S corp VS C corp: Which Business Structure Is Suitable For You? How To Elect Them?

31 December 2025

8 Mins Read

- What Is A C-Corp?

- What Are The Key Features Of A C-Corp?

- What Is An S-Corp?

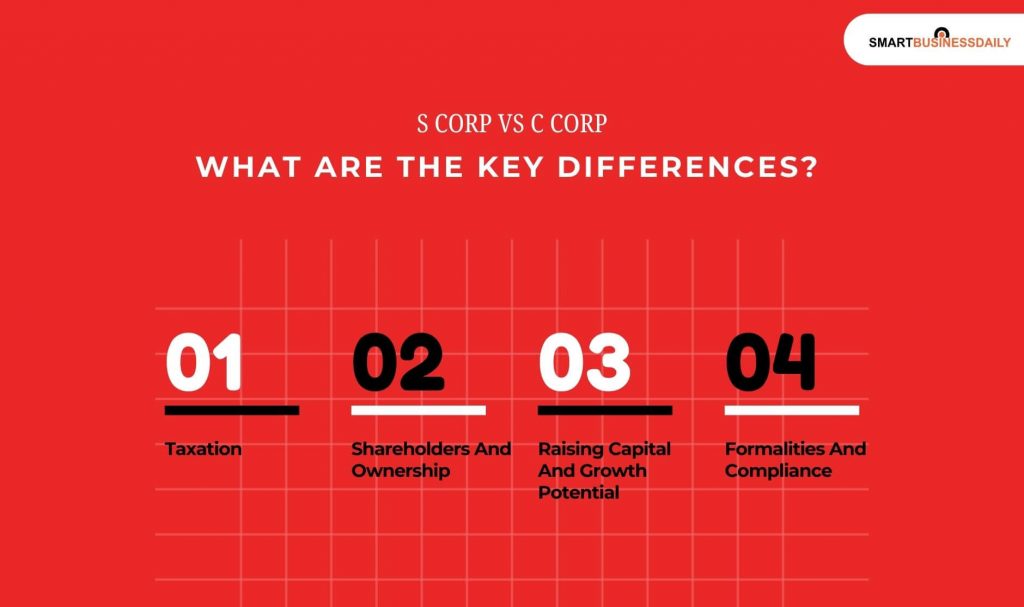

- S Corp Vs C Corp: What Are The Key Differences?

- 1. Taxation

- 2. Shareholders And Ownership

- 3. Raising Capital And Growth Potential

- 4. Formalities And Compliance

- S Corp Vs C Corp: Evaluating The Advantages And Disadvantages Of Each

- Advantages Of C-Corp

- Disadvantages of C-Corp

- Advantages Of S-Corp:

- Disadvantages of S-Corp

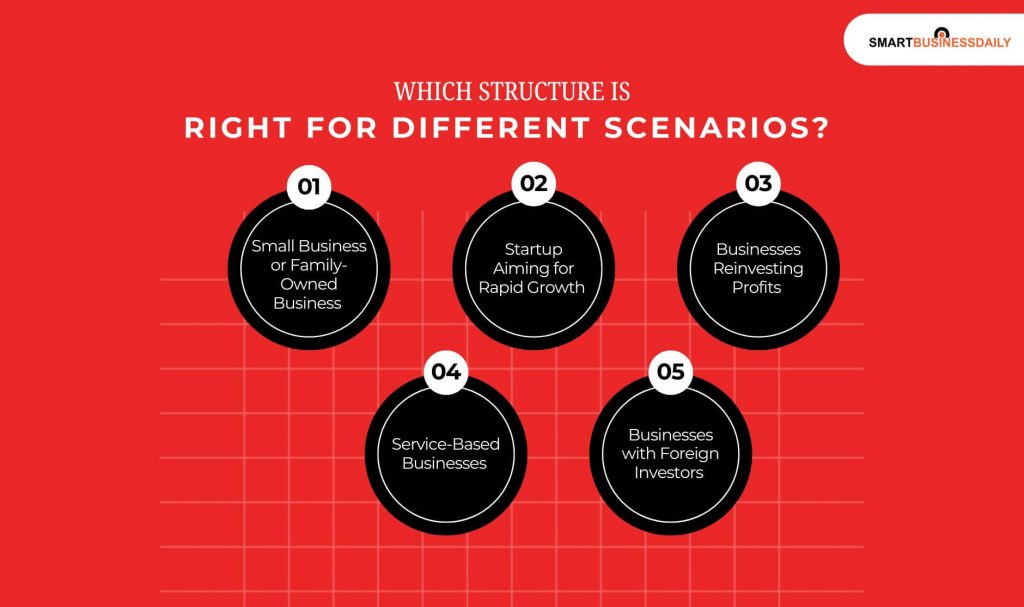

- Which Structure Is Right for Different Scenarios?

- 1. Small Business or Family-Owned Business

- 2. Startup Aiming for Rapid Growth

- 3. Businesses Reinvesting Profits

- 4. Service-Based Businesses

- 5. Businesses with Foreign Investors

- How to Convert or Elect Structure?

- What Are Some Common Misconceptions and Mistakes?

Hey! Do you know what the most important decision I had to make as a founder is?

It was the same as any other founder faces. I had to choose which business structure would be right for me.

Yes! I bet you didn’t see it coming! Choosing the right business structure is one of the most important decisions a founder makes.

It affects how much tax you pay. Additionally, it also influences how you raise money.

Also, it dictates how you manage ownership. In fact, it even decides how your company grows over time.

Many businesses in the United States get confused over the S Corp VS C Corp debate structure. This is because it offers:

- Credibility

- Scalability

- Legal protection

Among corporate structures, two names appear most often. These are S-Corporations and C-Corporations.

Both are legal corporations. But they differ sharply in:

- Taxation

- Ownership rules

- Growth flexibility

This article explains S-Corp vs C-Corp in a simple and practical way. It compares how each structure works.

Additionally, I will explain what their advantages and drawbacks are. In fact, I will also tell you guys which type of business each one suits best.

Business size, tax goals, and long-term growth plans all play a role in deciding the best option.

By the end, you will have a clear framework to choose the structure that aligns with your business vision, supported by guidance from credible industry and regulatory sources.

What Is A C-Corp?

A C-Corporation is the default corporate structure in the United States. Let’s say that I have incorporated a business. Additionally, I do not elect special tax treatment.

Then, what have I acquired? It automatically becomes a C-Corp.

A C-Corp is considered a separate legal and tax-paying entity. This means the company itself pays corporate income tax on its profits.

In addition, your shareholders are taxed again if profits are distributed as dividends.

But how can I form one? You can form a C-Corp begins by filing Articles of Incorporation with the state. Then, the corporation does the following:

- Issues shares to its owners

- Appoints a board of directors

- Adopts bylaws that govern operations

The board oversees major decisions. In addition, the officers manage daily operations.

Also, I want to highlight that the corporation is separate from its owners. So, the shareholders benefit from limited liability.

Lastly, your personal assets are generally protected from business debts. In fact, you won’t need to worry about lawsuits as well!

What Are The Key Features Of A C-Corp?

One of the defining traits of a C-Corp is its flexibility. It can have an unlimited number of shareholders. These shareholders can be

- Individuals

- Other companies

- Foreign investors

As you can see, there are no residency or citizenship restrictions.

C-Corps can issue multiple classes of stock. This makes them highly attractive to venture capital firms.

Also, it is particularly appealing to institutional investors. Then, what all are possible under this structure? All of these:

- Preferred shares

- Common shares

- Stock options

This flexibility is why most publicly traded companies and high-growth startups operate as C-Corporations.

Additionally, the C-Corp structure is designed for scalability. In fact, it focuses on external investment rather than tax simplicity.

What Is An S-Corp?

