Top 6 Finance Software Tools That Will Help Your Business Stay Financially Healthy in Difficult Times

4 Mins Read

Published on: 31 August 2022

Last Updated on: 14 October 2024

toc impalement

Over the past few years, the American economy has made a turn for the worse.

As a business owner, your main focus should be staying financially healthy during difficult times. If you want to accomplish this goal, then using the right technology is imperative.

Businesses around the world spend over $4 trillion a year on technology. Are you looking for software tools to keep your business financially stable?

If so, check out the options below.

Top 6 Finance Software Tools For Helping Your Business Stay:

Overview:

- Remove Credit Report Errors with DisputeBee

- Track Expenses with the Help of Expensify

- Xero is a Great Accounting Software Program

- PlanGuru Makes Budgeting a Breeze

- Use FreshBooks For Payment Processing and Billing

- Utilize the Power of BrightPay

1. Remove Credit Report Errors with DisputeBee

As you start to grow your business, you might need to take out loans and other lines of credit.

If your business is relatively new, you will have to use your personal credit to secure these loans.

Before you start applying for business loans, you need to check your credit report. If you discover errors on your credit report, then you need to use DisputeBee to remove them.

You can also use this software as a way to help clients repair their credit. By removing negative items from your client’s credit reports, you can help them out and make money in the process.

2. Track Expenses with the Help of Expensify

If you want to avoid financial mistakes during a recession, you have to learn how to track every dime coming in and going out of your business.

Having the right expense tracking tools at your disposal can keep your business on good financial footing.

Expensify is one of the most popular expense tracking tools on the market.

With this tool, your employees can upload cash expenses and scan receipts from their mobile devices. Once these documents have been uploaded into the Expensify system, you can generate an expense report with the click of a button.

3. Xero is a Great Accounting Software Program

Getting a good handle on how financially fit your business is can be simple with the right software.

For years, business owners have used Xero accounting software to manage their finances.

When investing in this accounting program, you will get such features as:

- Invoicing

- Automated recordkeeping

- Report generation

- Expense calculations

Having these helpful features at your disposal will allow you to keep a close eye on your business finances.

4. PlanGuru Makes Budgeting a Breeze

The key component of achieving your small business growth goals is developing and maintaining a budget.

Spending recklessly can lead to your small business failing. This is why you need to create a realistic budget and stick to it.

Using a program like PlanGuru helps you analyze your existing budget to see if any financial shortcomings exist.

This software extracts data from your income statements, balance sheets, and cash flow records. Investing in this software will help you keep a sound and realistic budget in place.

5. Use FreshBooks For Payment Processing and Billing

Billing your customers and processing the payments they provide is crucial when trying to keep your business on solid financial ground.

Some business owners make the mistake of handling the billing process manually. Not only is this an inefficient way to invoice clients, but it can also lead to big mistakes being made.

If you want to modernize your billing and payment processing system, then you need to think about using FreshBooks. With this software, you can successfully automate vital accounting tasks.

This is a cloud-based software program, which means you can access the data on it from anywhere.

6. Utilize the Power of BrightPay

Most business owners invest a lot of time and effort into the payroll process. Making sure there are no mistakes made during the salary and wage distribution process is vital.

This is why you need to realize the importance of using modern technology to handle your payroll.

BrightPay makes managing payroll an integrated and seamless process. This software also provides your employees with more payroll visibility.

| By implementing the software tools mentioned above, you can make your business more efficient and profitable. |

Bonus software tool

Simplifying Business Expense Management with Digital Wallets

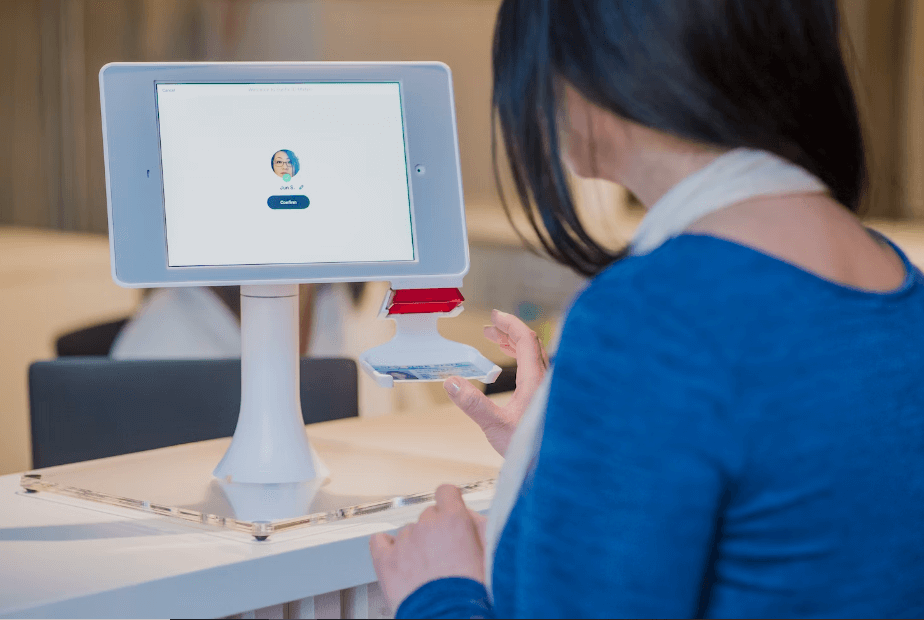

Digital wallet are transforming how companies handle their spending. With the help of Spenmo, businesses can easily track and organize their financial transactions.

With features like centralized expense tracking, digital wallets, simplified reimbursements, integration with accounting software, and secure contactless payments, Spenmo enables businesses to efficiently manage their expenses and improve their financial health.

Additionals:

Comments Are Closed For This Article