Types Of Business: A Complete Guide To Business Structures, Models, And Modern Trends

06 November 2025

8 Mins Read

- What Are The Different Types Of Business Structures?

- 1. Sole Proprietorship

- Advantages:

- Disadvantages:

- 2. Partnership

- Types of Partnerships:

- Advantages:

- Disadvantages:

- 3. Corporation / Company

- Types of Corporations:

- Advantages:

- Disadvantages:

- 4. Limited Liability Company (LLC)

- Advantages:

- Disadvantages:

- 5. Cooperative (Co-op)

- Types Of Cooperatives:

- Advantages:

- Disadvantages:

- What Are The Modern and Emerging Types Of Business?

- 1. Social Enterprises And B-Corps

- 2. Platform Cooperatives And Daos

- 3. Remote-First And Virtual Companies

- 4. Gig And Microbusiness Models

- Business Models vs. Business Structures: What Are The Main Differences?

- How To Choose The Right Type Of Business?

- A Comparative Analysis Of Business Structures Across Jurisdictions

- 1. USA

- 2. India

- 3. United Kingdom

- 4. European Union

- 5. Australia

- Types Of Business: Cost, Tax, and Compliance Comparison

- What Are The Steps To Transition Your Business Type?

- 1. Evaluate Your Goals

- 2. Consult Legal & Financial Experts

- 3. Register The New Entity

- 4. Transfer Assets And Contracts

- 5. Update Tax And Bank Details

- 6. Notify Stakeholders

- Types Of Business: Risks And Liabilities

- What Are The Emerging Hybrid Types Of Business?

- How Can You Choose Your Ideal Business Type?

- Different Types Of Business Explained

- Frequently Asked Questions (FAQs)

You must understand the different types of businesses, as it is one of the most important steps if you are planning to start one.

Also, you will need this information to expand or invest in a venture.

Whether you’re a freelancer launching your first side hustle, a startup founder seeking funding, or a corporate leader scaling operations globally, the type of business you choose shapes everything.

Additionally, you can use it for everything from your legal liability and taxes to your governance, funding options, and long-term growth strategy.

In this guide, I’ll explore traditional and modern business structures, the difference between legal forms and business models, and how to select the right structure for your goals and stage of growth.

You’ll also discover insights on hybrid and emerging business types, jurisdictional comparisons, and real-world examples that make these complex concepts easy to grasp.

