A Comprehensive Review Of Wave payroll Software That You Need To Know Today!

5 Mins Read

Published on: 14 June 2023

Last Updated on: 25 September 2024

toc impalement

Wave Payroll offers a mix of automated and manual payroll processes. Reducing automated processes makes pricing more affordable and ‘on budget’ for some businesses. As a result, payroll processing, tax filing, and employee self-services are easy to access.

With everything automated in the payroll process, businesses often end up paying more than their budget can afford. However, thanks to Wave Payroll, they can tie their own hands. This one is a lot different from Gusto’s.

But, small and medium businesses can maintain their payroll budget thanks to a mix of manual and automated processes on Wave Payroll services. Yes, the paperwork required might seem a bit extra. However, that amount of time and effort is exchangeable for a saveable amount for some businesses.

Therefore, if you are curious about this payroll processing software, read this article.

What Is Wave Payroll?

Wave Payrolls allows users to choose and shift between manual and automated payroll processing, thereby managing their costs. As a result, the automated tax filing options are exclusive to some states only. Otherwise, you will be stuck with some heavy paperwork.

The employee onboarding process is made easy through the self-service portal. As a result, the employees can quickly fill out their information and complete the portal. As a result, even the pay stubs and tax stubs will be easy for them to view.

Employees can also choose to receive their payment through direct payments. However, in that case, they have to wait for at least three days after you process the payroll. Otherwise, they should stick to check payments.

However, the best part of using this platform for employee payroll processing is that users are allowed a trial period of 30 days. As a result, users can try the platform out for 30 days before deciding to pay.

Is Wave Payroll Right For Your Business?

Wave Payroll is an exemplary payroll service for medium and small businesses with fluctuating employees and contractors. Also, you have more money to save with many manually controllable options.

So, is it a good fit for your business? Yes. Here are different types of the companies that will find the wave payroll a good fit –

Small Businesses that have already used the trial version of Wave Payroll would be interested in converting into paying customers. Furthermore, if you have previously used Wave Accounting and Wave Invoicing, you would love to use this platform.

Small businesses that have varying levels of payrolls with payroll should use this payroll service. As a result, businesses often have to change needs with a payroll service provider. As a result, such companies can also use the Wave payroll services. Therefore, wave Payroll allows users to put employees on hold; they can skip pay runs when necessary.

Wave Payroll Features

Here are some of the payroll features of the wave payroll boasts. However, the system is gradually updating itself.

Therefore, you need to understand that things might change over time.

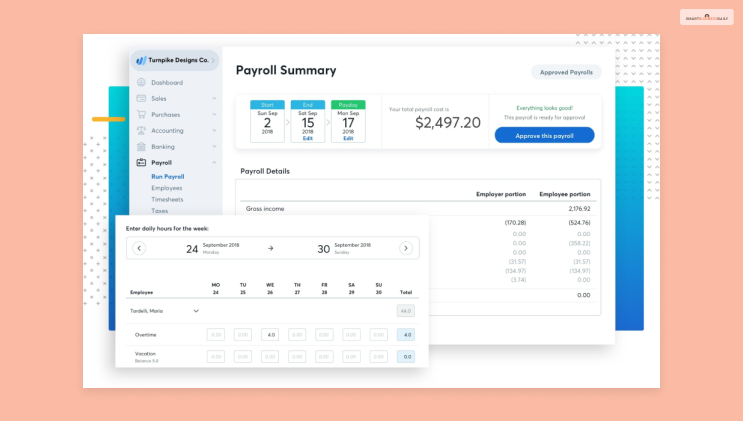

✔ Wave Payroll Dashboard

The Wave payroll dashboard is one of the best places to check out if you want a summary of the payroll functions.

Subsequently, the dashboard has upcoming start and end of payroll dates. The “Review this payroll” option allows users to glance at the payrolls and amounts.

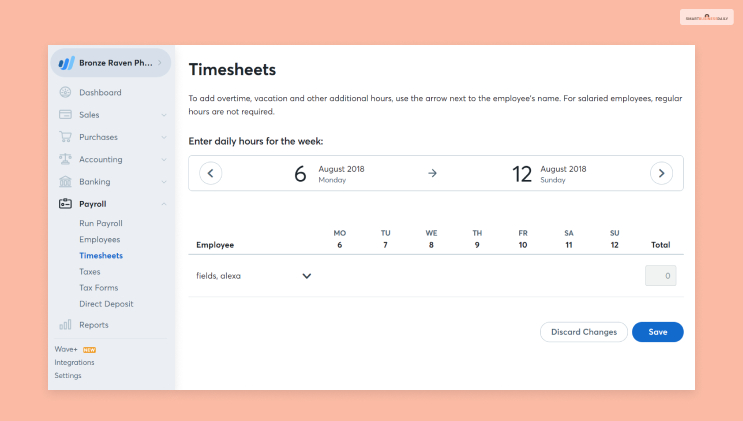

✔ TimeSheets

Employers have access to a timesheet, allowing them to keep track of their hourly-salaried workers. This feature is exclusive to employers alone, and employees cannot fill out the information on this sheet. Your employees have to track their times on a different basis, and you have to fill them out manually while running payroll.

