How Much Can I Withdraw From Chase ATM: A Detailed Guide To The Most Burning Question

24 November 2025

8 Mins Read

- What Is An ATM Withdrawal Limit?

- How Much Can I Withdraw From Chase Atm: Getting To Know The Withdrawal Limits

- How Much Can I Withdraw From Chase Atm Depending On The Account Type?

- 1. Chase Total Checking (Basic Accounts)

- 2. Chase Sapphire Checking (Premium Accounts)

- 3. J.P. Morgan Private Bank or Chase Private Client (Private Clients Account)

- How To Check Your Personal Limit For Cash Withdrawal From Chase Atm?

- 1. Log Into The Chase App

- 2. Check On The Website

- 3. Contact The Customer Service

- What Are The Chase ATM Withdrawal Limit Charges?

- 1. Local Charges

- 2. International Charges

- How To Change Or Increase Your Chase ATM Withdrawal Limit?

- 1. Know Your Reason:

- 2. Your Relationship With The Bank:

- 3. Account Type Matters:

- 4. Visit A Branch

- 5. Contact The Customer Service

- How To Withdraw More Once You’ve Reached Your Withdrawal Limit?

- 1. Cash Back At Retailers

- 2. Withdraw From Another Account

- 3. Cash A Cheque

- 4. Withdraw From The Bank Directly

- How Much Can I Withdraw From Chase ATM Explained

It’s not always feasible to rely solely on cashless payments. Additionally, there are certain situations where you have to withdraw a large amount of money from Chase ATMs, such as:

- Travel

- Emergencies

- Large Business Purchases

Basically, I am talking about times when cash is simply necessary.

Now, the main part. If you have a Chase bank account holder, then you might have a very common question: How much can I withdraw from Chase ATM?

Let me tell you, I had the same query as well. But now that I have gotten the hang of it and I have clearer information, I thought of helping you guys out too!

That’s a valid question! Banks often impose withdrawal limits for a few reasons:

- Reducing the risks associated with card theft

- To ensure that ATMs have enough cash available

- Keeping financial transactions in balance and managing potential risks

In this article, we’ll break down everything you need to know about withdrawal limits at Chase ATMs.

What Is An ATM Withdrawal Limit?

An ATM withdrawal limit refers to the highest amount of cash you can take out from an ATM in a single day.

Banks set these limits mainly to protect their customers from fraud, make sure there’s enough cash available for everyone, and help manage their overall operational costs.

The specific limit can differ depending on the bank, the type of debit card you have, and your account specifics.

If you find that you need a higher limit, you can usually call your bank to see if they can increase it for you.

How Much Can I Withdraw From Chase Atm: Getting To Know The Withdrawal Limits

When you get your Chase debit card for the first time, you’ll notice it has a set limit for ATM withdrawals.

Unfortunately, Chase doesn’t make these limits super clear on their website.

According to what I’ve heard from Chase customer service, here’s a quick rundown of the usual limits:

- You can withdraw up to $3,000 per day at ATMs located in your branch.

- If you’re using ATMs outside your branch, the limit is typically $1,000 per day.

- For non-Chase ATMs, it’s capped at $500 each day.

If you find that your current withdrawal limit isn’t quite enough, you might want to look into increasing that option.

On a side note, while there’s no daily deposit limit at Chase ATMs, keep in mind there might be a restriction on how many bills you can deposit at once.

How Much Can I Withdraw From Chase Atm Depending On The Account Type?

I have mentioned the maximum withdrawal limits already. But I feel like if I should do a deeper analysis and explain the withdrawal limit according to the type of bank account you have.

It’s better to note that these still may vary depending on your particular Chase branch.

1. Chase Total Checking (Basic Accounts)

The daily ATM withdrawal limit for a Chase Total Checking account is typically $5,000.

However, this can change depending on the ATM you use. For the highest limits, it’s a good idea to stick to Chase ATMs.

2. Chase Sapphire Checking (Premium Accounts)

With a Chase Sapphire Checking account, you can take out up to $3,000 daily from ATMs.

But I must add that this may change based on the ATM or your account history.

When it comes to withdrawing money in person at a branch, there isn’t a set limit.

Additionally, you must keep in mind that large withdrawals may need some prior notice.

3. J.P. Morgan Private Bank or Chase Private Client (Private Clients Account)

If you have a Chase Private Client account, you’ll find it convenient that you can withdraw up to $3,000 in a single day at a Chase ATM.

On the other hand, if you’re a J.P. Morgan Private Bank account holder, you might enjoy even higher ATM withdrawal limits compared to regular accounts.

However, these amounts can vary, so it’s a good idea to touch base with your banker or look over your account agreement to get the exact figures.

