How Can You Use Traceloans Com Student Loans Effectively In 2026?

20 February 2026

8 Mins Read

- What Are Traceloans.com Student Loans?

- What Are The Key Features and Benefits of Traceloans com Student Loans?

- 1. A Comparison Tool That Adds Convenience

- 2. Prequalification Option

- 3. Wide Network Of Lenders

- 4. Educational Blog

- 5. Real-Time Updates

- How To Get Started With Traceloans Com Student Loans?

- 1. Open the Website

- 2. Find the Login Button

- 3. Enter Your Details

- 4. Click Login

- How to Apply for a Loan on Traceloans Com Student Loans?

- 1. Assess Your Financial Needs

- 2. Explore Loan Options

- 3. Application Process

- 4. Review Loan Offers

- 5. Finalize the Loan

- 6. Funds Distribution

- What Are Some Useful Tips For The Effective Management Of Student Loans?

- 1. Borrow Only What You Need

- 2. Choose the Right Repayment Plan

- 3. Set Up Auto-Pay

- 4. Monitor Interest

- 5. Stay Informed

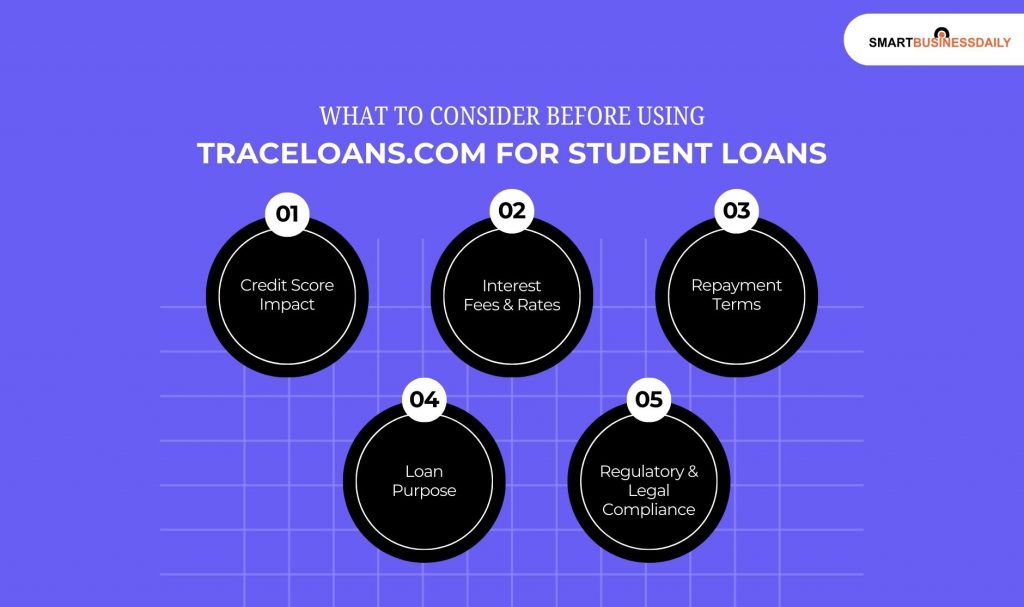

- What to Consider Before Using Traceloans.com for Student Loans

- 1. Credit Score Impact

- 2. Interest Fees And Rates

- 3. Repayment Terms

- 4. Loan Purpose

- 5. Regulatory And Legal Compliance

- Who Should Use Traceloans.com?

- What Are The Different Repayment Plans And Interest Rates For Traceloans Com Student Loans?

- 1. Variable VS Fixed Interest Rates

- 2. Repayment Plans Driven By Income

- 3. Repayment Plans After Graduation

- 4. Extended Repayment Plans

- The Dynamics Of Traceloans Com Student Loans

When I was in college, I had a classmate who had taken a student loan. I was lucky enough not to know about the concept then.

But later, I realised that student loans are way more important than what people perceive them to be.

But I also came to know that dealing with student loans is not a walk in the park!

It can be very, very stressful. Nonetheless, you cannot avoid them. They are an important way to pay for education. In fact, they will also improve job opportunities.

Traceloans com student loans help simplify this process. They provide resources and tools to help borrowers make smart choices.

Additionally, considering the borrowers are students, they also provide relevant expert advice as well.

At Traceloans.com, the goal is not just to find a loan. But you must understand the details.

In addition, you must also compare options. Then, you can create a repayment plan that fits your needs.

This will help you, no matter what your position is, whether you’re a student or a financial advisor.

In fact, I am someone who is interested in financial education. So, I find this site to be very useful as well!

This guide will show you how Traceloans.com can help you take charge of your financial future step by step.

