What Is Phantom Tax? (And Why It Could Catch You Off Guard)

5 Mins Read

Published on: 04 August 2025

Last Updated on: 18 September 2025

- What Is Phantom Tax?

- Why Is It Called A "Phantom" Tax?

- Application Of Phantom Tax In Real Life:

- Who Does Phantom Tax Impact?

- Is Phantom Tax Legal?

- How Do You Prepare For Phantom Tax?

- 1. Seek Advice From A Tax Professional:

- 2. Set Aside Cash:

- 3. Look At The Details:

- 4. Negotiate Tax Redistributions:

- Is Phantom Tax Always Undesirable?

- Frequently Asked Questions:

- 1. What Is A Tax Distribution Clause?

- 2. How Can Companies Prepare For Phantom Income Tax?

- 3. Is Non-Cash Compensation Considered Phantom Income?

Imagine you got a large K-1 form in the mail. You open it up with high hopes of seeing a check or some positive news.

But what you discover is that you owe taxes on money you never even laid eyes on. Wait… what?! That, my friend, is phantom tax.

So, what is phantom tax? Simply put, it’s paying income tax on cash you earned, but never received in cash.

That’s correct, cash you never touched, never saw, and never spent. It does sound a little odd. That’s why it’s referred to as phantom tax.

We’ll break it down step by step in this easy, no-jargon guide to phantom tax and why you absolutely must understand it if you’re an investor or business owner.

What Is Phantom Tax?

Phantom tax is an investment gain that hasn’t been received yet, but still creates a tax liability for an individual or a partnership. This type of income is also known as phantom revenue.

I’ll tell you how this works: Any income from a business is not always distributed. It could be reinvested in the operations departments. The owners or partners still bear liability for paying the applicable income tax for the same.

Moreover, phantom income is applicable for limited partnerships, zero-coupon bonds, debt forgiveness, real estate investing, and limited liability corporations (LLC) or S corporations.

| Key Takeaway: As per Investopedia, “Phantom income is typically an investment gain that has not yet been realized through a cash sale or a distribution.” Moreover, you should always remember that this income creates tax liability for the people concerned. |

Why Is It Called A “Phantom” Tax?

Now, let’s discuss why it has such a scary name.

Consider it this way: The income is an illusion. You never saw it. You never got it. But the IRS? They fully believe it exists. So you still have to pay taxes on it.

The “phantom” in phantom tax is that the money vanished. It’s recorded as if you received it, but it never actually found its way into your pocket. That’s a ghost story we did not want!

Application Of Phantom Tax In Real Life:

Here’s a relatable example to make this clearer:

Suppose that you have a small property company. The company earns a profit of $100,000 yearly. You own 20% of the company, so your share of the profit would be $20,000.

Now, instead of giving you your $20,000, the business would rather reinvest the profits in buying more properties. That doesn’t sound like a bad business decision.

But come tax time, your K-1 statement indicates you earned $ 20,000, even though you never laid eyes on a penny.

And, guess what? You pay taxes on that $20,000. Yeah. That’s phantom income. And the taxes you pay on it? That’s the phantom tax.

Who Does Phantom Tax Impact?

If you find yourself uttering, “Wow, I’m just an average employee. This has nothing to do with me,” you may be correct for the moment. But if you ever:

- Invest in a limited partnership or an S-Corp

- Own shares in a private company.

- Work in a startup with profit-sharing contracts

- Receive deferred compensation

- Be a trust or an estate that generates income.

Then, of course, you may get phantom tax at some point.

Startups and new companies are notorious for this. Stock options or equity may be offered to you, and you’re told they’re worth a lot on paper, although you can’t yet sell them.

When it’s taxed as income, guess what? You’re taxing something you can’t even use.

Is Phantom Tax Legal?

Yes. It’s entirely legal. The IRS has very strict guidelines about it.

In their opinion, if your name is on the profit statement, and even though you didn’t get a check, you still owe them their share.

That’s simply how tax law operates on pass-through entities and investment income of that sort.

Although it may not be fair, the phantom tax is part of the system. The trick is to be aware that it is arriving so that it will not catch you by surprise.

