How To Start An LLC In 2026? Will It Actually Benefit You? Learn Everything About This Here!

11 February 2026

7 Mins Read

- What Are The Benefits Of Starting An LLC?

- 1. Less Restrictions On Ownership And Structure

- 2. Pass-Through Taxes

- 3. Personal Liability Protection

- 4. Credibility

- 5. Access To Business Loans

- What Are The Disadvantages Of Starting An LLC?

- 1. High Up-Front Costs

- 2. Limited Ways To Raise Capital

- 3. State-Specific Rules

- 4. Possible Tax Disadvantages

- Is An LLC Right For Your Business?

- How To Start An LLC: Analysing The Process In Detailed Steps

- 1. Choose Where To Register:

- 2. Pick A Name For Your LLC:

- 3. File Your Articles Of The Organization:

- 4. Find A Registered Agent:

- 5. Write Your Operating Agreement:

- 6. Meet All Regulatory Requirements:

- How To Change From A Sole Proprietorship To An LLC?

- 1. Check That Your Business Name Is Available:

- 2. File Your Articles Of Organization:

- 3. Write An LLC Operating Agreement:

- 4. Get A New Ein:

- 5. Open A Business Bank Account:

- 6. Apply for any necessary business permits and licenses:

- How To Start An LLC? Now You Know!

I recently turned my business into an LLC. What is an LLC, you ask? I will get there, of course!

But I first want to give you a little bit of context. So recently, one of my friends faced a huge loss in his business.

I know, this is heartbreaking, but also unavoidable. It will happen when it happens. Businesses are like ticking bombs, I feel.

So, I wanted to learn something from his experience. And the only wisdom I had is that I don’t want to lose my personal assets anyday!

Now, I will come to what an LLC is. Later, I will also tell you how to start an LLC.

An LLC, or Limited Liability Company, is a flexible business structure. There are many entrepreneurs, including myself, who go for this because it protects its owners.

Well, here, they are called members. They protect the members from being personally responsible for the company’s debts or legal issues.

Also, I want to make it very clear that this is nothing like a partnership, where owners share personal liability. An LLC keeps personal and business assets separate.

This means members’ personal belongings, like homes or savings, are safe if the business runs into financial problems.

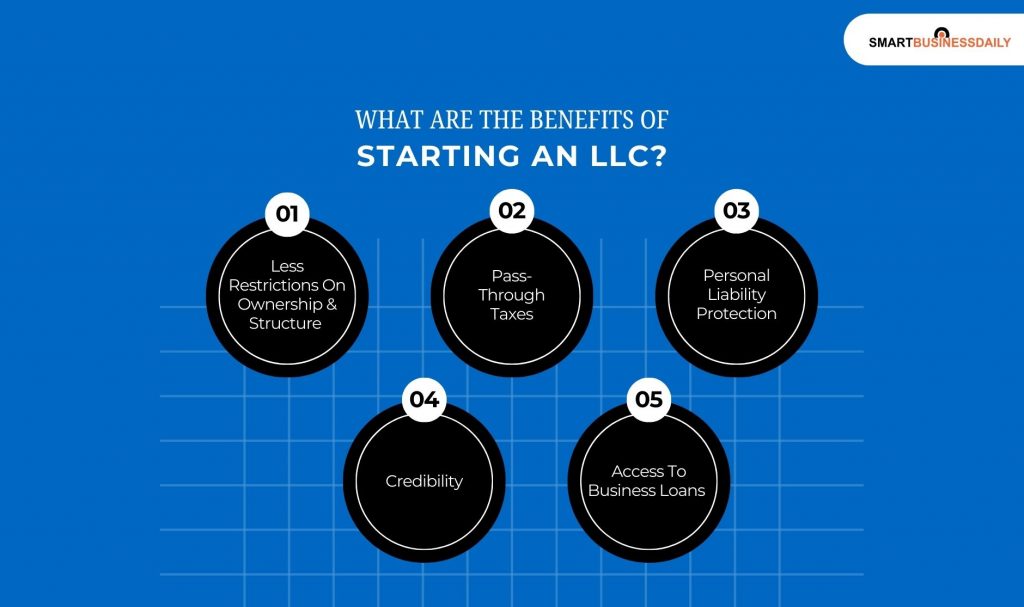

What Are The Benefits Of Starting An LLC?

