How Gofinance.com Credit Score Helped Me Level Up My Financial Game

20 August 2025

5 Mins Read

- So, What is Gofinance.com Credit Score?

- The Resources That Make It Stand Out

- Why It’s Perfect for New Learners

- My Journey With Gofinance.com Credit Score!

- Step 1: Understanding My Score

- Step 2: Making Small Changes

- Step 3: Using the Learning Resources

- Step 4: Tracking Progress

- Step 5: Reaching My Goal

- How It Can Help You Too

- A Few Extra Tips I Learned Along the Way

- Up next..

When I first stumbled upon gofinance.com credit score, I honestly wasn’t expecting much. I had been in that awkward spot where I knew credit scores were important, but I didn’t really understand how they worked.

I thought, “As long as I pay my bills, I’m fine,”!

However, it turns out there’s a whole world behind those three little numbers. If you’ve ever wondered how to keep track of your credit score, learn how to improve it, and actually understand what it means, this platform is worth checking out.

In this post, I’ll share what gofinance.com credit score is all about, the resources it offers, how it helps beginners like me, and my personal journey of going from “clueless” to “credit savvy.”

So, What is Gofinance.com Credit Score?

Simply out, gofinance.com credit score is an online platform that helps you to:

- Check,

- Monitor, and

- Understand your credit score.

But it’s not just about showing you a number; it breaks down why your score is what it is, and what steps you can take to improve it.

Think of it as your personal finance buddy that’s always on your side. It doesn’t just throw fancy financial jargon at you.

Instead, it explains things in everyday language, which makes it perfect for people who are just starting to get serious about managing their money.

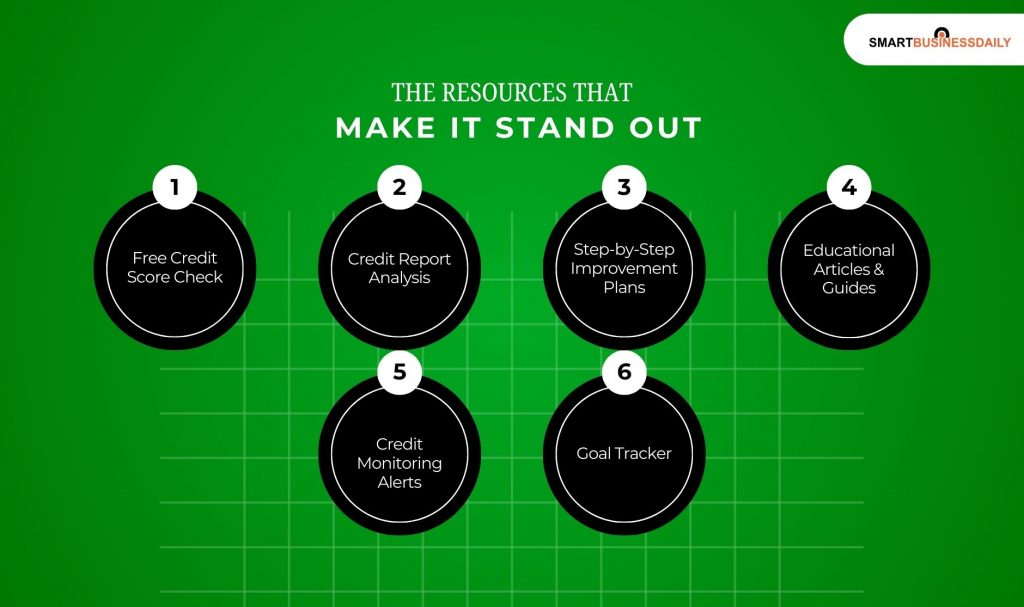

The Resources That Make It Stand Out

One thing I love about gofinance.com credit score is how beginner-friendly it is. Here’s what you’ll find when you explore the platform:

- Free Credit Score Check: No hidden fees, no strings attached. You can instantly see your score.

- Credit Report Analysis: Instead of a boring list of numbers, it breaks your report into sections and explains what’s going on.

- Step-by-Step Improvement Plans: The platform doesn’t just say “Your score is low”; it tells you exactly what you can do to boost it.

- Educational Articles & Guides: From “What is a credit score?” to “How to remove errors from your report,” the guides are written in plain English.

- Credit Monitoring Alerts: You get notified when something changes, like if a new account is opened in your name.

- Goal Tracker: If you’re aiming for a certain score to get a loan or a credit card, it helps you track your progress.

It’s basically like having a teacher, coach, and cheerleader all in one place.

Why It’s Perfect for New Learners

When I first started, I felt overwhelmed. All the termsAPR, utilization ratio, inquiriesmade my head spin. But gofinance.com credit score broke it down so simply.

Here’s why I think it’s great for beginners:

- Clear Explanations – No more Googling “What’s a hard inquiry?” and ending up confused.

- Small, Actionable Steps – It doesn’t overwhelm you with 20 things to do at once. It gives you one or two realistic actions to focus on.

- Motivational Tracking – Watching your score go up little by little is so satisfying.

- Accessible Anytime – You can check it on your phone while you’re waiting for your coffee.

If you’re someone who’s never really paid attention to your credit score before, this is the kind of platform that will make you actually care, because it shows you why it matters in real life.

My Journey With Gofinance.com Credit Score!

When I first signed up for GoFinance.com credit score, I had a “fair” score. Not terrible, but not exactly brag-worthy either.

I had a couple of late payments in the past, and I didn’t understand how things like credit utilization could drag my score down.

Here’s what happened over the next few months:

Step 1: Understanding My Score

The first thing I did was read through the analysis on gofinance.com credit score. It told me that my credit card utilization was too high and that I had too many recent hard inquiries.

I had no clue these things could impact me so much.

Step 2: Making Small Changes

I started paying off more than the minimum balance and avoided applying for new credit cards for a while.

Step 3: Using the Learning Resources

I read their beginner’s guide to “Improving Your Credit in 90 Days” and followed it religiously. It even gave me tips like setting up payment reminders to avoid missing due dates.

Step 4: Tracking Progress

Every month, I logged in to gofinance.com credit score to see my updated credit score. That little bump each month kept me motivated.

Step 5: Reaching My Goal

After about eight months, I went from “fair” to “good.” That opened up better interest rates and even allowed me to get approved for a rewards credit card I’d been eyeing.

Honestly, I don’t think I would’ve made this progress without the structure and guidance from gofinance.com credit score.

How It Can Help You Too

If you’re just starting your financial journeyor if you’ve been avoiding looking at your credit score because you’re scared of what you’ll seegofinance.com credit score is the perfect first step.

Here’s why:

- It’s judgment-free. Yes, you get facts and advice, not lectures.

- You learn as you go. You don’t need to be a finance expert to understand the tips.

- It’s progress-focused. The whole point is to help you improve, not just tell you where you stand.

I used to think of my credit score as this mysterious number that banks cared about, but I didn’t need to.

Now, I see it as one of my most important financial tools, and I actually enjoy checking in to see how it’s doing.

A Few Extra Tips I Learned Along the Way

While gofinance.com credit score gave me a lot of guidance, I also picked up a few personal habits that helped boost my score:

- Never Miss a Payment: Even one late payment can do damage.

- Keep Utilization Low: I aim to use less than 30% of my available credit.

- Don’t Apply for Credit Unnecessarily: Too many inquiries in a short time can hurt you.

- Check Your Report for Errors: Sometimes mistakes happen, and catching them early helps.

These might sound simple, but trust methey make a big difference over time.

Comments Are Closed For This Article