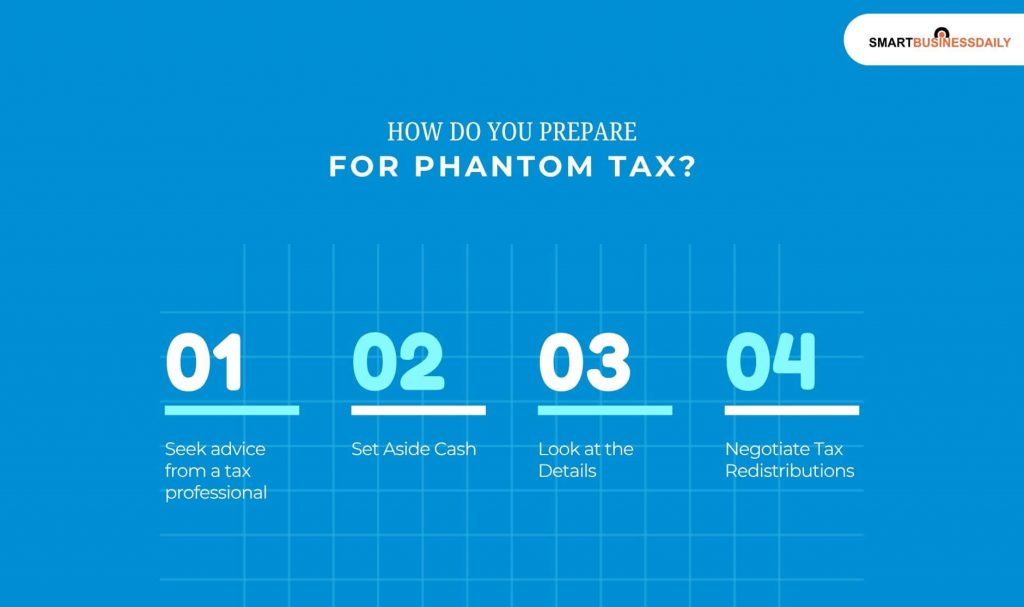

How Do You Prepare For Phantom Tax?

Alright, we’ve got a definition of phantom tax, but now let’s talk about how to cope with it.

These are some tips to prepare:

1. Seek Advice From A Tax Professional:

If you’re entering trusts or partnerships, consult with someone who knows tax law. They can assist you in planning.

2. Set Aside Cash:

If you know that you are going to have phantom income, put aside enough to pay the tax amount. This way, you won’t be in a panic when the IRS shows up.

3. Look At The Details:

Before you get into any business agreement or investment contract, make sure you know the distributions and the taxes. Questions to ask are:

- Will I receive cash payments to pay taxes?

- Is income reinvested or distributed annually?

- What kind of tax forms will I receive?

4. Negotiate Tax Redistributions:

In certain alliances, you can negotiate a “tax distribution” provision in your contract. This is where the company commits to distributing sufficient funds annually to cover your taxes. This is extremely useful!

Phantom Tax In Startups: A Hidden Surprise

A quick note to all the startup dreamers and tech bros, phantom tax can catch you off guard.

If your company gives you stock options or restricted stock units (RSUs), they can be taxed as income when you possess them, not when you sell them.

That is, even when the stock is not very valuable, or you cannot even sell it all, you may receive a tax notice.

Always read your equity contracts extremely carefully and seek advice from a tax professional before signing.

Is Phantom Tax Always Undesirable?

Honestly, not really.

It usually means that the investment or business is in good health, at least on paper. It’s profitable, and that’s terrific!

And even if you didn’t profit this year, the business may be making good investments that will pay off big in the long run.

But sure, having to pay taxes on money you don’t even possess can be annoying. So just be aware of that and the budget.

Frequently Asked Questions:

Check out the most commonly asked questions related to Phantom tax:

1. What Is A Tax Distribution Clause?

Tax distribution clauses are included in an LLC or a partnership’s business operation agreement. Such a clause will require a business to make the right distributions for covering the tax liability of the member from allocated income. So, it basically guarantees that members can obtain enough cash from the said LLC for covering any sort of tax liability. (Source: Investopedia)

2. How Can Companies Prepare For Phantom Income Tax?

Companies employ tax professionals to plan their phantom taxation. However, one idea that can work for partnerships involves allocating a specific percentage in a way that all their members get covered for taxation. (Source: Investopedia)

3. Is Non-Cash Compensation Considered Phantom Income?

Non-cash compensation refers to perks like a company vehicle at your disposal. Now, these perks fall under taxation even though an employee doesn’t get any cash – the value is included in the income of the employee. (Source: Investopedia)

Disclaimer: Our intentions behind writing about phantom tax and other financial topics are educational and informative. In case you are facing difficulty or are in the middle of a problem related to this topic, we recommend consulting with a professional.

Comments Are Closed For This Article