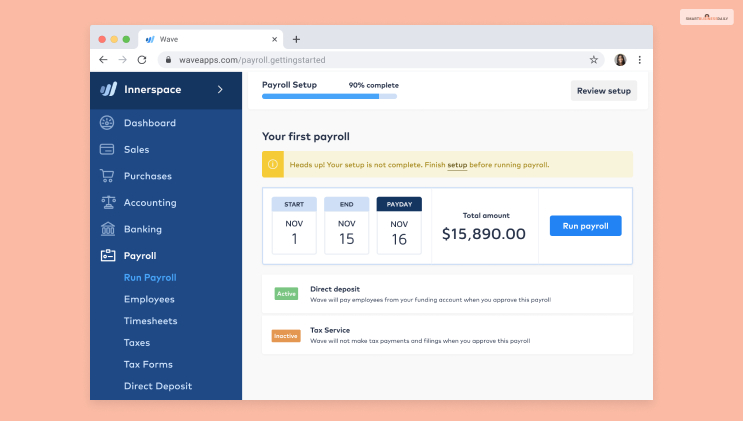

✔ Ease Of Use

Users can use this payroll processing software with little to zero experience in running payrolls. On top of that, the setup process is pretty straightforward. You will find step-by-step instructions for most of the processes. Also, 24/7 customer service is available on the platform to answer your queries.

✔ Compliances

The payroll software complies with federal and state-level payroll regulations. Automatic tax filing is exclusively available to only 14 of the US states. So, you will probably find some compliance issues coming up.

✔ Tax Filing

Users will be able to automatically file taxes in 14 states alone. The states include Arizona, California, Georgia, Florida, Illinois, Minnesota, Indiana, North Carolina, New York, Washington, Tennessee, Virginia, Texas, and Wisconsin. If you live in any of these states, you can file taxes automatically. Otherwise, you have to file them manually.

✔ Benefits Administration

Wave payroll offers a variety of employee benefits. Health insurance and retirement benefits are available on this platform.

You can add these benefits deductions to the payroll service. But you can also choose to manage them using other resources.

✔ Accessibility

Wave payroll services allow users to access the platform through their mobile devices. You can access the platform through iOS and Android devices. You can use your Wave payroll login password and ID to access it through your desktop.

Wave Payroll Pros & Cons

Here are the pros and cons of the Wave payroll services –

Pros

- The most beneficial part of this software is its free trial period.

- Three-day direct deposit option for employees.

- Distinguish between your employees and hourly contractors.

- Easy and manual time tracking.

- Employee self-service portal.

Cons

- Auto tax filing is limited to 14 states alone.

- No service for data migration. It needs to be done manually.

- Payroll is not automated.

- There is no mobile application.

- The mailing service does not exist.

Wave Payroll Pricing: How Much Does Wave Payroll Cost?

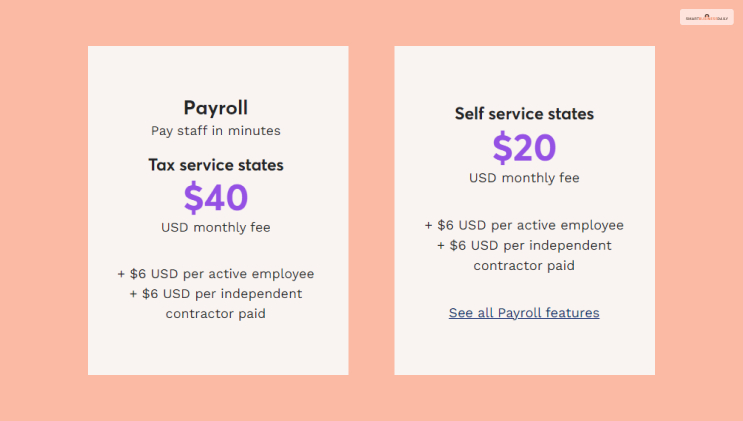

Compared to other payroll services such as Gusto, Paychex Flex, or Justworks, Wave offers a different pricing model. They charge you $20 or $40 based on the state you live in. The 14 states where they offer an automated tax filing option charge users $40 per month for payroll services.

But, if you are from the rest of the 36 states, then you have to pay $20 per month, and there is also a fee for each user. The per-person fee for wave payroll is $6 per month.

Bottom Line

Small businesses in the US with varying numbers of hourly employed or monthly salaried employees will find Wave Payroll helpful. The pricing plan is unique and odd to some users.

However, it is cheap nonetheless. If you can deal with a little bit of manual work, this is the perfect payroll software. The 30-day free trial period is also worth considering if you consider a trial period before paying for the service.

Did you find this review helpful? Let us know through our comment section below. Thank you for reading. Please share your feedback.

Additional Reading:

Comments Are Closed For This Article