What Is An International Money Transfer API, And Why Are Global Businesses Going Gaga Over It?

18 February 2026

8 Mins Read

- What Is an International Money Transfer API?

- Traditional Money Transfers vs API Driven Transfers

- What Is The Role of APIs in Financial Connectivity?

- How International Money Transfer APIs Work

- 1. Authentication and Authorization

- 2. Create and Validate Transfer Request

- 3. Funding the Transfer

- 4. Execution and Routing

- 5. Tracking and Notifications

- What Are The Benefits of Using an International Money Transfer API?

- 1. Speed and Efficiency

- 2. Cost Reduction

- 3. Global Reach and Multi-Currency Support

- 4. Security and Compliance

- 5. Scalability and Control

- What Are The Core Use Cases?

- 1. Business and B2B Payments

- 2. Payroll and Remittances

- 3. E-commerce and Refunds

- 4. Fintech and Wallet Integrations

- What Are Some Common Challenges and Integration Considerations?

- 1. Technical Complexity

- 2. Regulatory and Compliance Requirements

- 3. FX and Liquidity Management

- 4. Error Handling and Monitoring

- How to Choose the Right International Money Transfer API Partner?

- 1. API Documentation and Developer Support

- 2. Integration Ease and Time to Launch

- 3. Cost Structure and Transparency

- 4. Reliability and SLA

- International Money Transfer API Implementation Options

- 1. Bank Provided APIs

- 2. Fintech Platforms

- 3. White Label Solutions

- What Are The Upcoming Future Trends and Innovations

- 1. Real Time Cross Border Payments

- 2. Decentralized Networks And Blockchain

- 3. Embedded Finance Growth

- 4. Regulatory Modernization

- The Overall Mechanism of the International Money Transfer API Explained

I think one of the best developments in the business world is that borders no longer limit global business.

Additionally, all the companies are now selling products across continents. I myself have hired a few remote teams.

So, I am receiving all the help I need to serve customers in multiple currencies.

In my career as an entrepreneur, I have seen how rapidly digital commerce expands.

Now, because the area and the dynamics are expanding, it is only natural that the needs of the people involved will also change!

The most important need for both manufacturers and customers is fast and secure cross-border payments. And guess what? It continues to grow.

An international money transfer API helps businesses move funds across countries through automated software systems.

It replaces slow manual processes with programmable and scalable infrastructure.

Instead of relying on traditional banking steps, businesses can integrate payment functionality directly into their platforms.

What Is an International Money Transfer API?

An international money transfer API is a software interface. It allows applications to initiate and process all the cross-border payments.

Additionally, you will be able to manage and track all the cross-border payments programmatically.

Instead of manually logging into banking portals, businesses send structured requests to an API endpoint.

According to industry discussions from Runa and IFX Payments, APIs enable companies to connect directly to financial networks and automate international transactions within their own systems.

Traditional Money Transfers vs API Driven Transfers

Traditional international transfers usually involve:

- Manual data entry

- Bank branch visits or online banking portals

- SWIFT messages processed through correspondent banks

- Limited tracking visibility

API driven transfers replace these steps with:

- Automated request submission

- Real-time validation

- Programmatic status tracking

- Integrated compliance workflows

This shift reduces human error and increases speed.

What Is The Role of APIs in Financial Connectivity?

Money transfer APIs connect businesses to financial rails such as:

- SWIFT for international bank-to-bank transfers

- SEPA for euro payments within Europe

- Local payment networks and clearing systems

APIs act as bridges between business applications and banking infrastructure.

They abstract complexity and allow developers to build seamless payment flows without building global banking relationships from scratch.