What Are Traceloans.com Student Loans?

Traceloans.com Student Loans connects students with several lenders to help them understand available loans.

Additionally, it helps students compare loan options and interest rates.

Also, they are introduced to a lot of repayment terms. This works as a blessing for them, as they are finally able to cover tuition.

In fact, they can use this money for their books and living costs too!

All they have to do is go through an easy application process.

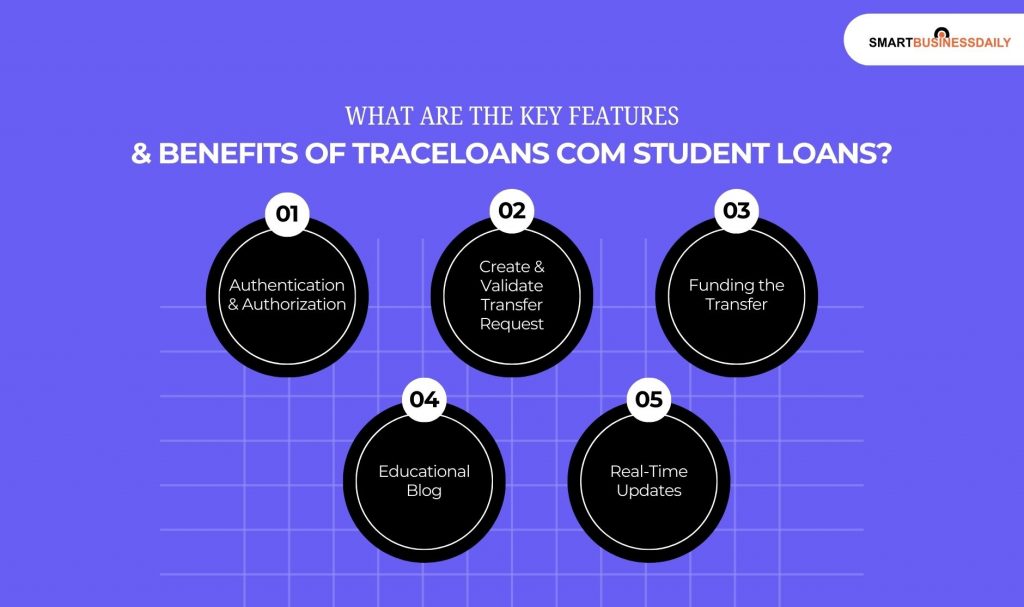

What Are The Key Features and Benefits of Traceloans com Student Loans?

1. A Comparison Tool That Adds Convenience

Traceloans.com offers a simple comparison tool. It lets students compare loans side by side.

Additionally, you can use this to choose loans with the best interest rates.

In fact, you will also be able to compare and choose the most suitable repayment terms.

Basically, you will have all the resources and benefits based on your preferences.

2. Prequalification Option

I really like that there is a prequalification option. You will find this really useful.

With this, you can find out if you qualify for different loan offers. And the best part? It will show you exactly the loans that won’t affect your credit score.

So, this allows you to make informed financial decisions before applying for a student loan.

3. Wide Network Of Lenders

Traceloans.com connects students to a large network of reliable lenders. So, this increases the chances of finding the right loan repayment plans.

You will find the ones that fit your financial situation. Also, it will be enough for your college funding needs.

4. Educational Blog

The site features a blog filled with helpful information for students. Also, they are very informative for the parents as well!

They will get to know all about getting student loans and budgeting.

Additionally, they will learn about the updated repayment strategies. In fact, they will also become aware of long-term financial planning.

5. Real-Time Updates

This is another great feature of this platform. You will receive real-time information about

- Loans

- Rates

- Applications

This transparency keeps borrowers informed. Additionally, this helps them make quick decisions during the loan application process.

How To Get Started With Traceloans Com Student Loans?

1. Open the Website

Firstly, you need to open your web browser. Then, you have to go to Traceloans.com.

Also, you need to make sure the site is secure. For that, you need to look for HTTPS. This is very important to protect your personal data.

2. Find the Login Button

Secondly, after you are on the website, you need to look in the upper right corner for the Log In or Sign In button.

Then, all you have to do is click on it. Now, you will be able to access the login page.

3. Enter Your Details

Then, you need to type your registered email address. Also, you can use your username and your password in the provided fields.

Now, I would suggest that you double-check your entries. This is because passwords are case-sensitive. So, you must match them exactly.

4. Click Login

Click the Log In button. If your details are correct, you will go to your dashboard.

If not, follow the prompts to reset your password or recover your account.