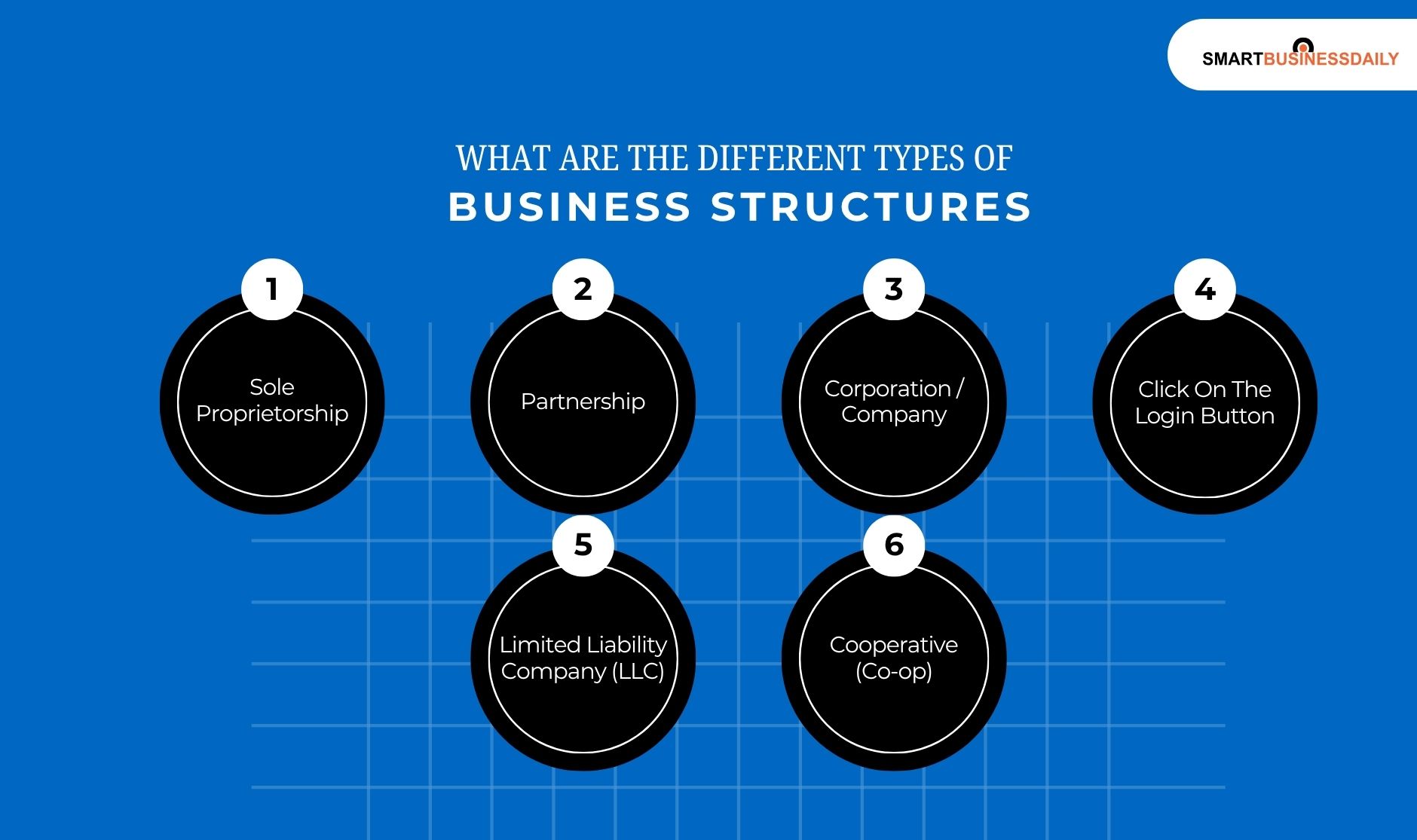

What Are The Different Types Of Business Structures?

A business structure defines the legal organization of your company — how it’s registered, taxed, and managed.

The structure determines how profits are distributed, how liability is shared, and what compliance requirements apply.

The main types include sole proprietorships, partnerships, limited liability companies (LLCs/LLPs), and corporations.

Let’s dive into each.

1. Sole Proprietorship

A sole proprietorship is the simplest and most common form of business.

It’s owned and managed by one individual, and there’s no legal distinction between the owner and the business.

According to Investopedia, it’s ideal for small-scale operations or freelance professionals who want minimal paperwork and full control.

Advantages:

- Easy to set up and operate

- Full ownership of profits

- Minimal compliance and cost

Disadvantages:

- Unlimited personal liability

- Difficult to raise capital

- Business continuity depends on the owner

Best for: Freelancers, consultants, independent retailers, and side hustlers.

Example: A freelance graphic designer or local café run by one person.

2. Partnership

A partnership involves two or more individuals sharing ownership, profits, and liabilities.

It’s governed by a partnership deed that defines each partner’s rights and responsibilities.

Types of Partnerships:

- General Partnership (GP): All partners share liability equally.

- Limited Partnership (LP): One or more partners have limited liability.

- Limited Liability Partnership (LLP): Offers limited liability with flexibility, ideal for professionals like lawyers, architects, or accountants.

Advantages:

- Easy to form with pooled resources

- Shared responsibility and expertise

- Tax benefits in some jurisdictions

Disadvantages:

- Disputes among partners can harm the business

- Personal liability in general partnerships

- Limited access to external funding

Example: A law firm or accounting practice.

3. Corporation / Company

A corporation (called a company in India and the UK) is a separate legal entity from its owners.

It can own property, incur debts, and be taxed independently. It’s the preferred structure for businesses planning to scale, raise investment, or go public.

Types of Corporations:

- C-Corporation: Common in the U.S., with unlimited shareholders and potential for public trading.

- S-Corporation: For small to medium businesses meeting certain IRS conditions.

- Private Limited Company (Pvt. Ltd.): Common in India for startups and SMEs.

- Public Limited Company (PLC): Listed on stock exchanges, allowing public investment.

Advantages:

- Limited liability protection

- Easier to raise capital

- Perpetual existence

Disadvantages:

- Higher compliance and setup cost

- Double taxation in some cases (corporate + dividend tax)

- More regulatory oversight

Example: Tech startups, multinational corporations, and manufacturing firms.