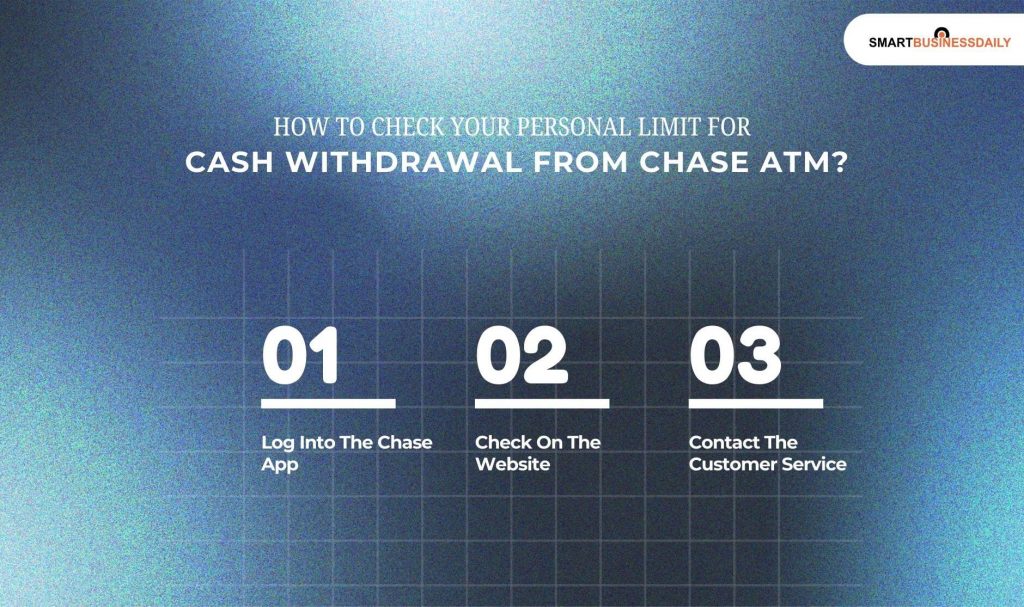

How To Check Your Personal Limit For Cash Withdrawal From Chase Atm?

If you want to check your Chase ATM withdrawal limit, there are a few easy ways to do it.

You can log into the Chase app on your phone, take a look at your account on their website, or just give customer service a call for assistance.

It’s pretty straightforward!

1. Log Into The Chase App

If you want to get familiar with your ATM limits, using the Chase mobile app is a great way to do it.

The app provides real-time updates, making it easier to keep track of your account. Here’s a simple step-by-step guide to help you out:

1. Open the Chase mobile app and log in to your account.

2. Find your checking or savings account on the main screen.

3. Select your debit card from the options available.

4. Look for the card controls feature to view your ATM limits.

2. Check On The Website

To check your ATM withdrawal limits on the Chase website, start by logging into your account.

Once you’re in, select the specific account you want to review. There, you should easily find the details about your withdrawal limits.

The steps are quite similar if you’re using the Chase app instead. Just log in and look for the information you need.

It’s a straightforward process that can help you stay informed about your banking options!

3. Contact The Customer Service

If you’re having trouble locating your withdrawal limit on the app or website, don’t worry!

You can easily reach out to customer service for assistance. Just give them a call at 1-800-935-9935, and they’ll be happy to help you understand your withdrawal limits.

What Are The Chase ATM Withdrawal Limit Charges?

While Chase doesn’t impose any fees for sticking to their ATM withdrawal limits, it’s worth noting that withdrawing from other ATMs can quickly become costly, whether you’re using them nearby or traveling abroad.

1. Local Charges

If you have a Chase account, you can enjoy making ATM withdrawals without any extra fees at their own ATMs.

However, if you need to use an ATM that’s not part of the Chase network, be aware that there will be a fee.

Usually around $3 from Chase, not including any additional charges the ATM operator might impose.

This applies whether you’re in the US, Puerto Rico, or the US Virgin Islands.

2. International Charges

When you’re traveling abroad and need to withdraw cash using your Chase debit card, keep in mind that there’s a $5 fee for each withdrawal made at a non-Chase ATM.

Plus, the ATM itself might hit you with an additional charge. As if that weren’t enough, there’s also a 3% foreign transaction fee on top of it all.

So, just be mindful of these extra costs when you’re managing your money overseas!