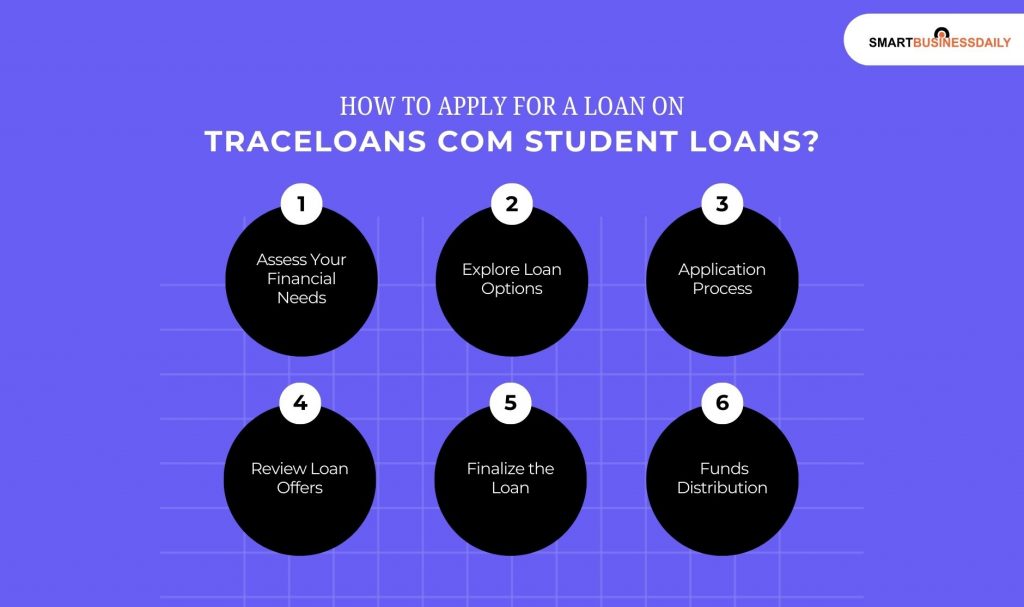

How to Apply for a Loan on Traceloans Com Student Loans?

1. Assess Your Financial Needs

You need to start this assessment by estimating all of your costs. This includes your:

- Tuition

- Housing

- Other School Costs

Then, you must determine how much funding you need. Make sure you choose an amount that won’t require you to borrow more than necessary.

So, you must take your time and set realistic repayment plans.

2. Explore Loan Options

Here, you get to use traceloans.com’s comparison tools. You can look at different:

- Loans

- Interest rates

- Terms

- Lenders

Also, I suggest that you choose a loan that fits your school schedule. In fact, you must also consider your repayment ability and financial goals.

3. Application Process

Fill out the online loan application with your personal, academic, and financial information.

Provide any required documentation, such as proof of enrollment or income.

4. Review Loan Offers

Once you see the loan offers, compare them. Firstly, you need to look at interest rates.

Then, you need to assess the monthly payments and terms. Also, you just learn about any fees to find the best and most affordable option.

5. Finalize the Loan

Now, you need to sign the electronic loan agreement for your chosen offer.

For this, make sure that you understand all terms. This includes when repayments start and possible deferments.

Also, you must be aware of the penalties for missed payments.

6. Funds Distribution

After approval, the funds will usually be sent directly to your school or your designated account.

Contact the recipient to manage the funds effectively.