An S-Corporation is not a different type of corporation in legal terms. It is a tax election made by a corporation.

Also, you can see it as an eligible LLC to be taxed under Subchapter S of the Internal Revenue Code.

The defining benefit of an S-Corp is pass-through taxation. Here, it doesn’t pay corporate income tax.

The profits and losses pass directly to shareholders. Then, they are reported on their personal tax returns.

The S-Corp structure was created to support small and medium-sized businesses that want the legal protection of a corporation without the burden of double taxation.

It combines corporate liability protection with pass-through tax treatment similar to partnerships.

This structure is especially popular among closely held businesses where owners actively participate in operations.

Not every business qualifies for S-Corp status. The Internal Revenue Service enforces strict eligibility rules.

An S-Corp can have no more than 100 shareholders. All shareholders must be U.S. citizens or resident individuals. Corporations, partnerships, and most foreign entities cannot be shareholders.

The company can issue only one class of stock, although voting and non-voting variations are allowed. These restrictions limit ownership flexibility but help preserve pass-through taxation.

S Corp Vs C Corp: What Are The Key Differences?

Although both are corporations, S-Corps and C-Corps differ significantly in how they are taxed, owned, and funded. Understanding these differences is essential before choosing a structure.

1. Taxation

C-Corps pay corporate income tax on profits. When profits are distributed as dividends, shareholders pay tax again at the individual level. This is known as double taxation.

S-Corps avoid this issue. Income and losses pass directly to shareholders, who report them on personal tax returns. The company itself does not pay federal income tax in most cases.

2. Shareholders And Ownership

C-Corps allow unlimited shareholders with no restrictions on nationality or entity type.

This makes them ideal for global investment and complex ownership structures.

S-Corps are limited to 100 shareholders. Additionally, all of them must be eligible U.S. individuals.

In addition to this, the authorities will permit them only one class of stock. So, this rapidly reduces flexibility.

3. Raising Capital And Growth Potential

C-Corps excel at raising capital. They can issue preferred shares. Additionally, they can also issue stock options.

In fact, they can also attract venture capital or institutional investors. This is why most startups choose this structure. They seek rapid expansion.

S-Corps face challenges in raising outside capital. This happens completely due to ownership and stock limitations.

Additionally, I also need to add that many investors are ineligible to hold S-Corp shares.

4. Formalities And Compliance

Both structures require corporate formalities such as:

- Board meetings

- Record-keeping

However, C-Corps often face more complex compliance. This mainly happens due to investor reporting.

Additionally, it happens because of regulatory oversight.

S-Corps simplify taxation. But it still requires careful compliance to maintain eligibility. In fact, it also needs deep analysis to avoid penalties.

S Corp Vs C Corp: Evaluating The Advantages And Disadvantages Of Each

We will never be able to know fully about anything if we don’t evaluate its advantages and disadvantages.

So, let’s check these out!

Advantages Of C-Corp

- C-Corps offer unmatched flexibility for growth. They can raise unlimited capital.

- Additionally, they can also issue multiple stock classes and attract global investors.

- This structure supports long-term scaling, acquisitions, and public listings.

- Another advantage is reinvestment. Profits can be retained within the company. In fact, it doesn’t need immediate shareholder taxation.

- This can benefit businesses focused on expansion rather than distributions.

Disadvantages of C-Corp

- The biggest drawback is double taxation. Corporate profits are taxed at the company level and again when distributed as dividends.

- C-Corps also involve higher administrative complexity. The business has to deal with the compliance costs

- Additionally, there is the hassle of reporting requirements. Also, governance obligations can feel excessive for small or closely held businesses.

Advantages Of S-Corp:

- The biggest advantage of an S-Corp is pass-through taxation. The business itself does not pay federal income tax in most cases.

- Profits and losses flow directly to shareholders and are reported on their personal tax returns.

This helps avoid double taxation. Additionally, it often results in lower overall tax liability.