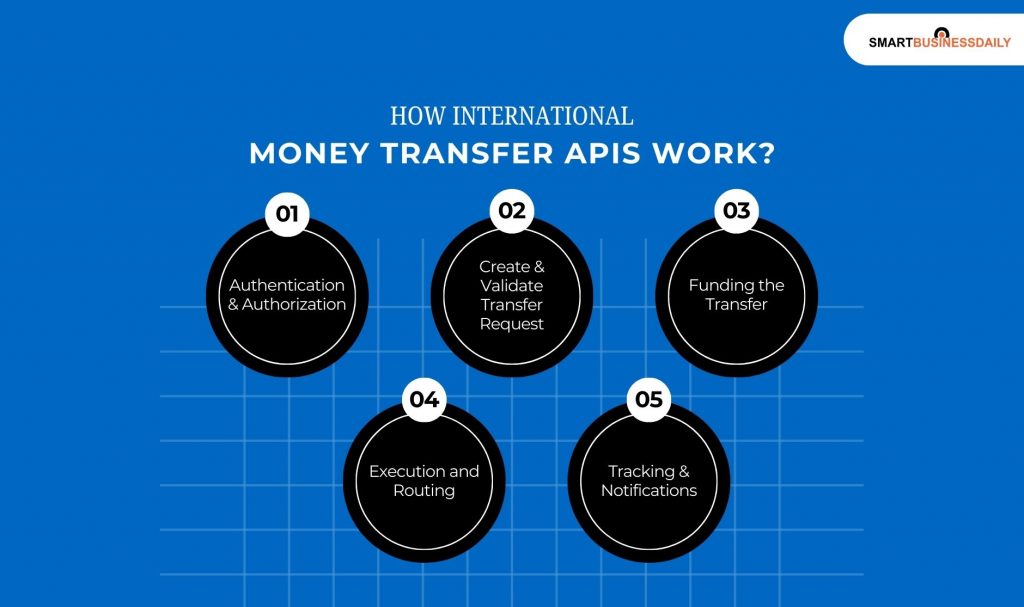

How International Money Transfer APIs Work

International money transfer APIs follow a structured workflow. Each stage ensures security, compliance, and accuracy.

1. Authentication and Authorization

Every API interaction begins with authentication. Businesses receive API keys or OAuth tokens.

These credentials verify identity and control access.

Secure authentication ensures that only authorized systems can initiate transfers.

Most providers use encrypted connections and token-based access methods to protect financial data.

2. Create and Validate Transfer Request

The next step is creating a transfer request. This request includes:

- Sender details

- Recipient details

- Currency pair

- Amount

- Exchange rate

- Fees

Many APIs provide a quote endpoint. This allows businesses to retrieve real-time exchange rates and fee breakdowns before confirming the transaction.

Validation checks ensure that account details and compliance data are complete.

3. Funding the Transfer

Once validated, the system must fund the transfer. This can happen through:

- Debiting a linked bank account

- Using a stored wallet balance

- Pre-funded accounts with the API provider

The provider confirms that sufficient funds are available before executing the payment.

4. Execution and Routing

After funding, the API routes the transaction through appropriate payment networks.

For global transfers, this often involves the SWIFT network. In regional contexts, it may involve domestic clearing systems.

Routing decisions depend on:

- Destination country

- Currency

- Compliance rules

- Available correspondent banks

The API provider manages these backend processes.

5. Tracking and Notifications

Modern APIs provide real-time tracking. Businesses can query transaction status or receive webhooks.

Common status updates include:

- Pending

- Processing

- Completed

- Failed

Webhooks notify systems automatically when a status changes. This improves transparency and user experience.

What Are The Benefits of Using an International Money Transfer API?

International money transfer APIs deliver measurable business advantages.

1. Speed and Efficiency

API based transfers eliminate manual processing delays. Automated workflows reduce back-and-forth communication with banks.

Also, I would like to inform you about the transfers. You see, some of these settle in near real time.

But it completely depends on currency corridors. Also, the payment networks play a certain role as well.

So, this improves liquidity and customer satisfaction.

2. Cost Reduction

Traditional international transfers often involve intermediary banks. It also requires layered fees.

On the other hand, the API providers may offer more transparent pricing structures.

In addition, automation also lowers operational costs. So, there is less need for manual reconciliation and administrative work.

3. Global Reach and Multi-Currency Support

Money transfer APIs support multiple currencies and countries. Businesses can send funds in local currencies without opening separate bank accounts in every region.

This capability simplifies global expansion.

4. Security and Compliance

APIs integrate encryption and secure authentication. Many providers embed compliance tools such as:

- Know Your Customer verification

- Anti Money Laundering screening

- Transaction monitoring

Industry resources emphasize that built-in compliance frameworks are critical for cross-border transfers.

5. Scalability and Control

APIs are designed to handle:

- High volume transactions

- Batch payouts

- Recurring payments

As businesses grow, the same infrastructure can support larger transaction volumes without major system changes.

