How Has Fintechzoom Forex Market Developed Trading And Impacted The Market Trends In 2026 And Beyond?

12 February 2026

7 Mins Read

- What Is The Fintechzoom.com Forex Market All About?

- How Does The Forex Market Work?

- Factors That Affect Exchange Rates

- Benefits and Risks of Forex Trading

- Advantages:

- Risks:

- Trading Strategies Highlighted by Fintechzoom

- Technical Analysis:

- Fundamental Analysis:

- Risk Management:

- What Are The Various Market Trends That Are Rising Globally In 2026 And Beyond?

- 1. Central Bank Policies

- 2. Inflation and Global Growth

- 3. Digital Currencies and Technology

- 4. Geopolitical Tensions

- 5. AI and Automated Trading

- Choosing the Right Broker and Platform

- 1. Regulation and Safety

- 2. Trading Costs

- 3. Leverage and Margin

- 4. Platform and Tools

- 5. Customer Support

- What Are Some Tips For Beginners Entering The FintechZoom Forex Market?

- 1. Start Small

- 2. Build a Trading Plan

- 3. Learn the Basics

- 4. Manage Risk

- 5. Control Emotions

- 6. Keep Learning

FintechZoom.com is a key resource for traders. So, if you are looking for updates, you can definitely resort to this platform.

Additionally, you will also get a lot of clarified analysis. In fact, you will also get insights into foreign exchange (forex) trading.

The platform offers real-time market data, economic indicators, and expert strategies.

This helps both new and experienced forex traders make better financial decisions.

This guide explains how FintechZoom.com improves forex trading results.

What Is The Fintechzoom.com Forex Market All About?

Fintechzoom.com gives a clear view of the global foreign exchange market.

It provides live updates on major currency pairs such as EUR/USD, GBP/USD, and USD/JPY.

Additionally, it also shares equal updates on minor and exotic pairs such as NZD/CHF and USD/TRY.

Let’s see all that this platform has to offer:

- Firstly, it will offer you live currency rates updated in real time

- Secondly, you will get all the interactive charts. It will help you with technical analysis

- Thirdly, you will receive all the educational guides. Both beginners and advanced traders can benefit from these.

- Additionally, you will get all the updated market news. These will be linked to economic events.

- Finally, you will receive a lot of analysis articles. They will highlight opportunities and risks.

Traders can use this information to make decisions. For instance, if Fintechzoom shows that USD/JPY is rising due to changes in Japan’s interest rates, a trader might choose to buy or wait.

Overall, Fintechzoom.com is a useful tool for learning and real trading.

How Does The Forex Market Work?

Forex, or foreign exchange, is always traded in pairs. The first currency is called the base currency.

Additionally, the second is the quote currency. For example:

- EUR/USD means you are trading the Euro against the US Dollar.

- GBP/JPY means you are trading the British Pound against Japanese Yen.

- If EUR/USD is 1.1000, it means 1 euro equals 1.10 dollars.

The forex market is very liquid. So, this means you can buy or sell quickly without waiting.

Additionally, it is a large market. All the central banks participate in it. In addition, you will also find a lot of hedge funds and governments participating daily.

The forex market opens on Monday morning in Sydney. Then, it closes on Friday night in New York.

There are four main trading sessions:

| Session | Time (GMT) | Major Centers |

|---|---|---|

| Sydney | 22:00 – 07:00 | Sydney, Wellington |

| Tokyo | 00:00 – 09:00 | Tokyo, Singapore |

| London | 08:00 – 17:00 | London, Frankfurt |

| New York | 13:00 – 22:00 | New York, Chicago |

Factors That Affect Exchange Rates

Currencies change value for several reasons. The main ones are:

- Firstly, what matters the most is interest rates. So, as we know, higher interest rates attract investors.

- Secondly, inflation is also quite a prominent factor. You see, rising inflation lowers a currency’s value.

- Thirdly, you also have to consider the economic data. Reports like GDP, employment, and trade balance have a big impact on the forex market.

- Additionally, the role of geopolitics is also undeniable. Wars, elections, or trade disputes create fluctuations.

