Maximizing Real Estate Investments With the 1031 Exchange

5 Mins Read

Published on: 27 June 2023

Last Updated on: 16 January 2025

toc impalement

The 1031 Exchange is a powerful tool that real estate investors utilize to maximize their investments.

By understanding and implementing this tax-deferment strategy, investors can sell their investment property. Subsequently, another property of equal or higher value should be acquired while deferring capital gains tax.

Referred to as “trading up,” the 1031 Exchange offers several advantages for investors in the real estate market. In this article, we will explore the benefits of the 1031 Exchange and its impact on real estate investment.

Therefore, being good at this form will also ensure that you are great at Real Estate Investments.

What is A 1031 Exchange?

For years, real estate experts have sworn that Section 1031 is one of the most important and powerful tools for maximizing investment. However, you can only implement this tool if you have a complete idea about the whole deal.

So, what is a 1031 exchange? This is a federal taxation provision set by the US government. The provision allows businesses to defer federal taxes if they plan on reinvesting the proceeds gained from one property into another. This is a form of a like-kind exchange.

Property owners and investors primarily use this method to defer federal taxes. This method is also known as the Starker loophole. The loophole’s inception can be traced back to the 80’s.

However, this clause went through some major changes over time. Before December 31st, 2017, this form of investment can be imposed on any kind form of property. However, this changed.

Here is a detailed rundown of all the updated rules of a 1031 exchange:

- The proceeds of a purchase have to go to a like-kind property. This means the proceeds of a penthouse sale can only be reinvested in a penthouse.

- Such an investment comes with a time limit. If a sale occurs, you will have 45 days to identify the like-kind property and 180 days.

- All the previous taxation must be cleared before the year of the 1031 exchange. Pending taxation can derail the program.

Types of 1031 Exchanges

1031 exchanges come in different shapes and sizes. Therefore, having some sense of clarity on their types will actually help you further your understanding of what a 1031 exchange is. Here we go!

- Delayed Exchange: This is the most common format of 1031 exchanges. This variant allows investors to buy property within 180 days of selling a property.

- Reverse Exchange: In this case, you just reverse the process. You are expected to find a property before the selling of the relinquished property.

- Build-To-Suit Exchange: In this case, investors use proceeds to renovate another property. However, the improvement needs to be completed before 180 days of selling.

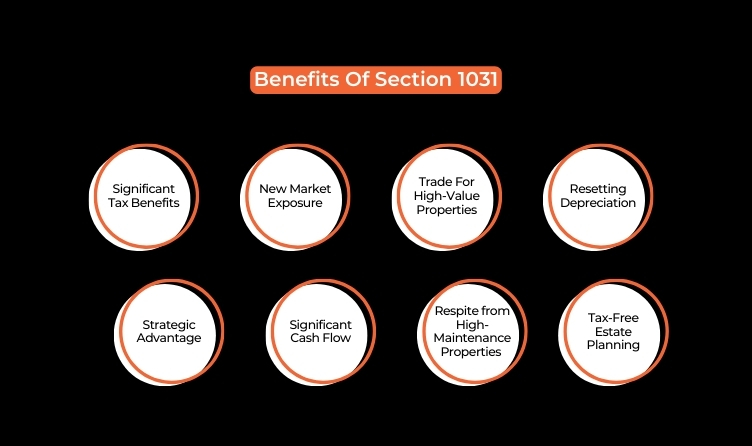

Benefits of Section 1031

Section 1032 is not just a means of averting federal taxation on property. It is so much more than that.

Hence, the only way you can truly understand what is a 1031 exchange you need to have some sense of clarity of its benefits.

Here are some of the most prominent benefits of the 1031 exchange that you need to know.

Significant Tax Benefits

One of the primary reasons investors choose to execute a 1031 Exchange is the substantial tax benefits it provides. Unlike direct selling and reinvesting, the 1031 Exchange allows investors to defer capital gains tax, which results in more capital available for investing in another property. This tax-deferment process enables investors to keep their capital working instead of paying it towards capital gains taxes.

Additionally, for those looking to diversify their real estate holdings, a tic 1031 exchange could offer a flexible option for deferring taxes while expanding investments.

New Market Exposure

Utilizing the 1031 Exchange in real estate investment opens up opportunities to enter new markets and enjoy greater returns in the long run. Investors can explore a wide array of passive investments and diversify their portfolios, moving away from a specific property type.

By spreading their risk across the market, investors can regenerate time that would have been spent on property management and maintenance. This flexibility allows investors to invest in high-value real estate properties with higher yields.

Trade For High-Value Properties

The 1031 Exchange enables investors to trade their properties for those with higher quality, better returns, and that align with their investment objectives. The advantage lies in the fact that investors do not have to pay taxes when purchasing another property. Tax payment on capital gains only occurs if the investor chooses to execute another 1031 Exchange. By

utilizing the 1031 Exchange, investors can acquire high-value properties more affordably, experience improved cash flow, and generate higher returns over time.

Resetting Depreciation

Investors can utilize the 1031 Exchange to reset the depreciation of their real estate properties. This allows property owners to account for property deterioration associated with aging, structural issues, wear and tear, and obsolescence. Typically, the depreciable period for real estate investment property is considered to be 27.5 years by the IRS. This means that the property’s value, divided by 27.5 each year, is subtracted from the regular taxable income for 27.5 years. By reinvesting through a 1031 Exchange, investors can curtail the income tax amount due to depreciation and reset the depreciation amount by investing in higher-value properties with greater tax benefits.

Strategic Advantage

One of the notable advantages of the 1031 Exchange is the ability to save a significant amount of funds by exempting taxes on capital gains. By deferring the tax payment, investors can enhance their available funds and invest in larger properties, ultimately maximizing their returns.

Significant Cash Flow

When a property fails to generate adequate income, investors can sell it and use the funds to purchase another property that offers higher cash flow in a shorter period.

Respite from High-Maintenance Properties

When an investor is not interested in handling a high-maintenance property, they can re-invest or repurchase a property with minimal management or maintenance routine.

Tax-Free Estate Planning

An investor might replace the traditional property inheritance procedure with the 1031 Exchange. This helps to preserve the excellent amount till the estate is passed down to the next generation tax-free. It is tax-free only if it is applicable under the tax slab.

Conclusion

The 1031 Exchange is an excellent tax-exemption tool and one of the most popular real estate Investments that Realty Mogul real estate investment players use extensively.

Investors use the 1031 Exchange to create significant wealth, enjoy tax benefits, and expand their portfolios in the investment market.

This tactic is used by investors who aim to sell a present property and trade for higher-value property for greater cash flow and income.

Read Also:

Comments Are Closed For This Article