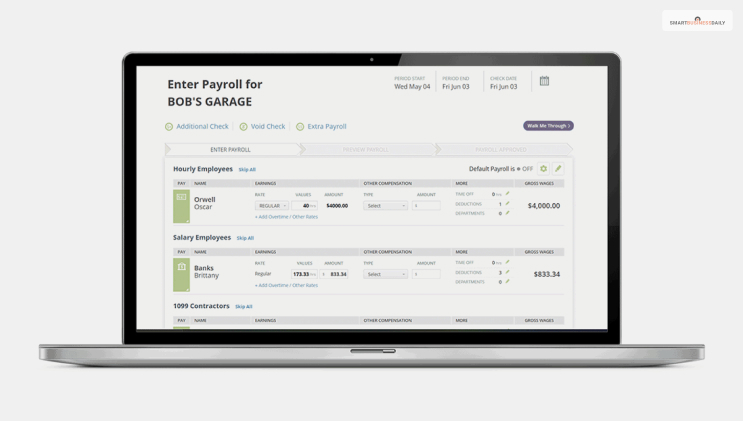

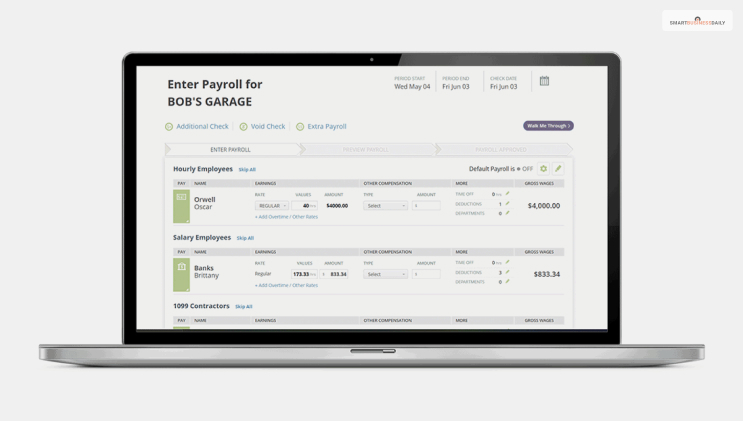

For most businesses, processing and paying employees’ salaries and filing taxes for them is a repetitive process. However, SurePayroll lets users run payroll for unlimited runs and calculates the taxes for the employers. Employees can also process payment in time by calculating employee’s clock-in and clock-out times at work.

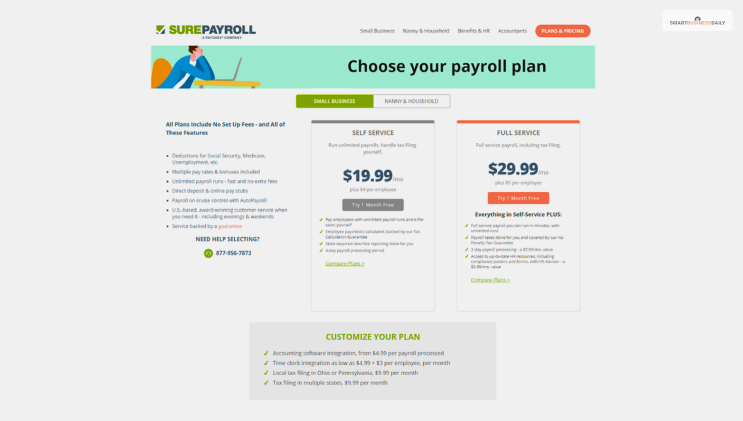

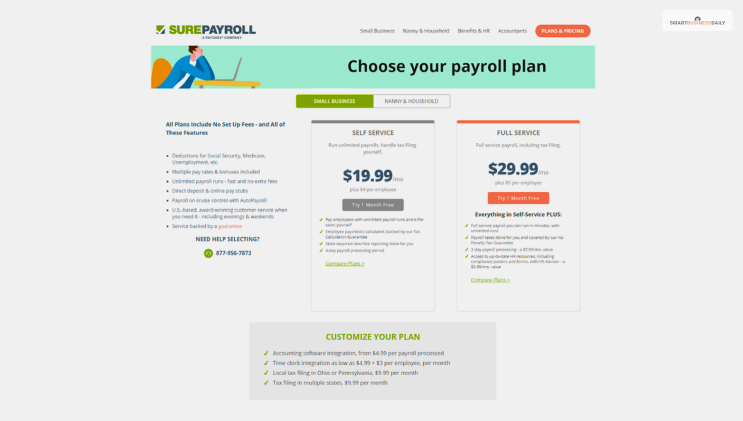

Yes, the pricing quotation is difficult to get. But users can keep their spending limited to $19.99 to $29.99 per month and a $4/employee. However, SurePayroll does not have a comprehensive HR service compared to its competitors.