- Finally, we have the factor of market sentiment. Trader emotions, whether optimistic or fearful, influence price changes.

Benefits and Risks of Forex Trading

Forex trading has both advantages and disadvantages.

Advantages:

- One of the biggest advantages here is the high liquidity. This means that it’s easy to buy or sell.

- Then, another advantage this platform provides us is the low cost. Most brokers charge only spreads

- Another really good advantage is leverage. So now, the traders can manage larger positions with smaller amounts.

- Finally, we have flexibility. Trading is available 24 hours a day, five days a week.

Risks:

- One of the major challenges you have to face here is high volatility. Prices can change quickly. So, this leads to possible losses.

- Additionally, the leverage risk is another common risk. Although leverage increases profits, it also raises the risk of losses.

- You also have to deal with the huge market complexity. Global events make it hard to predict market movements.

- Finally, you will get a tremendous amount of emotional stress. Emotions like fear and greed can cause mistakes.

The Fintechzoom.com Forex Market often points out these ups and downs. So, it is always encouraging traders to be careful.

Trading Strategies Highlighted by Fintechzoom

To succeed, traders should use strategies. Some common ones include:

Technical Analysis:

This looks at charts and indicators to forecast price changes. Common tools are:

- Moving Averages

- Relative Strength Index (RSI)

- Bollinger Bands

- Fibonacci Levels

Fundamental Analysis:

This focuses on economic news and reports. Traders pay attention to:

- Central bank rate decisions

- Employment data

- Inflation reports

- GDP growth figures

Risk Management:

Every strategy needs a safety plan. This includes:

- Setting stop-loss orders

- Limiting position sizes

- Keeping a trading journal

- Avoiding over-leverage

By combining these methods, traders can boost their chances of success in the Fintechzoom.com Forex Market.

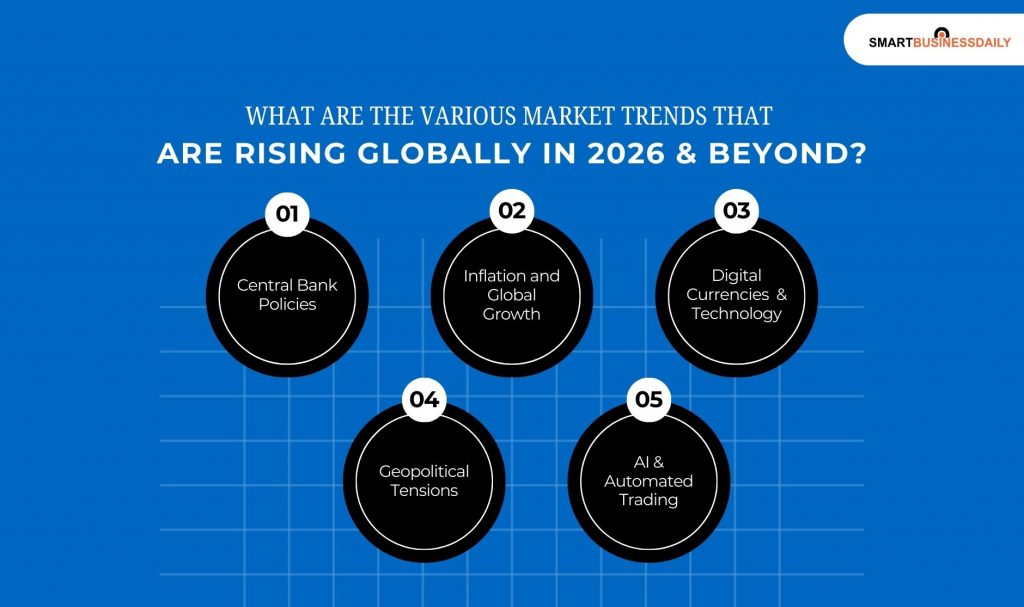

What Are The Various Market Trends That Are Rising Globally In 2026 And Beyond?

The forex market is always changing. In 2025, several global trends are affecting how currencies move.

So, if you pay a little attention, you will have a clear picture of how traders operate.