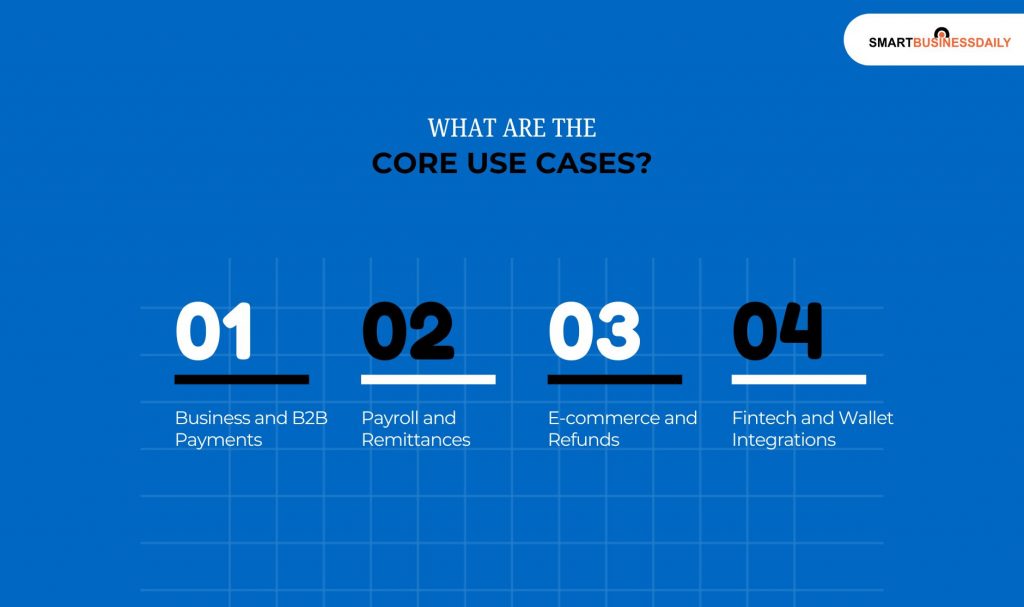

What Are The Core Use Cases?

I have spoken about the growing importance of the international money transfer API to my colleagues and friends in business.

Guess what? Everyone in them aggresses with me. This is because this system benefits a lot of industries and business spheres.

So, let’s take a look at these varieties:

1. Business and B2B Payments

As we all know, most of the companies today have to pay suppliers and contractors across borders.

So, in this case, the APIs automate invoice settlements. Additionally, they also seamlessly manage the vendor payments.

Alo, I strongly feel that this reduces delays and improves cash flow management.

2. Payroll and Remittances

Now, let’s change the perspective I mentioned right above. All the global companies also manage payroll for remote employees.

So, here APIs enable automated salary disbursement in local currencies.

Additionally, all the remittance platforms also rely on APIs. They need help to move funds between countries securely.

3. E-commerce and Refunds

Online marketplaces serve customers worldwide. So, in their case, APIs allow:

- Multi-currency checkout

- Fast international refunds

- Seller payouts

So, what happens? We get an integrated payment system. This improves trust and retention.

4. Fintech and Wallet Integrations

Fintech apps embed money transfer functionality directly into user experiences.

So now, all the digital wallets can connect to international rails through APIs.

Additionally, this creates seamless financial products. And the best part? You won’t even require to interact with traditional banking portals.

