What’s the Buzz About Fintechasia Net Crypto Facto? (Here’s What You’re Not Hearing)

6 Mins Read

Published on: 12 August 2025

Last Updated on: 02 October 2025

- First of All… What Is Fintechasia Net Crypto Facto?

- Why Is Fintechasia Net Crypto Facto Such a Big Deal in Asia?

- What Kind of Content Does Crypto Facto Cover?

- Government involvement (the good AND the messy)

- Web3 x Fintech x Culture

- What’s NOT Being Talked About (Until Now)?

- 1. Crypto’s role in remittances

- 2. Undercover regulations

- 3. The rise of “Regenerative Finance” (ReFi)

- Who Should Actually Read Fintechasia Net Crypto Facto?

- Does It Only Cover Big Players Like Bitcoin & Ethereum?

- Is Fintechasia Net Crypto Facto Reliable?

- What’s Next for Fintechasia Net Crypto Facto?

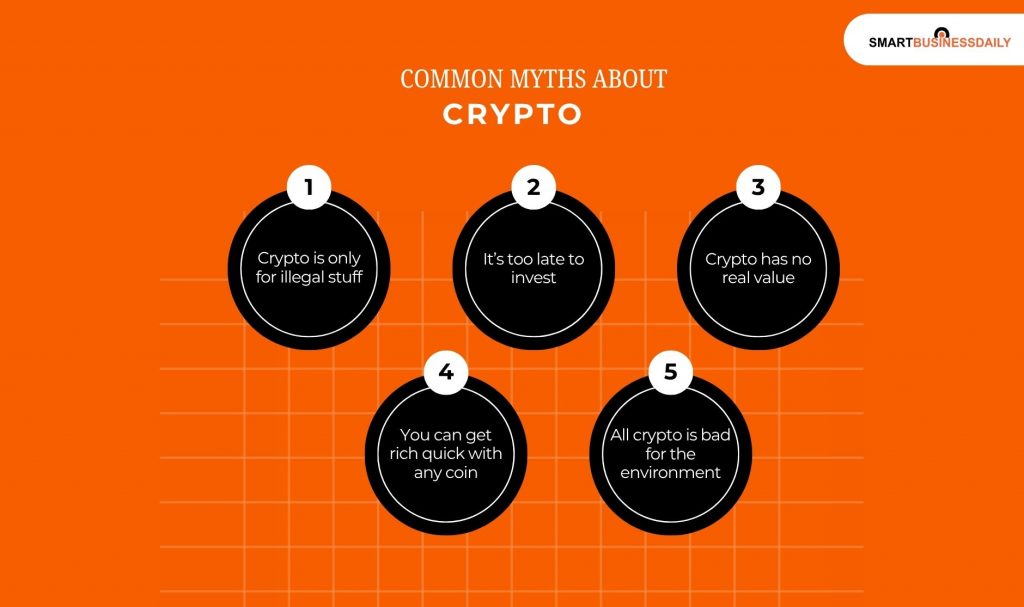

- Common Myths About Crypto (And Why They’re Totally Wrong)

- 1. “Crypto is only for illegal stuff.”

- 2. “It’s too late to invest.”

- 3. “Crypto has no real value.”

- 4. “You can get rich quick with any coin.”

- 5. “All crypto is bad for the environmen.t”

If you’ve been nosing around in the crypto space lately—especially in Asia—you’ve probably stumbled upon something called Fintechasia Net Crypto Facto.

Sounds a little mysterious, right? Kind of like a top-secret financial club or a crypto-themed detective agency.

Well, it’s not quite that, but it is becoming a hot spot for everything crypto, fintech, and web3 in the Asian financial scene.

But beyond the headlines and surface-level buzz, what’s really going on with Fintechasia Net Crypto Facto? Why are crypto-curious folks bookmarking it? And what’s in it for you?

Let’s break it all down in plain English and uncover the stuff most people aren’t talking about.

First of All… What Is Fintechasia Net Crypto Facto?

Okay, let’s decode the name.

Fintechasia.net is a platform that covers financial technology (fintech) news, trends, and insights, especially around the Asian market.

Crypto Facto is a sub-section or focused segment within the platform that dives deep into cryptocurrency news, projects, thought leadership, and more.

So when people say Fintechasia Net Crypto Facto, they’re referring to the crypto-focused corner of the fintech world, as viewed through the lens of Asia’s rapidly growing digital economy.

But it’s not just another crypto blog. And that’s where it gets interesting.Just like how an AI Video Generator makes content creation easier to understand, Fintechasia Net Crypto Facto simplifies the complex world of crypto for its readers.

Why Is Fintechasia Net Crypto Facto Such a Big Deal in Asia?

Asia isn’t just “catching up” with crypto innovation—it’s leading in many ways.

Here’s why Fintechasia Net Crypto Facto matters:

First of all, Asia is a crypto testing ground. Countries like Singapore, South Korea, and Hong Kong are experimenting with CBDCs, crypto-friendly regulations, and blockchain integration at a national level.

Secondly, it provides you with real-world case studies. Yes! The site doesn’t just talk theory. It highlights actual adoption, from payment systems in Thailand to DeFi integration in Indonesia.

Third? The Cultural lens. Western crypto sites often miss the cultural context. Fintechasia dives into how crypto behaves differently in Asia.

It’s a more grounded, realistic, and region-specific take—something that hasn’t been getting enough attention.

What Kind of Content Does Crypto Facto Cover?

