How Gomyfinance.com helped me save money and manage my finances?

8 Mins Read

Published on: 12 June 2025

Last Updated on: 02 January 2026

- The Wake-Up Call: Paycheck to Paycheck Living

- Learning the Basics: 50/30/20 Rule

- Monitoring My Spending in Real Time

- Setting goals

- Automation is freedom

- Cool Features That Made Saving Easy

- 1. Bill Calendar

- 2. Customized Budget Segments

- 3. Spending Alerts

- What Are Some Behavioral Hacks To Lock In Savings?

- Following the 72-Hour Rule

- Building an Emergency Fund

- Debt Management the Intelligent Way

- Looking Ahead: Investing and Growing

- Where Can You Put Your Savings For Better Returns?

- 1. Fixed Deposits (FDs)

- 2. Government Bonds

- 3. Direct Stocks

- 4. Equity Mutual Funds

- How To Save Smarter During Inflationary Periods?

- Concluding Thoughts: How Gomyfinance.com Saves You Money

Managing money can be challenging at times. There are expenses, unexpected expenses, and saving for the future, and you can feel lost.

I used to just scrape by from paycheck to paycheck and had no idea where my money was going.

That all changed when I discovered gomyfinance.com saving money tools. It was as if I finally knew my money and had a clear course of action to follow.

The Wake-Up Call: Paycheck to Paycheck Living

At some point, I believed saving money was for the big earners. However, the reality is that even six-figure earners are struggling.

Did you know that over half of those earning over $100,000 per year are still living paycheck to paycheck? I was amazed.

It made me realize that I wasn’t alone, and perhaps I didn’t need to make more—I just needed to be smarter about my money.

That’s when I came upon gomyfinance.com and its money-saving benefits, so I decided to try it out.

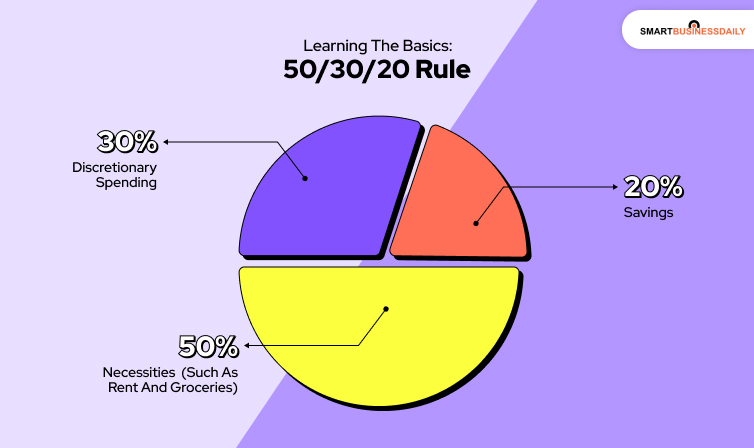

Learning the Basics: 50/30/20 Rule

One of the first lessons the platform taught me was the 50/30/20 budget rule. It’s a simple concept—

- Allocate 50% for necessities (such as rent and groceries),

- 30% for discretionary spending (like takeout or Netflix), and

- Allocate the remaining 20% to savings.

Honestly, I’ve heard it before, but gomyfinance.com saving money tools made it a reality. It allowed me to categorize my spending and track my progress at the time.

What was enjoyable about it? The system automatically adjusts when you enter your income and expenses. You don’t have to be a spreadsheet guru to balance your budget.

Monitoring My Spending in Real Time

I hadn’t budgeted for my expenses before I used the site. I would tell myself, “I am not spending much.” I was miserably mistaken.

After connecting my accounts to gomyfinance.com to save, everything was different. I got to see where my money was going—coffee houses, online purchases, food delivery… the whole nine yards. The charts and graphs were very helpful and sort of surprising.

It was the push I needed to start reducing things I didn’t need.

Setting goals

One of the most useful aspects of gomyfinance.com for making savings is goal setting. I needed to save $1,200 in a year for a vacation. The website divided it into monthly targets—$100 a month. That did not sound difficult.

But it didn’t stop there. It taught me how to adapt my spending so that I could reach that goal. I even received notifications when I was straying.

Such encouragement turned saving money into a game to be played rather than a difficult task to be achieved.

Automation is freedom

I just can’t say it enough: automating my savings revolutionized my life. I set it up so that a portion of my paycheck is automatically deposited into savings the moment I receive it. There is no deliberation, and no opportunity to spend it.

Gomyfinance.com saving money also facilitated automatic bill payments, such that I never missed a deadline. No longer a last-minute rush or late fees.

