6 Facts About The Invoice Factoring Industry

5 Mins Read

Published on: 04 April 2022

Last Updated on: 26 April 2024

toc impalement

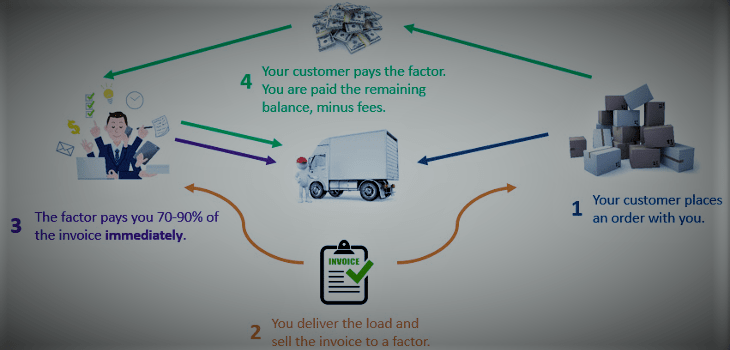

Invoice factoring is a financial transaction that’s been used for a very long time, with reports indicating it’s been around for about 4000 years. This transaction involves a factoring company giving you a percentage of your unpaid invoices, then collecting the invoices on your behalf at the end of the term.

They’ll then remit the remainder of the invoice to you, minus a small fee. This method of financing enables a business to have a stable cash flow even when customers are late on payments or decide to wait until the end of the invoice term to make payments. If you’re exploring options for managing your accounts receivable more effectively, partnering with accounts receivable financing companies can provide the necessary funds to maintain operations and growth without relying solely on customer payments.

It’s easy for invoice factoring to be confused with traditional loans, but they’re different. For example, traditional loans emphasize your credit score, while invoice factoring emphasizes the creditworthiness of your customers.

Here are some of the most important facts you need to know about invoice factoring:

1. Any Business Can Use It

Whether your business is small or large, invoice factoring can help your company get the immediate cash it needs. You might think that only certain businesses, like manufacturers or trucking companies, can use this service.

You can use invoice factoring for virtually any business that has to wait 30 days or longer to be paid by their customers. Factoring companies aren’t interested in the type of industry your business is in, as long as you sell to other businesses on credit terms.

Companies often use invoice factoring with large amounts of outstanding invoices from their clients. It’s also used by companies that need cash quickly rather, than waiting for their invoices to be paid.

The time it takes to pay the factored invoices is called the ‘factoring period.’

In addition to providing cash in exchange for unpaid invoices, factors can also help businesses manage their accounts receivable and collections process.

2. It Is Not A Loan

Factoring is different from a business loan because it’s not debt-based financing. When you borrow money with a loan, you generally have to make monthly payments until the entire balance is paid (plus interest). There are no monthly payments or interest rates with invoice factoring—just a one-time fee for selling your invoices outright.

Factors consider the creditworthiness of your customers when determining whether or not they’ll buy your invoices. Moreover, while loans can finance startups, factors don’t generally finance startups. The only exception is that the startups have established customers with significant credit limits generating revenue.

The most common example would be a company awarded a large contract by the government or another large corporation, guaranteed to pay its invoices on time. Some factors may finance startup companies if the owners have solid credit histories, but only if the contracts are solid.

3. Invoice Factoring Isn’t A New Financing Strategy

Businesses have been financing invoices for thousands of years. The practice dates back to the Ancient Mesopotamia, Babylonian, and Roman empires when traders would accept grains of salt in exchange for goods.

As trade networks expanded and international commerce became more commonplace, buyers and sellers started to use letters of credit, which were documents that promised payments in exchange for goods.

Back then, not unlike today, merchants would sell goods and services on credit terms, with the expectation that they’d be paid at a later date. The factor extracted a fee from its customer in exchange for cash.

Over the last few decades, invoice factoring has evolved into a more sophisticated financing solution that, today, allows businesses of all sizes to access much-needed working capital without incurring debt or giving up any equity in their company.

4. There Are No Long-Term Commitments

When you contract with a factoring company, there are no long-term commitments between the company and the client. This makes invoice factoring financing extremely flexible, unlike bank loans or lines of credit that typically require long-term commitments and contracts. The only binding agreement is until the invoice in the contract is paid.

The factoring process doesn’t involve site visits, loan committees, and lengthy due diligence. Therefore, you can choose to use factoring only one time or use it repeatedly. It’ll depend on how much stable cash flow you need in your business.

Also, you can choose to work with different factoring companies each time you want to get money. However, it’s always advisable to build a strong relationship with one factoring company.

5. Quick And Affordable

For small businesses, cash flow is everything. If they don’t have cash on hand, they can’t pay their bills. You can get up to 97% of the invoice amount with freight factoring within 24 hours of submission.

This means you can afford to accept new loads and get paid for them immediately. Factoring companies also offer fuel advances, so you know you’ll always have enough gas money to get from point A to point B.

Moreover, the cost of freight factoring is often a small percentage of the invoice amount. The price is determined by the credit of your customers. If your customers have good credit, the cost will be lower. It’s a simple, affordable way to get paid for your work without waiting 30 days or more.

6. It’s A Good Way To Increase Cash Flow

Cash flow is the biggest reason why businesses use invoice factoring. When you have a pile of unpaid invoices, you’ll have less cash flow and working capital. Some businesses can’t even pay their employees because of this problem.

With invoice factoring factors, you can get up to 100% of the invoice amount from your invoice factoring company without waiting around for your clients to pay you. Your client pays your invoice factoring company directly, so they don’t even know that you’re using a factoring service.

With increased cash flow and working capital in hand, you can grow your business, pay your employees and suppliers on time, or take on new contracts without any worries.

Conclusion

The invoice factoring industry is an industry that’s been there for a very long time and has been used by businesses to stabilize their cash flow. There may be similarities between invoice factoring and loans, but they’re not the same. In this article, six facts about the invoice factoring industry have been discussed in detail.

Read Also:

Comments Are Closed For This Article