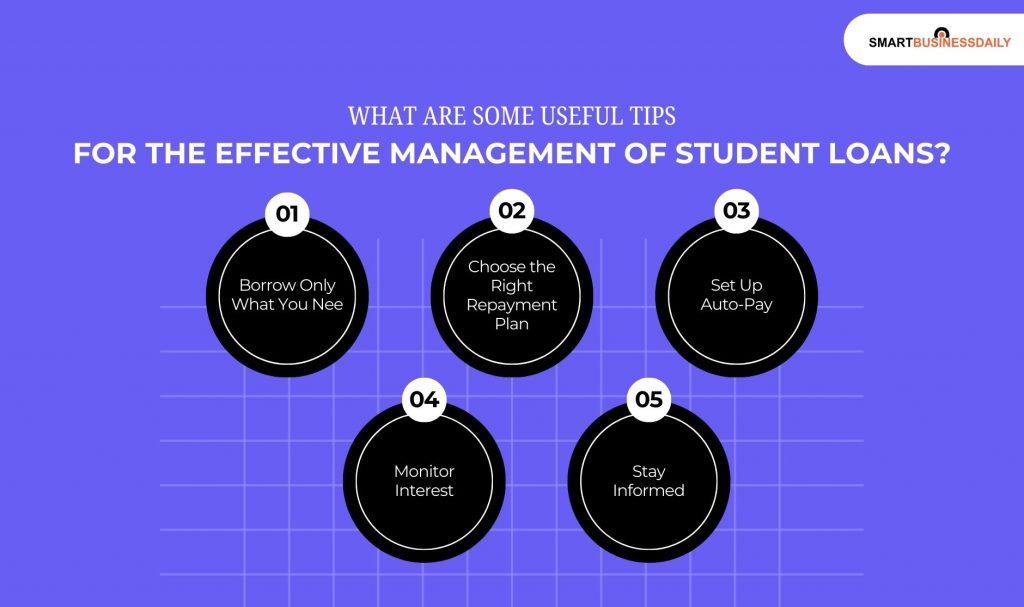

What Are Some Useful Tips For The Effective Management Of Student Loans?

1. Borrow Only What You Need

Your goals must be to avoid taking on too much debt. So, you need to find out the actual costs of your education. I would suggest that you include your living expenses as well.

So, all I am saying is that the wise decision is to borrow only what you need.

This will help you manage your debt better in the future. Also,. It will make your repayment easier once you graduate.

2. Choose the Right Repayment Plan

You need to pick a repayment plan that fits your income. Additionally, the plan must align with your career goals.

So, I will suggest that you go for options like income-based repayment. In fact, long-term loans are a good choice as well.

These can make it easier to manage your payments as you start your career.

3. Set Up Auto-Pay

You must set up automatic payments. This will ensure you pay on time each month.

Also, I know many such lenders who will offer a lower interest rate if you choose auto-pay.

So, this can drastically reduce the overall cost of your student loans over time.

4. Monitor Interest

Keep an eye on how interest accumulates, especially on unsubsidized loans. By monitoring interest, you can prevent it from increasing your loan balance during school or any deferment period.

5. Stay Informed

Stay updated on changes to student loan policies, forgiveness programs, and important deadlines.

This knowledge can help you take advantage of opportunities and avoid losing benefits.

What to Consider Before Using Traceloans.com for Student Loans

1. Credit Score Impact

Applying for loans and checking prequalification can affect your credit score.

Understand how each inquiry impacts your credit and work to maintain or improve your financial standing.

2. Interest Fees And Rates

Carefully compare fixed and variable interest rates, as well as any origination fees and late payment charges.

Even small differences can greatly impact your repayments over time.

3. Repayment Terms

Review the loan terms, including monthly payment amounts and grace periods.

Some plans offer flexibility, but longer terms usually mean higher interest rates. Choose terms that work for your financial situation.

4. Loan Purpose

Use the loan only for qualified educational expenses like tuition, housing, and supplies.

Misusing the funds can lead to financial problems or breaching the loan agreement.

5. Regulatory And Legal Compliance

Make sure you comply with federal and state regulations related to the lender.

While Traceloans.com works with trustworthy lenders, always read the disclosures, loan agreements, and privacy policies before signing.

Who Should Use Traceloans.com?

Traceloans.com is great for:

- Firstly, if you are one of the students, you will find it useful. You will be able to quickly compare different private loan options.

- Secondly, if you are a borrower yourself, you will also benefit from it. This will help you more if you have a little credit history and may need a co-signer for loans.

- Thirdly, graduates who are looking to refinance their existing student loans can use it.

- Finally, and most importantly, it will be useful for parents seeking financial support for their child’s education.

What Are The Different Repayment Plans And Interest Rates For Traceloans Com Student Loans?

Now, as the blog comes to an end, I wish to discuss all the plans and payment options you will find at this platform.

1. Variable VS Fixed Interest Rates

Fixed interest rates stay the same throughout the loan period, making payments easy to predict.

Variable interest rates can change based on market conditions, which means payments may go up or down over time.

2. Repayment Plans Driven By Income

You can use these plans to adjust your monthly payments. This will completely depend on your income. In fact, your family size will matter as well.

So, this makes them more affordable.

They are ideal for borrowers with lower incomes or those with irregular earnings.

3. Repayment Plans After Graduation

Graduated plans start with lower monthly payments, which increase every two years.

They are suitable for borrowers who expect their income to grow after graduation.

4. Extended Repayment Plans

These plans allow you to pay off your loan over a longer period, usually 25 years.

They reduce monthly payments. But they also increase the total interest that you have to pay over the life of the loan.

The Dynamics Of Traceloans Com Student Loans

Traceloans.com helps students compare, apply for, and manage their education loans easily.

It offers various lenders and terms, along with helpful tools for smart financial decisions and successful academic outcomes.