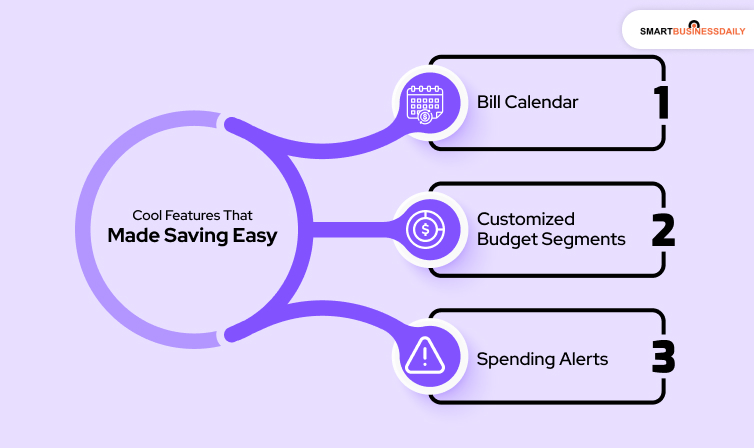

Cool Features That Made Saving Easy

There are a few things that were apparent and benefited me a lot while trying to manage my finances:

1. Bill Calendar

Bill calendar is similar to your money planner. It displays upcoming payments and reminds you, so you’ll never be surprised. I used to forget due dates, but nI o mlonger do

2. Customized Budget Segments

I enjoyed being able to set up categories such as “eating out,” “subscriptions,” or “gifts.” It categorized my spending for me, and I could easily see at a glance where I was overspending.

3. Spending Alerts

These were very helpful. I was notified of large spends, low account balances, and when my pay was received. I was in charge, so I was not caught out by overdrafts or unexpected charges.

What Are Some Behavioral Hacks To Lock In Savings?

Trust me when I say this, these hacks absolutely changed my life! And guess what? They are not very hard to follow as well. Let’s have a look!

Following the 72-Hour Rule

My biggest issue was impulse shopping. I was purchasing everything that I saw on the internet. But gomyfinance.com helped me learn to save by attempting the “72-hour rule”—wait 72 hours before buying something I do not need.

I started using it and saved a lot. The app would send me reminders on what I needed to purchase, and by the third day, I would often not want the item anymore. It’s simple but very effective.

Building an Emergency Fund

My first target was to save $1,000 for emergencies. It was not much, but it reassured me. If something unexpected happened—a car repair bill or a visit to the doctor—then I was ready.

Gomyfinance.com showed me that it was easy to save money when I put it away in $50 a week. This wasn’t hard at all, and before long, I had my safety net.

Debt Management the Intelligent Way

After my emergency fund, next I prioritized paying off debt on credit cards. The site helped me keep high-interest cards at the top of the list and track payments.

Seeing the balance go down every month was wonderful. It also kept me in mind about minimum payments and due dates, so I wouldn’t forget.

Looking Ahead: Investing and Growing

After learning to save and budget, I started considering some avenues of investment. According to gomyfinance.com, saving money not only assists in budgeting but also assists in investment tracking and long-term planning.

I began small, but having my portfolio monitored in the same software as my budget made it a lot easier. This helped me to feel more at ease with my financial future.

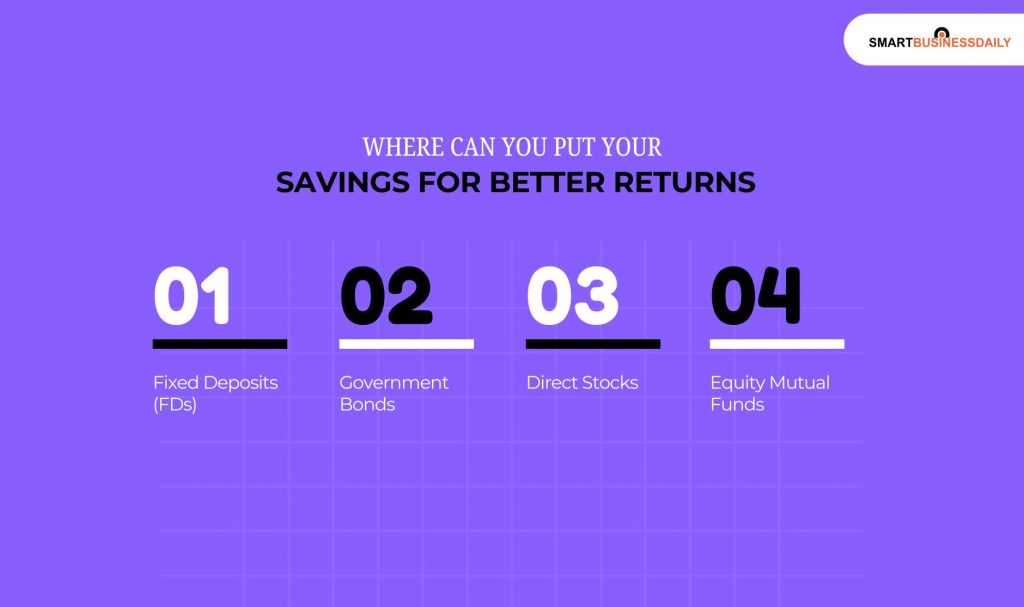

Where Can You Put Your Savings For Better Returns?