This is the same for both small and medium-sized businesses.

- S-Corps are well-suited for closely held companies. These companies have owners who are actively involved in daily operations.

- Shareholders who work for the company can receive part of their income as distributions rather than wages.

This may reduce certain payroll taxes. But they need to be structured correctly. Also, it needs to be within legal guidelines.

- Another benefit is simplicity for owners. I am not saying that corporate formalities don’t apply.

But the tax reporting is generally more straightforward compared to a traditional C-Corp.

- For many small business owners, this balance of legal protection and tax efficiency makes the S-Corp structure appealing.

Disadvantages of S-Corp

- Despite its tax benefits, the S-Corp structure comes with strict limitations.

- The cap on shareholders and the restriction to U.S. individuals can block growth opportunities.

- Foreign investors, venture capital firms, and corporate shareholders are usually not allowed.

- The one-class stock rule limits flexibility in distributing profits or creating investor incentives.

This makes S-Corps less attractive to outside investors who often prefer preferred shares or custom ownership terms.

- S-Corps also require careful compliance. Violating eligibility rules, even unintentionally, can result in termination of S-Corp status and unexpected tax consequences.

- For businesses with complex ownership or long-term expansion plans, these constraints can become a serious drawback.

Which Structure Is Right for Different Scenarios?

Choosing between S-Corp and C-Corp depends on how the business operates today and how it plans to grow in the future.

1. Small Business or Family-Owned Business

For small businesses, family-owned companies, and solo entrepreneurs, the S-Corp structure often makes sense.

It offers pass-through taxation, predictable ownership, and simpler tax treatment.

Businesses that generate steady income and distribute profits regularly tend to benefit the most.

2. Startup Aiming for Rapid Growth

Startups planning to raise venture capital, issue stock options, or expand internationally typically choose a C-Corp.

The flexibility in ownership and capital structure makes it easier to attract investors and scale operations.

This is why most high-growth startups incorporate as C-Corps from the beginning.

3. Businesses Reinvesting Profits

If a business plans to reinvest most of its profits instead of paying dividends, a C-Corp can still be effective.

Retained earnings are taxed only at the corporate level until distributed, which may delay shareholder taxation.

4. Service-Based Businesses

Professional services firms and owner-operated businesses often prefer S-Corps.

Income passes through to owners. Additionally, the structure aligns well with stable ownership. Also, it’s the same with limited outside investment needs.

5. Businesses with Foreign Investors

If a company expects foreign shareholders or international investment, the C-Corp is usually the only viable option.

S-Corp restrictions generally disqualify foreign ownership entirely.

How to Convert or Elect Structure?

Starting as a C-Corp and Electing S-Corp Status

Many businesses start as C-Corps and later elect S-Corp tax treatment. To do this, the company must meet all eligibility requirements and file Form 2553 with the Internal Revenue Service.

Timing is critical. Elections must be made within specific deadlines to apply for a given tax year.

Missing these deadlines can delay tax benefits or result in penalties.

Some businesses outgrow the S-Corp structure. Converting back to a C-Corp may be necessary when raising capital, issuing multiple stock classes, or adding foreign investors.

This change has tax implications and often triggers built-in gains considerations.

Professional tax and legal advice is strongly recommended before making any structural change.

The wrong move at the wrong time can create long-term tax exposure.

What Are Some Common Misconceptions and Mistakes?

- One common mistake is assuming an S-Corp is always better for taxes. While pass-through taxation is attractive, it may not suit businesses with high retained earnings or complex ownership.

- Another misconception is underestimating compliance requirements. Both S-Corps and C-Corps require formal governance, record keeping, and regulatory filings.

- Many founders also fail to consider future growth. Choosing a structure based only on current needs can create costly restructuring later.

- Ignoring shareholder restrictions is another frequent error. Bringing in an ineligible shareholder can instantly terminate S-Corp status, leading to unexpected tax consequences.

Comments Are Closed For This Article