Before I start with the guide on how to start an LLC, I would like to talk about its benefits.

An LLC is an easy-to-use business structure that combines the best features of other business types.

It offers the tax benefits of sole proprietorships and partnerships while also providing the limited liability protections typical of corporations.

Here are five advantages of starting an LLC:

1. Less Restrictions On Ownership And Structure

LLCs have flexible rules for how they operate and who can own them. Depending on state laws, members can be individuals, corporations, other LLCs, or foreign entities.

The IRS allows any number of members. So you can go for it with a single member. Or, it can be a multimember business.

A single-member LLC works like a sole proprietorship, while a multimember LLC is similar to a partnership.

An LLC can also choose to be treated as a corporation for tax purposes.

2. Pass-Through Taxes

One major advantage of an LLC is that profits go directly to the business owners.

Members report their share of the profits on their personal tax returns.

So, this means they only pay taxes once.

This is called pass-through taxation. Corporations face double taxation—inflating their tax bills—because they first pay taxes on profits and then again on individual returns.

3. Personal Liability Protection

LLC members enjoy limited liability for business debts. They are not personally responsible for the business’s financial problems.

Additionally, they are also not responsible for any of the businesses’ lawsuits.

But, there is a condition, of course! It stands as long as they do not engage in fraud or illegal actions.

4. Credibility

Forming an LLC can boost your credibility with clients, suppliers, and lenders.

An LLC is viewed as a more established business than a sole proprietorship or partnership.

So, this makes it easier to be seen as a trustworthy entity.

5. Access To Business Loans

While sole proprietors can apply for loans, lenders often hesitate to approve them.

Established LLCs, with their formal structure, are generally seen as lower-risk by lenders.

This means that once you start your LLC, your business can begin to build a credit history.

Additionally, you will also be able to improve your chances of getting loans or credit lines.

What Are The Disadvantages Of Starting An LLC?

An LLC, or Limited Liability Company, has many advantages. But there are some downsides to consider. Here are a few:

1. High Up-Front Costs

Uh Oh! This is a really shitty part. What do you mean that protecting my own money also requires money?!

But we have to abide by the rules. It is what it is.

So, if you are starting an LLC, I want to remind you of this. It can be more expensive than a sole proprietorship.

In fact, it might cost more than a partnership. This varies depending on the state where you register.

2. Limited Ways To Raise Capital

LLCs cannot issue stock. Now this is a problem.

This can make it harder to attract new investors compared to corporations.

3. State-Specific Rules

The laws for LLCs differ from state to state. So, this can complicate business operations if you operate in multiple states.

4. Possible Tax Disadvantages

LLC members may need to pay self-employment taxes on their earnings, which can be higher than the corporate tax rate.

Is An LLC Right For Your Business?

Many small business owners choose an LLC. This is because it offers a good mix of ease of use and protection for personal assets.

But, when you are wondering how to start an LLC, I want you to consider these questions:

- Do you want to limit your personal liability for business debts?

- Are you looking to attract capital from new investors or partners?

- Do you want to avoid paying taxes twice on your profits?

Choose a business structure that can grow with you. Changing from a sole proprietorship or partnership to an LLC later can be difficult, so research your options to find the best fit for your long-term goals.

How To Start An LLC: Analysing The Process In Detailed Steps

Starting an LLC is a simple process, but you need to pay attention to some important details to set up your business successfully. Here are the steps to start an LLC:

1. Choose Where To Register:

Decide which state to register your LLC, usually where your business is located.

Registering in a state with lower fees or taxes might seem good, but it can lead to more costs and paperwork.

2. Pick A Name For Your LLC:

Choose a name that follows your state’s rules. Most require the name to include “LLC” or “Limited Liability Company.”

3. File Your Articles Of The Organization:

Find your state agency. Often it is the Secretary of State. Then, you have to file your articles of organization.

This is a very important step in the ‘how to start an LLC’ guide!

The purpose of this document is to officially register your LLC. Additionally, it includes all the key details like the name of your business.

In addition, it also includes other information about your business, like its address and members.

4. Find A Registered Agent:

A registered agent will receive all the legal and official documents for your LLC.

Most states require LLCs to have a registered agent with a physical address in the same state.

5. Write Your Operating Agreement:

This document sets out the management structure and rules for your LLC.