You know, savings alone won’t be able to take you very far. Which is why you need your put your money in places where it can make more money while you sleep.

These are some places you can park your savings for better returns:

1. Fixed Deposits (FDs)

When it comes to investing, you might be looking for options that promise reliable outcomes.

With guaranteed returns, you can have peace of mind knowing that your investment is secure.

Plus, there’s flexibility in the duration of your investment, ranging from as short as 7 days to a more extended period of up to 10 years.

This allows you to choose a tenure that aligns with your financial goals and needs.

However, it’s important to keep in mind that the interest you will earn from these investments is fully taxable.

While guaranteed returns can be appealing, factoring in the tax implications will help you better understand the net benefit of your investment.

Always consider your overall financial strategy to ensure it aligns with your long-term goals.

2. Government Bonds

When considering investment options, safety often takes precedence, especially for those who prioritize security over high yields.

An ideal choice for risk-averse investors is a financial product. Also, you will get a sovereign guarantee.

This type of investment offers the peace of mind that comes with the assurance of government backing, significantly reducing the risk of loss.

Additionally, fixed interest payments are a key feature, providing a reliable income stream that can help set predictable financial goals.

This makes it particularly suitable for long-term investors who prefer a consistent and steady return, allowing them to plan effectively for the future.

Overall, for those looking to safeguard their capital while still earning a return, this investment approach can be an excellent fit.

3. Direct Stocks

Investing in this opportunity presents the potential for significantly high returns, which is certainly appealing.

However, it’s important to keep in mind that it also comes with a level of risk that is considerably elevated.

This isn’t a path for everyone; it demands a solid understanding of the market and a commitment to thorough research.

Being well-informed and having the right strategies in place can help mitigate some of the risks involved.

Ultimately, if you’re someone who is willing to put in the effort to understand the nuances and fluctuations of the market, the rewards can be substantial.

4. Equity Mutual Funds

Professionally managed funds that invest in a variety of stocks can be a smart choice for those looking to build wealth over the long term.

These funds will help you create a diversified portfolio. This means they spread investments across several different sectors and companies.

This approach helps to mitigate risk while still taking advantage of market growth.

One of the most effective ways to invest in these funds is through Systematic Investment Plans (SIPs).

With SIPs, you can contribute a fixed amount of money regularly. So, this makes it easier to manage your budget.

Additionally, this also benefits from the potential of compound growth over time.

How To Save Smarter During Inflationary Periods?

This is how you can save more money even during high inflation. And no, you don’t need to worry much because I have curated the tips in such a way that protects you while it helps you save.

Also, I have tried them myself as well. They are:

- When you are amidst an inflation, the first and most important thing you must do is stop panicking.

I know it sounds stupid and unthinkable, but panic kills our brain’s ability to execute something we know that can solve the issue.

- You must have kept some money aside for the future, right? Well, the time to put that money in an account that will earn you some interest.

- Additionally, you have to sit down and calmly make a list of the expenses you can cut down.

You also have to start tracking your expenses.

- Additionally, this is the time when you should start focusing on paying down variable-rate loans.

- Finally, you must choose a certain type of credit card that will offer you rewards. This way, you will get value out of your purchases.

Concluding Thoughts: How Gomyfinance.com Saves You Money

If you have ever asked yourself whether you have money problems, I understand you. I was in the same situation. But gomyfinance.com saved me money and changed my life around. The user-friendly tools, easy-to-grasp graphics, and one-on-one guidance made money management less frustrating—and even enjoyable.

This is what helped me the most:

- Following every dollar as it flows.

- Simple budgeting using the 50/30/20 principle

- Automatic bill paying and saving

- Useful reminders to prevent charges and overspending

- Goal-setting tools for keeping motivated

- Money is not necessarily scary.

With the proper resources and with a little bit of effort each day, anyone can successfully handle their money. I truly believe that gomyfinance.com is one of the best sites to begin saving money.

If you want to break the cycle of living paycheck to paycheck, save for a dream vacation, or no longer worry about money, this website will assist you. You don’t have to be a financial expert.

Just take that initial step. You can do this, and gomyfinance.com will help you save money at every step.

Comments Are Closed For This Article