What Is Shopify Capital? Everything You Need To Know About Shopify Capital

5 Mins Read

Published on: 09 August 2022

Last Updated on: 16 August 2022

toc impalement

The world of e-commerce seems to forever trend upwards.

In 2021, online retail sales across the world were $4.9 trillion. It would rise by 50% in the near term, according to Statista.

But such numbers hide a fact. Large businesses make up the lion’s share. Amazon handled 57% of all US online sales last year.

Elsewhere, it is the same—giant enterprises, Alibaba, eBay, Flipkart, and Rakuten tower over others.

According to Forbes, 90% of online businesses fail to make any headway!

You need deep pockets to survive in this domain.

Shopify Capital is one of the alternatives to explore if you are short of funds.

What is Shopify Capital?

As of May 2021, there are reportedly 1.7 million Shopify stores globally.

It does not take long in the online business to understand that capital is its lifeblood.

Everything depends on how many financial reserves you have.

- Want to launch a new product—you need market research and a trip to meet vendors.

- Want to give your site a makeover—you need developers who understand the Shopify platform.

- Want to grow fast—you need to spend on Facebook, YouTube, and Instagram ads.

But most online entrepreneurs do not have deep pockets.

All they have is a dream and the wish to work hard and succeed.

Shopify realized this early on and in 2016 introduced Shopify Capital. It offers small short-term loans to Shopify owners.

Is Shopify Capital open to everyone?

Shopify Capital is not open to everyone.

You cannot open a store and ask for a handout a week later.

Shopify extends the facility to shop owners based on:

1. Duration

Every lender likes to know that they can trust their debtor. Those who have worked with Shopify for at least a year become eligible.

You must be a frequent seller, who visits the site regularly.

2. Volume

Shopify earns not only from hosting but also from a percentage of transactions. It varies between 2.5 to 3% depending on the plan opted for.

A low-volume seller cannot access Shopify Capital. At least, $10,000 in revenue is needed (though exact figures are never disclosed).

It is important to note that you cannot apply for Shopify Capital. They will reach out to you by email and dashboard notification.

How Does Shopify Capital Work?

As the owner of a Shopify business, you have to understand the distinction between Shopify Capital and a venture capital firm.

A venture capitalist offers a certain amount for the growth of the business. They keep a close watch on the business process and perform due diligence.

Very often, a VC would provide management inputs. VCs have one or more seats on the board and own shares.

It is not necessary that to receive an amount from Shopify Capital you have to be registered as a company. Shopify wants no say in your management decisions or how you handle marketing and logistics.

They offer quite small amounts (say 2-5% of your annual turnover ).

It might be as low as $250 and as high as $500,000.

They do no credit check and subtract the amount from your balance. The rates of interest are quite low, which makes it very appealing.

When you apply for a loan, there is a 5-day waiting period for approval. After the loan is sanctioned, the amount is provided within 2 days.

The payback begins the next day. For every sale, they take 10-20% till the amount is paid back.

Why use Shopify Capital?

The advantages of Shopify Capital are many. Let’s discuss each in turn.

Overview:

1. Minimum fuss

2. Upgrade your team

3. Add new products

4. Update your site

5. Grow through ads

1. Minimum fuss

If you would approach a bank for a loan, there would be an immense amount of legwork necessary.

You have to provide details about your business. Some of these can run into pages of information.

Perhaps you do not maintain an Income & Expenditure Account and Balance Sheet, and drawing these up for the last few years would be painstaking.

Moreover, a bank can require you to buy fire insurance to protect your stock.

Most importantly, banks are not interested in providing loans to online stores because they consider it a risky venture.

Shopify Capital on the other hand knows about your business and its metrics—what you sell, turnover, trends, number of customers, interest in your product—nothing is unknown to them.

It is easier for them to provide loans.

2. Upgrade your team

Every business needs professionals. Sooner or later, the burden would be too much for you to bear alone.

At the start, you managed product shipment and advertisement, but as the business grows past the $200,000 revenue mark, you need a team.

The best approach is to hire a consultant and freelancer for SEO and advertising. Those are specialized tasks you are not an expert at.

Though a freelancer would cost you less than someone on permanent payroll, you need to settle their accounts once every fortnight.

Loaning a bit from Shopify Capital and paying it back over a week is the perfect model.

3. Add new products

To grow your business you need more customers. To attract more customers you need a lot of products.

Maybe at the start, your product line was quite restricted because you had no capital.

Vendors would not provide you with goods unless you came up with a 50% advance. Unfortunately, you had exhausted your nest egg in developing the online store and had little to spare.

But as an experienced business owner now you have access to ready cash thanks to Shopify Capital.

You can not only add new products but also find vendors in person instead of trusting the web.

The best dropshippers have visited China and spent a week in Guangzhou identifying manufacturers and shippers.

The same is true if you are going to source from any other place. Visiting a factory and understanding it firsthand is a key part of growing your business. Without a first-class knowledge of how it’s made, you can never sell a product.

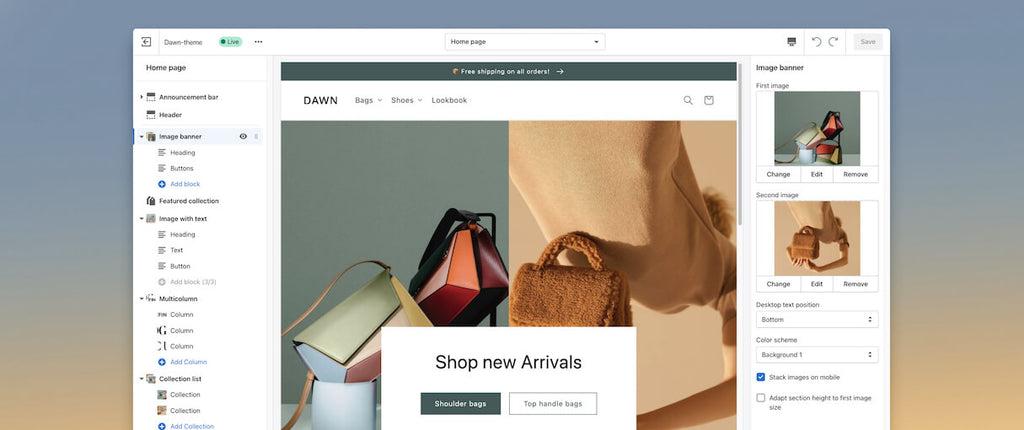

4. Update your site

When it comes to online shopping aesthetics matter a lot.

Your site needs to look trendy to attract customers. The price filters have to work perfectly, the blog has to be well written, and so on.

But how do you hire a Shopify developer unless you have a few thousand to spare?

A top-notch SEO firm and good content writers don’t come cheap either.

For all of this, you need an injection of capital and the $10,000 you can access at Shopify Capital is just what you need.

5. Grow through ads

You have the site and the product but little sales are happening.

This is because you are not visible through organic search. SEO worked well and propelled you from page 30 to page 2 but that simply was not enough.

You need to spend on marketing.

A few thousand spent on YouTube ads and Instagram would do the trick. And Shopify Capital is the perfect way to access that amount.

Lastly…

Shopify Capital is an excellent idea.

Small businesses need access to easy capital to survive. Shopify Capital is a fantastic way to avail of loans when needed.

The interest is quite low and the payment terms are not very strict.

If you are eligible, borrow from Shopify Capital and watch your revenue rise.

Additionals:

Comments Are Closed For This Article