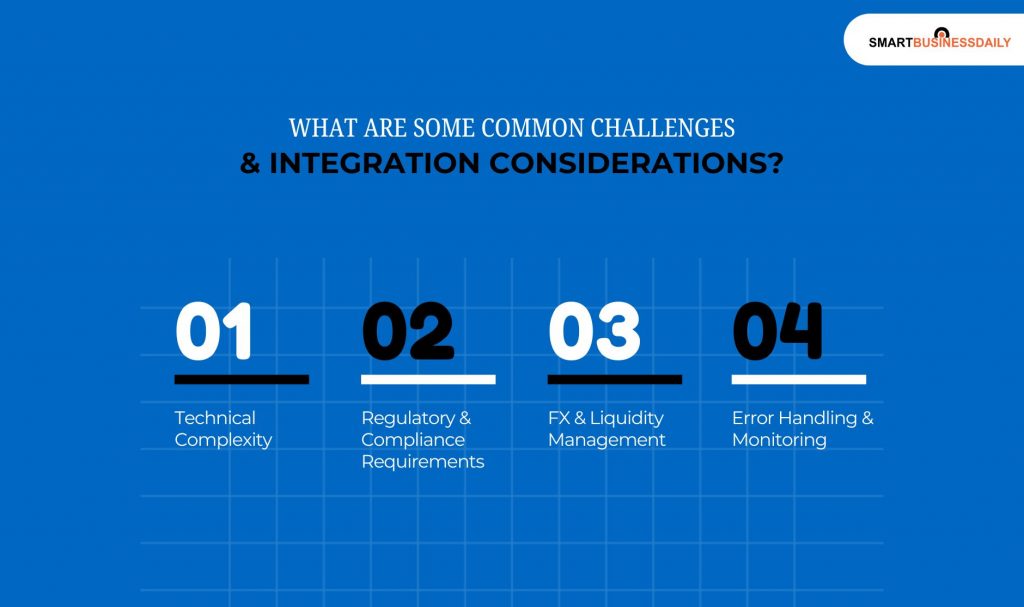

What Are Some Common Challenges and Integration Considerations?

While international money transfer APIs offer efficiency, integration requires careful planning.

1. Technical Complexity

API integration involves backend development. Teams must handle:

- Authentication flows

- Webhook listeners

- Error responses

- Retries for failed requests

- Timeout management

Also, you might know that these webhooks require secure endpoints.

Additionally, the systems must verify signatures. Also, they can confirm message authenticity.

Additionally, I always suggest regular logging. It is essential for traceability.

I am always very conscious about poor implementation. It can result in duplicate transfers.

Also, it might lead to missed status updates.

Robust testing in sandbox environments reduces risk before going live. So, most providers offer developer portals and simulation tools.

2. Regulatory and Compliance Requirements

Cross-border transfers are subject to strict regulations. Businesses must comply with:

- KYC verification

- AML monitoring

- Sanctions screening

- Local licensing rules

Compliance requirements vary by country. Some corridors require additional documentation for high-value transfers. API providers often embed compliance tools, but businesses remain responsible for lawful usage.

Regulatory obligations should be reviewed before launch.

3. FX and Liquidity Management

Exchange rates fluctuate constantly. Real-time rate management is critical.

Businesses must understand:

- Rate markups

- Settlement timing

- Liquidity requirements

Some APIs allow pre-funding accounts in multiple currencies. Others convert funds at execution. Each model impacts cash flow planning.

Clear visibility into FX spreads improves transparency.

4. Error Handling and Monitoring

International payments may fail due to:

- Incorrect beneficiary details

- Insufficient funds

- Compliance flags

- Bank network disruptions

Systems should implement monitoring dashboards. Alerts should notify teams of failed transactions. Retry logic must avoid duplicate transfers.

Failover strategies reduce downtime risk.

How to Choose the Right International Money Transfer API Partner?

Selecting a provider requires a structured evaluation.

1. API Documentation and Developer Support

Clear documentation reduces integration time. Strong providers offer:

- Well-structured API references

- Code samples

- SDK libraries

- Sandbox testing environments

Responsive technical support is equally important. Developer onboarding quality directly impacts time to launch.

2. Integration Ease and Time to Launch

Some APIs are plug-and-play. Others require a complex setup.

Questions to evaluate include:

- How long does onboarding take

- Are compliance checks automated

- Is there a dedicated account manager

Faster integration lowers operational cost.

3. Cost Structure and Transparency

International transfers include several potential fees:

- FX margins

- Transaction fees

- Funding fees

- Withdrawal charges

Providers should disclose pricing clearly. Hidden costs reduce predictability.

Transparent pricing models support better forecasting.

4. Reliability and SLA

Uptime matters. Downtime impacts revenue and customer trust.

Review:

- Service level agreements

- Historical uptime records

- Incident response policies

- Customer support responsiveness

High reliability is essential for mission-critical payment flows.