SurePayroll Features

SurePayroll is an award-winning payroll processing platform. It supports w-2 employees and also helps 1099 contractors. Tax calculation, filing, and easy setup for direct deposit are some features of the SurePayroll processing platform. Here are some of the key elements of the Surepayroll processing platform –

✔ Payroll Processing

A good employer does not keep their employee’s payments on hold. If you want to keep your employees happy and process their payments faster, then you can use SurePayroll. It helps you automate payroll processing and also helps employees get their payments on time.

✔ Tax Filing

Small companies can use the SurePayroll for calculating Payroll taxes and filing them. However, if businesses need to pay local and all state taxes, they have to pay an additional $9.99 on a monthly basis. It might sound like an extra cost. But there is a benefit to using the additional state tax filing option. The states in the US have different tax regulations. However, once your business pays the extra amount for the state tax filing, you can cut through all that complexity.

✔ Employee Time Tracking

The SurePayroll payroll processing platform allows employers to easily track the clock-in and clock-out times of their salaried and contracted employees. Also, they can easily import the time tracking data into their payroll processing software.

The platform integrates itself with Stratustime to easily integrate the employee clock-in and clock-out timing. Employees can also enter their attendance time in the system through punching, a mobile app, and through a web application.

✔ Benefits Administration

Small and large-sized businesses usually offer their employees a set of benefits they can choose from. These include their health benefits, insurance, and flexible payment options. Employees also often receive 401(K) benefits from their employers. If your business is planning to offer these benefits to your employees, then SurePayroll benefits administration features can help.

✔ Accessibility

Yes, employees can access this payroll processing platform through their laptop, desktop, and their smartphones as well. SurePayroll offers all-rounded accessibility through both Android and iOS devices. The platform includes compensating independent contractors and employees alike. Employees can access their paystubs and payroll summaries.

On the other hand, employers can also access the portal to view paycheck information, find paycheck stubs, and monitor wage rates.

SurePayroll Pros & Cons

Go through these pros and cons of the SurePayroll processing platform before making a purchasing decision –

Pros

- The first positive side of SurePayroll is its pricing. It costs employers only $19.99 per month + $4 per employee for the starting plan.

- It is easy to use.

- The platform is accessible from Laptops, Desktops, and both Android and iOS phones.

- There is centralized HR and business form support.

Cons

- Users need to input their organization’s information to get a pricing quote.

- The customer service is not that responsive.

- The platform does not support global payroll processing.

- The basic version of the platform offers only phone support for customer support.

SurePayroll Pricing Plans

SurePayroll does not overcomplicate its pricing plans like some of the market competitors. You can opt for the Full Service or the base pricing plan within tax filing. However, some of the features are common in both the base and full services. Here are some of the most common features available in tax filing and the full-service feature.

| No Tax FIling | Full Service |

|---|---|

| ✔ $19.99/ month + $4/employee/ month | ✔ $29.99/month, plus $5/ employee /month |

| ✔ On boarding | ✔ On boarding |

| ✔ Payroll Tax filing | ✔ Payroll Tax filing |

| ✔ Auto Payroll | ✔ Auto Payroll |

| ✔ Third-Party Integrations | ✔ Third-Party Integrations |

| ✔ Reporting and Analytics | ✔ Reporting and Analytics |

No Tax Filing Plan

If you are getting the no-tax filing variant, the package will come with some common features such as online pay stubs, direct deposit, payroll taxes & live support. This plan also helps with new hire reporting and offers multiple payment rates. This plan comes for $19.99/month and $4/employee.

Full-Service Plan

The full-service plan of the SurePayroll platform offers small businesses all the payroll-related help. In addition, it also helps with tax filing for the different states in the US. However, you need to pay a little more for the Full service. This plan requires businesses to pay $29.99 per month plus $5 per employee /month.

Bottom Line

Small businesses needing to process payroll for salaried and contracted employees can use this platform. The platform is easy to use and offers most of the payroll-related support that small businesses and employers usually need. On top of it, it is pretty affordable. However, there is other payroll processing software like Wave Payroll or Gusto for simple payroll processing. You can check them out as well.

Did you find this review helpful? Please let us know your thoughts on this article. Also, leave any possible queries and questions you might have about the same.

Additional resources:

Comments Are Closed For This Article