It defines member roles, how profits are shared, and daily business operations.

6. Meet All Regulatory Requirements:

This includes filing the necessary documents. The first and foremost one is the articles of organization.

Additionally, you also need to obtain any licenses or permits. This will be based on your business type.

Consulting with a lawyer or accountant who specializes in LLCs can help ensure you follow the rules.

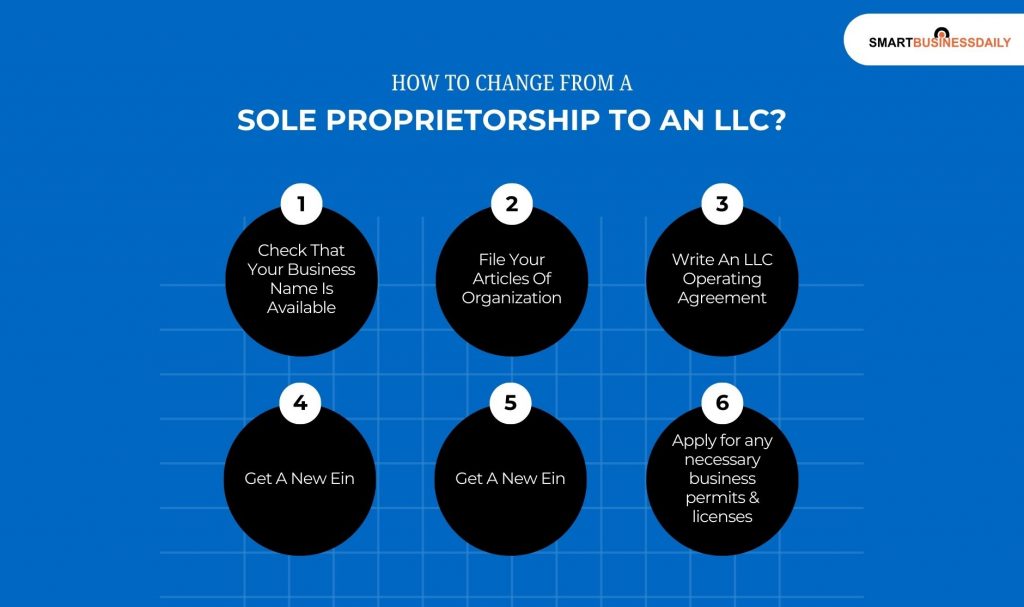

How To Change From A Sole Proprietorship To An LLC?

This is something that I did, as I mentioned at the beginning of this article.

So, I can assure you that if you are planning to change from a sole proprietorship to an LLC, I suggest you do it.

It can give your business more protection. Additionally, it will also give you more flexibility. Here are the steps to make the switch:

1. Check That Your Business Name Is Available:

Firstly, you need to search with the Secretary of State. Then, you also need to check the U.S. Patent and Trademark Office (USPTO).

This step is very important to make sure the name isn’t already taken or trademarked.

2. File Your Articles Of Organization:

Secondly, you need to provide important details like the LLC’s name and address.

Additionally, you also need to state its purpose. In fact, you also need to mention its registered agent and management structure.

Then, after all these, you need to pay the filing fee.

3. Write An LLC Operating Agreement:

This is the third, and a very important step. Outline the rights and obligations of members.

This includes voting rights and profit-sharing rules. Additionally, you need to mention the exit procedures.

In addition, you also need to be clear about the non-competitive rules.

4. Get A New Ein:

You need a new employer identification number (EIN) for your LLC. File Form SS-4 to get it, even if you have an EIN for your sole proprietorship.

5. Open A Business Bank Account:

It’s important to have a separate bank account for your LLC, as it must stay distinct from personal assets.

6. Apply for any necessary business permits and licenses:

You may need additional licenses and permits based on your industry or state.

An attorney or LLC service can help you with this process.

How To Start An LLC? Now You Know!

Well, I suppose I was able to tell you how you can start an LLC.

Additionally, I have also told you the process to transform a sole proprietorship into an LLC.

Businesses these days are pretty volatile. One moment it’s going pretty well, and the next moment you have no clue where you are standing.

So, an LLC is always a good choice if your business type matches. It allows you to safeguard your personal assets. So,. god forbid if someday your business becomes unstable, you will be assured about what you already own.