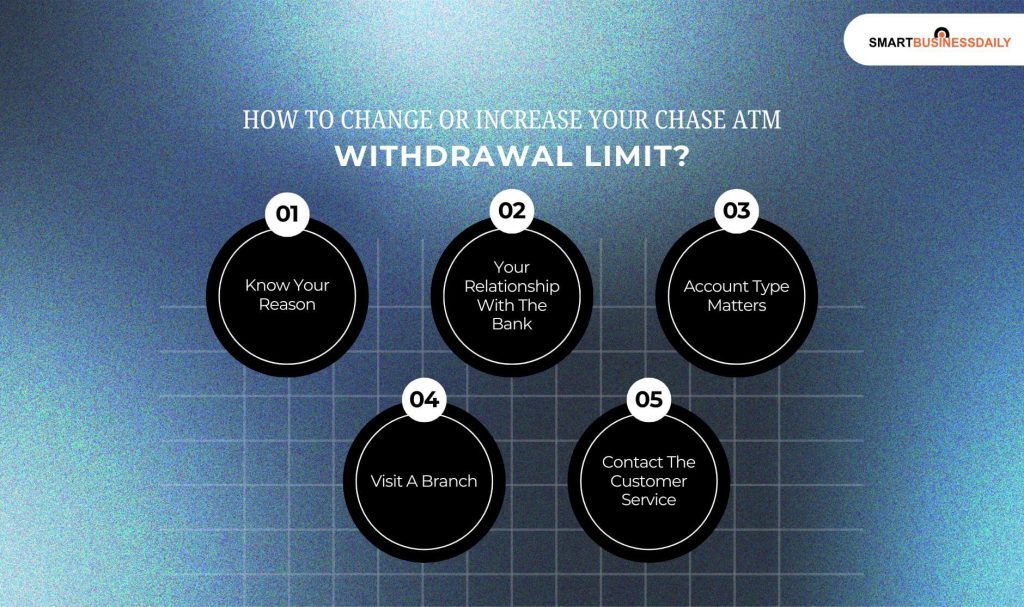

How To Change Or Increase Your Chase ATM Withdrawal Limit?

If you need to request a change to your Chase ATM withdrawal limit, whether in person or over the phone, there’s a way to make the process smoother.

Just keep in mind that any changes may not apply to ATMs outside of your bank’s branches.

Here are some steps to help you prepare:

1. Know Your Reason:

Think about why you need the increase. Are you traveling and need extra cash? Is it for an emergency?

Or maybe you’re making a down payment on a house or car? Having a clear reason can help the representative understand your situation.

2. Your Relationship With The Bank:

It’s worth mentioning how long you’ve been with Chase. If you have a good track record, like no overdrafts and a solid account balance, that’s definitely something to highlight. It shows you’re a responsible customer.

3. Account Type Matters:

Be aware that your account type can influence your ATM limits. If you have a premium account, for instance, you might already have a higher withdrawal limit than other account types.

4. Visit A Branch

If you’re looking to increase your Chase ATM withdrawal limit, one effective option is to visit a branch in person.

Chatting with a bank representative can really help get the process moving. Just be ready to explain why you need the increase.

They might ask a few questions to better understand your situation. It’s a straightforward approach that can make a difference!

5. Contact The Customer Service

If you want to increase your Chase ATM withdrawal limit, a simple and effective way is to reach out to customer service.

Just give them a call at 1-800-935-9935, the general line for personal banking, and let them know what you need.

They’ll be happy to help you with the change!

How To Withdraw More Once You’ve Reached Your Withdrawal Limit?

If you’ve reached the limit for cash withdrawals with your Chase debit card and still need money, there are other ways to get cash. Here are a few options:

1. Cash Back At Retailers

When you make a purchase at a grocery store or another retailer using your Chase debit card, there’s a little perk you might not know about: cash back!

After you’ve entered your PIN at the payment terminal, a screen will pop up asking if you’d like to take out some extra cash along with your purchase.

Just choose how much you’d like, and once the transaction is processed, the clerk will hand you the cash you requested.

It’s a convenient way to get a little extra money without having to make a special trip to the ATM!

2. Withdraw From Another Account

If you have a deposit or debit card, its withdrawal limits are connected to the particular bank account it is tied to.

So, you must adhere to the limitations of the particular bank account you are using currently. But if you have the privilege of multiple accounts, godfor you!

Then you can use another account in case you have exhausted the limitations of he bank account you are currently using.

3. Cash A Cheque

If you’ve got a checkbook and the person you’re paying is okay with checks, it can be a pretty straightforward way to handle the payment.

While it might not be the quickest option out there, it’s a dependable backup when you need to make a payment without any hassle.

4. Withdraw From The Bank Directly

If you’re planning to withdraw cash, it’s a good idea to visit your local bank branch, where you can interact with a teller directly.

This can make the process smoother, especially if you need a specific amount.

Just keep in mind that for larger withdrawals, it’s usually best to give the bank a heads-up beforehand.

By notifying them in advance, you can ensure that they have the cash available for you when you arrive, saving you any potential hassle.

It’s always nice to have a personal touch in banking cash withdrawals.

How Much Can I Withdraw From Chase ATM Explained

Chase takes a flexible approach when it comes to ATM withdrawal limits for debit cardholders.

Depending on various factors like your account history, the type of account and card you have, and how you choose to make the withdrawal, your daily limit can vary anywhere from $500 to $3,000.

It’s worth noting that if you use an ATM that isn’t owned by Chase, you may also face an extra fee for the transaction.

More Resources:

Comments Are Closed For This Article