4. Limited Liability Company (LLC)

An LLC combines the simplicity of a sole proprietorship or partnership with the liability protection of a corporation.

It’s widely used in the U.S. and similar to LLP in India or the Private Limited structure in the UK.

Advantages:

- Limited personal liability

- Flexible management and profit-sharing

- Pass-through taxation (profits taxed at owner level)

Disadvantages:

- More complex setup than sole proprietorship

- Compliance costs

- Varies by jurisdiction

Example: A digital agency, small tech startup, or family business.

5. Cooperative (Co-op)

A cooperative is owned and operated by a group of individuals for their mutual benefit.

It’s a democratic business model where each member has equal voting rights, regardless of investment.

Types Of Cooperatives:

- Producer co-ops (farmers, artisans)

- Consumer co-ops (retail, housing)

- Worker co-ops (employees own and manage)

- Credit unions (financial co-ops)

Advantages:

- Equitable distribution of profits

- Member-driven governance

- Community-focused impact

Disadvantages:

- Slower decision-making

- Limited capital-raising ability

Example: Amul (India), REI (U.S.) — successful cooperative models blending community ownership with profitability.

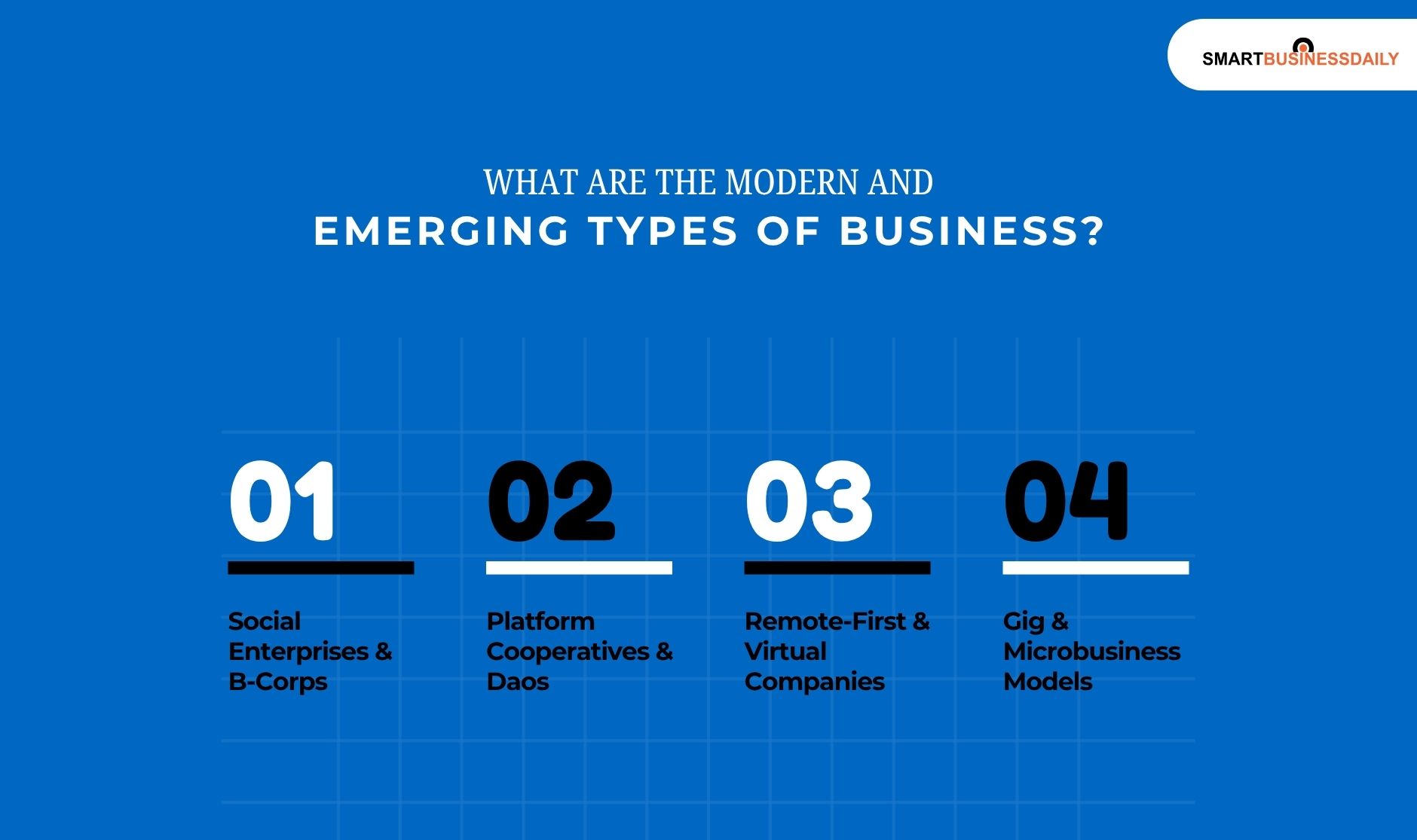

What Are The Modern and Emerging Types Of Business?

The digital revolution has given rise to new, hybrid business types that blend elements of traditional structures with innovative models.

1. Social Enterprises And B-Corps

A social enterprise prioritizes social or environmental goals alongside profit. Many are registered as Benefit Corporations (B-Corps) — legally required to consider social impact in decision-making.