You’d expect the usual crypto stuff like Bitcoin trends and Ethereum updates. And sure, that’s there. But Fintechasia Net Crypto Facto also dives into areas most platforms skip:

Hidden gems of Asian blockchain startups

They spotlight lesser-known projects, like blockchain-based supply chain solutions in Vietnam or carbon-credit NFTs out of Malaysia.

Government involvement (the good AND the messy)

They’re not afraid to talk about the complex relationship between crypto startups and national policy. Not every country’s approach is smooth, and Crypto Facto actually explains the “why.”

Web3 x Fintech x Culture

Like how NFTs are being used in Japanese streetwear drops or how Filipino gamers are earning in play-to-earn games to support their families.

This is the kind of well-rounded, regional insight that makes Fintechasia Net Crypto Facto stand out.

What’s NOT Being Talked About (Until Now)?

Here’s where it gets juicy.

1. Crypto’s role in remittances

Fintechasia has quietly been covering how crypto is changing cross-border payments for migrant workers in countries like the Philippines, Nepal, and Bangladesh. That’s a huge use case, and barely talked about elsewhere.

2. Undercover regulations

Crypto regulation in Asia isn’t just black or white. Some countries have “gray zones” where crypto is unofficially supported or quietly tolerated. Moreover, Fintechasia Net Crypto Facto shines a light on these blurry areas with on-the-ground insights.

3. The rise of “Regenerative Finance” (ReFi)

Beyond DeFi and NFTs, there’s a growing movement toward using blockchain for climate impact, sustainability, and social good. Moreover, Crypto Facto covers the Asian players in this space that no one’s watching yet.

So if you thought crypto was just about flipping coins for profit, you might want to dig deeper here.

Who Should Actually Read Fintechasia Net Crypto Facto?

Short answer? Anyone even remotely into crypto. But especially:

- Aspiring crypto investors looking for regional trends

- Startups in fintech are trying to stay ahead of innovation

- Crypto-curious policy nerds who want to see how governments interact with blockchain

- Students or researchers looking for case studies that go beyond the West

Even if you’re not deep into tech, Fintechasia Net Crypto Facto breaks it down without overwhelming jargon. Think of it like a chill crypto newsletter with smarter-than-average content.

Does It Only Cover Big Players Like Bitcoin & Ethereum?

Nope. That’s another cool thing. While they do touch on Bitcoin and ETH news, they’re not obsessed with price charts or meme coins (thankfully). Instead, you’ll find:

- Coverage of layer-2 solutions being tested in Asia

- Interviews with local crypto founders

- Reports on regional wallets, stablecoins, and cross-border tools

You’ll also find content around regulatory sandboxes—places where startups can test their tech without facing legal hurdles. That’s something most sites skip over entirely.

Is Fintechasia Net Crypto Facto Reliable?

Let’s be honest; the crypto space is full of hype, drama, and a whole lotta noise.

But Fintechasia—and especially the Crypto Facto section—is more informative than sensational. No “SHIBA INU TO THE MOON!!!” clickbait headlines.

They cite credible sources, often quote people from inside the industry, and focus on real-world impact.

If you’re tired of flashy nonsense and want content that respects your intelligence, Fintechasia Net Crypto Facto is a breath of fresh air.

What’s Next for Fintechasia Net Crypto Facto?

There’s already a growing buzz around it, and honestly, it feels like they’re just getting started.

What to look out for next:

- Possibly launching a crypto podcast (some rumors swirling!)

- More localized language content for non-English speakers across Asia

- Even collabs with blockchain events and summits across Singapore, Tokyo, and Jakarta

If you’re keeping an eye on how Asia is shaping the future of crypto, this is a space you’ll want to watch.

Common Myths About Crypto (And Why They’re Totally Wrong)

When people hear “crypto,” they often think of overnight millionaires, hackers in hoodies, or some shady underground business.

But trust me, the reality is way different. Here are some of the biggest myths I’ve heard — and why they’re not true.

1. “Crypto is only for illegal stuff.”

This one is straight out of a 2012 crime movie. While yes, Bitcoin was once linked to shady marketplaces, these days, most crypto transactions are fully traceable.

In fact, big exchanges and platforms (including ones you find through fintechasia net crypto facto) follow strict KYC and AML rules, so it’s actually harder to hide bad behavior in crypto than with cash.

2. “It’s too late to invest.”

People said this in 2017, then again in 2020… and guess what? Crypto kept evolving. New projects, better tech, and real-world use cases pop up all the time.

You don’t have to buy a whole Bitcoin; you can invest in tiny fractions or explore other tokens and DeFi opportunities.

3. “Crypto has no real value.”

This one’s a classic misunderstanding. Many cryptos are tied to real use cases — think faster payments, smart contracts, or powering decentralized apps.

Just like the internet didn’t “have value” in the 90s until people realized its potential, crypto’s value comes from the technology and trust behind it.

4. “You can get rich quick with any coin.”

Hate to break it to you, but chasing random tokens hoping to get rich overnight is more like gambling than investing.

The smartest people I’ve seen on fintechasia net crypto facto treat crypto like any other asset — with research, patience, and a clear strategy.

5. “All crypto is bad for the environmen.t”

While Bitcoin mining does consume a lot of energy, newer blockchains are switching to eco-friendly systems like proof-of-stake, which use far less power. Plus, many mining operations now run on renewable energy.

Comments Are Closed For This Article