1. Central Bank Policies

Major central banks significantly influence exchange rates.A good example might be these three banks:

- The Us Federal Reserve

- The European Central Bank

- The Bank Of Japan

So, what happens when there are changes in interest rates? It directly impacts trading patterns.

So, all the forex traders should check the Central Bank Calendar for updates.

2. Inflation and Global Growth

High inflation from 2022 to 2023 led many banks to raise interest rates. By 2025, inflation slowed in some areas.

But challenges remained in others.

Countries with steady growth and low inflation usually have stronger currencies.

3. Digital Currencies and Technology

Digital payment systems and central bank digital currencies (CBDCs) are changing how people think about money.

This development adds new risks to forex pairs linked to countries testing digital currencies.

4. Geopolitical Tensions

Political issues, from regional conflicts to global trade disputes, can greatly affect markets.

In 2025, traders may see sudden changes due to elections, policy shifts, or sanctions.

5. AI and Automated Trading

Traders now use artificial intelligence and algorithms for market analysis. Automated systems track models in real time, making trades faster and often more efficient.

Forex Market Reports from Fintechzoom.com highlight these changes and help traders adjust their strategies.

Choosing the Right Broker and Platform

A solid trading plan is pointless without the right broker. Many new traders struggle.

Why? This is because they chose the wrong platform. Here’s what to consider:

1. Regulation and Safety

Select brokers licensed by respected authorities, such as the FCA, CFTC, or ASIC. Avoid unregulated firms that promise unrealistic profits.

2. Trading Costs

Compare spreads and commissions. A difference of even one pip can affect profits over time.

3. Leverage and Margin

Higher leverage offers more control but also increases risk. Beginners should use lower leverage until they gain experience.

4. Platform and Tools

Good brokers provide reliable platforms, like MetaTrader 4 or 5, or cTrader. Look for features like charts, technical indicators, and mobile apps.

5. Customer Support

24/5 support is crucial. Brokers that offer multilingual services are better for global traders.

Traders often use Fintechzoom.com alongside their broker platform. While brokers execute trades, Fintechzoom provides updates.

Additionally, it also gives out all the updated news. In fact, it also shares all the top-rated educational content.

So, this helps traders make better decisions.

What Are Some Tips For Beginners Entering The FintechZoom Forex Market?

Starting in forex can feel overwhelming, but you can reduce risks with these simple steps:

1. Start Small

Begin with a demo account or a small live account to practice your skills before investing a lot of money.

This approach allows you to learn without the pressure of losing significant amounts.

It also helps you build confidence as you understand market movements.

2. Build a Trading Plan

Set clear goals, define your risk per trade, and decide on your strategy to guide your actions.

A trading plan acts like a roadmap. It helps you stay focused and organized.

So, what happens when you operate without a plan? Well, it doesn’t go well!

Additionally, you might make impulsive decisions that can lead to losses.

3. Learn the Basics

You must have a deep understanding of all the essential concepts, like pips and spreads.

In fact, you must also know everything about leverage in a detailed way. All this knowledge is important to make informed decisions.

Also, you must consciously avoid even small errors in these areas. It can lead to considerable financial setbacks.

But when you have this knowledge, it will empower you to trade more effectively and successfully.

4. Manage Risk

Never risk more than 1–2% of your capital on a single trade. Additionally, I suggest that you always use stop-loss orders. This is important to protect your investments.

In addition, this practice helps to maintain your capital over the long term. So, it allows you to trade again and again.

By managing risk, you can withstand market fluctuations without significant losses.

5. Control Emotions

Fear and greed can derail your trading success, so stick to your plan and avoid revenge trading after a loss.

Having emotional discipline is key to making rational decisions.

Regularly review your trades to learn from mistakes and improve your strategy.

6. Keep Learning

I suggest that you read daily updates on Fintechzoom.com’s Forex Market. This will help you stay updated.

Additionally, you must follow economic calendars. Also, try to study charts regularly to stay updated.

Another point that I would ike to emphasize here is that the forex market is constantly changing.

So, I will always recommend that you keep going with regular education. I assure you that it is very important for success.

Engaging with new information helps you adapt to market conditions and refine your trading tactics.