Example: TOMS Shoes or Patagonia, which combine commerce with positive social outcomes.

2. Platform Cooperatives And Daos

Platform Cooperatives are digital platforms owned by users or workers — a modern alternative to investor-owned platforms like Uber or Amazon.

DAOs (Decentralized Autonomous Organizations) operate using blockchain-based governance, allowing token holders to make decisions collectively.

3. Remote-First And Virtual Companies

Post-2020, many businesses have no physical headquarters. Virtual companies like GitLab or Zapier operate entirely online, using digital tools for collaboration and governance.

4. Gig And Microbusiness Models

Independent contractors, creators, and freelancers now form the gig economy, contributing to millions of microbusinesses worldwide. Platforms like Upwork or Etsy allow individuals to operate globally without traditional structures.

Business Models vs. Business Structures: What Are The Main Differences?

While business structure defines your legal identity, your business model defines how you make money. Both work together but serve different purposes.

Common Business Models:

| Model | Description | Example |

|---|---|---|

| Product-Based | Sell tangible goods | Apple, Zara |

| Service-Based | Offer professional or creative services | Deloitte, Fiverr |

| Subscription | Recurring revenue from regular payments | Netflix, Adobe |

| Marketplace | Connect buyers and sellers | Amazon, Airbnb |

| Freemium / SaaS Free | basic services + paid premium | Spotify, Slack |

| Franchise | Licensed brand and systems | McDonald’s, Subway |

Each model can operate under different legal structures. For example, a subscription-based LLC or a freelance sole proprietorship can both succeed if aligned with clear strategy.