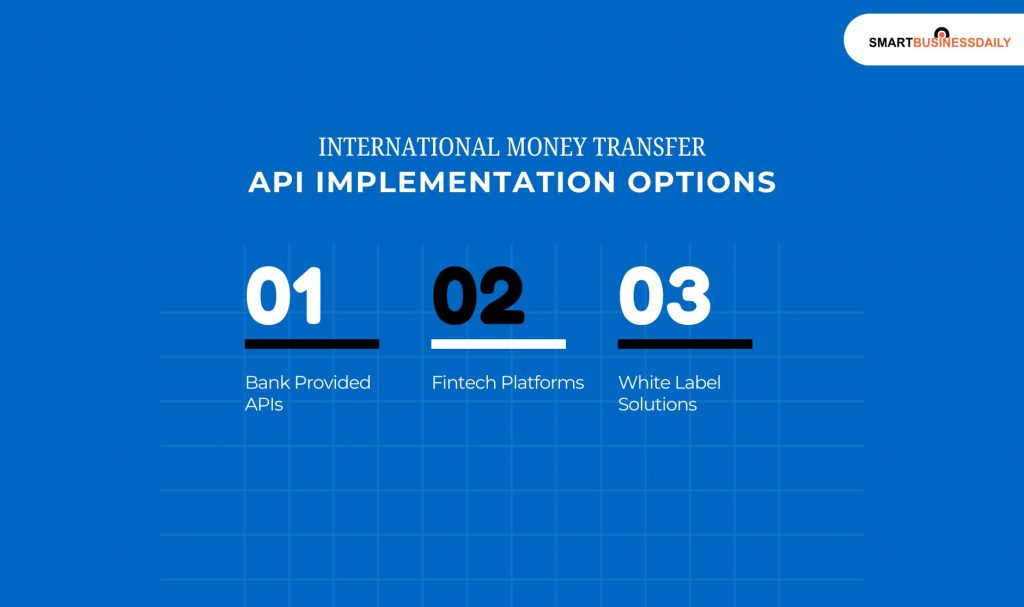

International Money Transfer API Implementation Options

Businesses can choose from different provider types. So, I would like to walk you through these types.

This will make you understand better which type is suitable fot your own business.

1. Bank Provided APIs

Some traditional banks offer API access to international transfers. These solutions provide direct banking connectivity.

It also has certain advantages. Firstly, you will get regulatory familiarity. Additionally, you will also enjoy an established infrastructure.

However, feature flexibility may be limited compared to fintech platforms.

2. Fintech Platforms

Fintech providers specialize in cross-border payments. They often maintain broader global networks and developer-friendly systems.

These platforms focus on automation, real-time tracking, and scalable infrastructure. Many startups and digital businesses prefer this model.

3. White Label Solutions

White-label APIs allow businesses to brand the payment experience as their own. The underlying infrastructure is managed by the provider.

This approach enables rapid product launches without building complex financial rails internally.

What Are The Upcoming Future Trends and Innovations

International payment systems continue to evolve.

1. Real Time Cross Border Payments

Global demand for faster settlement is increasing. Real-time domestic payment systems are expanding. Cross-border interoperability is improving.

As infrastructure matures, near-instant international transfers may become more common.

2. Decentralized Networks And Blockchain

I have also seen some platforms that explore distributed ledger technologies.

They do this to enhance transparency. Additionally, it helps them reduce settlement delays.

In fact, I also want to mention that the adoption varies. So, the blockchain-based rails aim to simplify correspondent banking chains.

3. Embedded Finance Growth

Embedded finance allows non-financial companies to integrate banking features directly into their platforms.

So, the international transfer APIs support this shift by making cross-border payments programmable.

In fact, they also make it pretty accessible within apps.

4. Regulatory Modernization

Regulators in many jurisdictions are updating fintech frameworks. Open banking initiatives and API standardization support broader interoperability.

Evolving regulatory clarity may encourage innovation while strengthening consumer protection.

The Overall Mechanism of the International Money Transfer API Explained

International money transfer APIs are essential for global business. They allow fast, secure, and automatic payments across borders in today’s digital systems.

Additionally, they are connecting apps directly to financial networks. So, in this way, these APIs cut down on manual tasks.

In addition, they also speed up transactions.

In fact, they also handle multiple currencies and support embedded finance.

However, integrating these APIs requires careful attention to compliance, technical reliability, and clear costs.

Businesses should choose providers based on the quality of documentation, global presence, pricing transparency, and service reliability.

With the right partner, international money transfer APIs can boost global growth and improve efficiency.