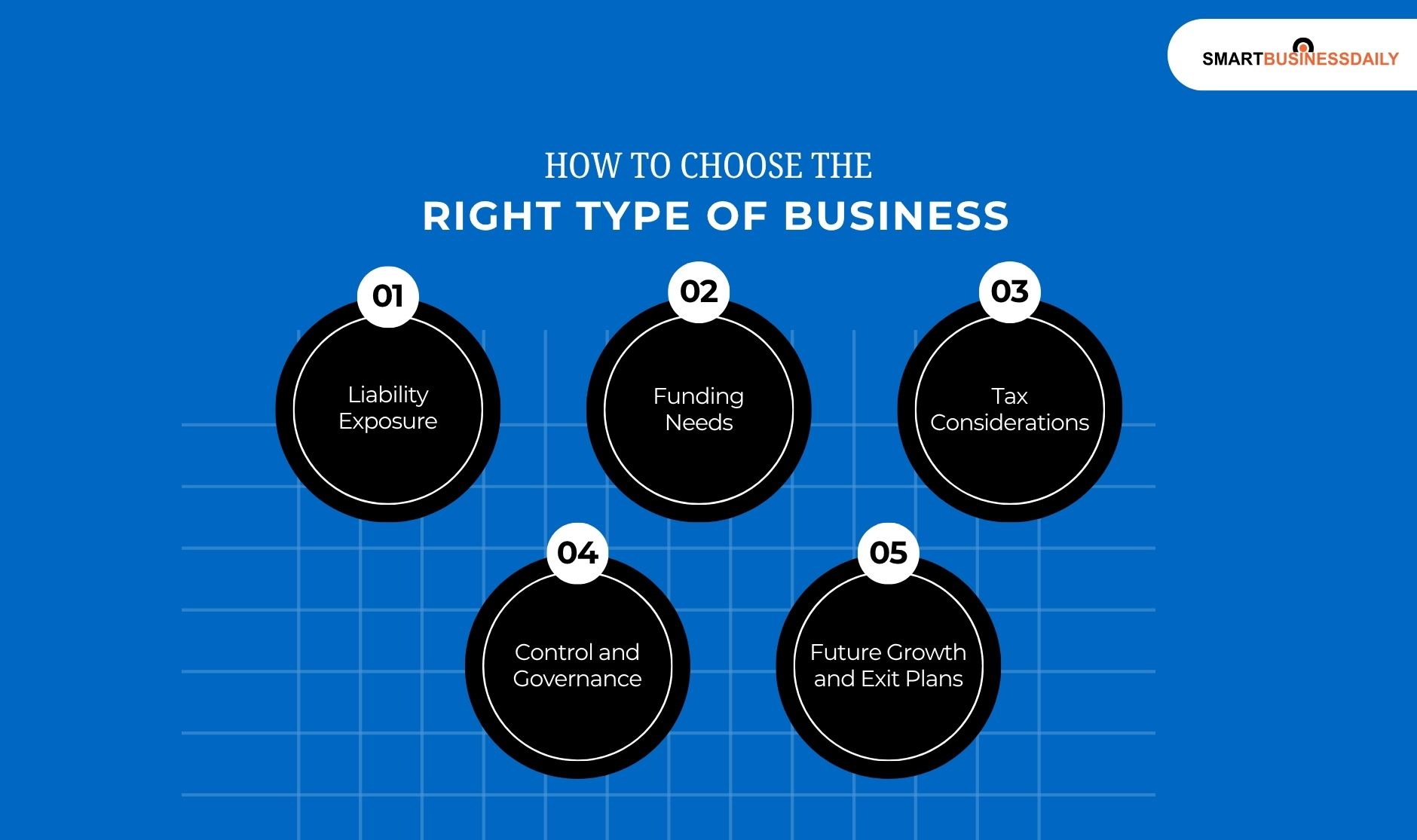

How To Choose The Right Type Of Business?

Your ideal business structure depends on your goals, scale, and risk tolerance. Consider these key factors before deciding:

1. Liability Exposure – How much personal risk can you tolerate?

2. Funding Needs – Do you need external investment or will you self-fund?

3. Tax Considerations – Different structures offer varied tax treatments.

4. Control and Governance – Do you prefer shared control or full ownership?

5. Future Growth and Exit Plans – Are you planning to scale, sell, or remain small?

A Comparative Analysis Of Business Structures Across Jurisdictions

Choosing the right business structure can vary depending on your country of operation, as taxation, compliance, and registration procedures differ significantly.

1. USA

- LLC (Limited Liability Company): Offers pass-through taxation and flexibility.

- C-Corporation: Preferred by startups aiming for venture capital.

- S-Corporation: Avoids double taxation but limits shareholders.

2. India

- Sole Proprietorship / Partnership: Easy to start but lacks legal separation.

- LLP: Protected under the Limited Liability Partnership Act, 2008.

- Private Limited Company: Most popular among startups under the Companies Act, 2013.

- OPC (One Person Company): Allows single-person ownership with limited liability — ideal for freelancers or solopreneurs.

3. United Kingdom

- Sole Trader: Similar to sole proprietorship.

- Limited Company (Ltd): Distinct legal identity, common for small and mid-sized businesses.

- Public Limited Company (PLC): Publicly traded, subject to stringent governance.

4. European Union

- GmbH / SARL: Limited liability models are common in Germany and France.

- Societas Europaea (SE): Pan-European corporate form allowing mobility across EU countries.

5. Australia

- Sole Trader / Partnership: Simplest structures.

- Proprietary Limited (Pty Ltd): Equivalent to a Private Limited company.

- Public Company: Suitable for large businesses and IPOs.

Types Of Business: Cost, Tax, and Compliance Comparison

The financial and tax implications of the business type can significantly affect profitability. Below is a generalized view (for illustration; actual rates vary):

| Structure | Setup Cost (Approx.) | Annual Compliance | Tax Rate / Treatment | Typical Maintenance |

|---|---|---|---|---|

| Sole Proprietorship | Low ($0–$100 or ₹1,000–₹5,000) | Minimal | Personal income tax slab | Simple |

| Partnership | Low–Medium | Partnership deed, filing | Taxed as individual partners | Low |

| LLP / LLC | Medium ($200–$1,000 setup) | Annual filings, audits | Pass-through or entity tax | Moderate |

| Corporation / Pvt. Ltd | High ($500–$1,500 setup) | Board meetings, audits, returns | Corporate tax (15–30%) + dividends | High |

| Cooperative / B-Corp | Varies by purpose | Member audits, impact reports | Tax exemptions or rebates are possible | Moderate–High |

What Are The Steps To Transition Your Business Type?

Take notes…

1. Evaluate Your Goals

Are you seeking liability protection, funding, or tax efficiency?

2. Consult Legal & Financial Experts

Professional advice ensures compliance with local laws (e.g., MCA in India, IRS in the U.S.).

3. Register The New Entity

Apply for incorporation or conversion with the relevant authorities.

4. Transfer Assets And Contracts

Move intellectual property, assets, and licenses legally to the new structure.

5. Update Tax And Bank Details

Obtain new PAN/TIN/Tax IDs.

6. Notify Stakeholders

Inform clients, vendors, and employees of structural changes.

Types Of Business: Risks And Liabilities

Each business type carries distinct risks, especially around personal liability, taxation, and compliance.

| Business Type | Liability Risk | Risk Mitigation |

|---|---|---|

| Sole Proprietorship | Unlimited – personal assets at risk | Business insurance, incorporation |

| Partnership | Shared liability | Partnership deed with clear clauses |

| LLC / LLP | Limited liability | Maintain separate business accounts |

| Corporation / Pvt. Ltd. | Very low personal risk | Regular filings, corporate governance |

| Cooperative | Shared among members | Transparent bylaws and audits |

Incorporation or forming an LLP is often considered a strategic protection tool, safeguarding personal wealth from business debts or lawsuits.

What Are The Emerging Hybrid Types Of Business?

As global entrepreneurship evolves, new hybrid forms are reshaping the business landscape:

- SPACs (Special Purpose Acquisition Companies): Used to raise funds for mergers or acquisitions.

- Digital Cooperatives: Community-owned digital enterprises leveraging blockchain for governance.

- Community Interest Companies (CICs): UK-based social ventures balancing profit and purpose.

- Virtual Holding Entities: Registered in low-tax jurisdictions for digital-first businesses.

These forms represent how technology, purpose, and decentralization are redefining what “business” means in the modern world.

How Can You Choose Your Ideal Business Type?

Before registering your business, walk through this simple checklist:

- Do I understand my target market and funding needs?

- Am I ready for legal and tax compliance?

- How much personal liability can I tolerate?

- Do I plan to raise investment or stay independent?

- What’s my exit plan — scaling, selling, or legacy building?

Different Types Of Business Explained

If your answers point toward scalability, funding, and formal structure — a Private Limited or LLC might suit you best. If flexibility and control matter more, start as a sole proprietor or LLP.

Choosing the right type of business isn’t just a legal formality — it’s a strategic foundation for success. From sole proprietorships to corporations and emerging digital cooperatives, every structure serves a unique purpose.

A good rule of thumb:

Your business type should evolve with your growth — just as your ideas, team, and ambitions do.

Frequently Asked Questions (FAQs)

Globally, the sole proprietorship is the most common because it’s easy to start, inexpensive, and perfect for small-scale entrepreneurs or freelancers.

For startups seeking scalability and investment, a Private Limited Company (India) or C-Corporation (U.S.) is ideal due to structured governance and share-based funding potential.

Yes, businesses often transition from sole proprietorship to LLP or LLP to Private Limited Company as they grow. Ensure you follow legal conversion processes to avoid tax or compliance issues.

A business type is your legal structure (LLP, corporation, etc.), while a business model is how you earn revenue (subscription, service, product, etc.).

Corporations and LLCs offer the least personal liability, protecting your personal assets from business debts or lawsuits.

These include social enterprises, B-Corps, platform cooperatives, and DAOs — innovative models combining profit-making with social or digital governance principles.

Sole Proprietors / Partnerships: Taxed as personal income.

LLPs / LLCs: May enjoy pass-through taxation.

Corporations: Pay corporate tax, and shareholders may also pay dividend tax.

A sole proprietorship, freelancer registration, or one-person company (OPC) provides flexibility for independent professionals with minimal compliance.

Comments Are Closed For This Article