The Story of Financeville CraigScottCapital: Lessons Investors Can Draw

09 September 2025

5 Mins Read

- What was Financeville CraigScottCapital?

- Why did Financeville CraigScottCapital cease?

- 1. Excessive Trading (Churning)

- 2. Poor Supervision

- 3. Misleading Information and Records

- What Were The Penalties Imposed On Financeville Craigscott?

- Why Does The Financeville Craigscottcapital Saga Matter?

- Investors' Guide

- For the Industry

- For Trust in Markets

- Current Position of Financeville CraigScottCapital

- Important People Who Caused The Downfall

- How Was The Scam Discovered?

- What Are The Lessons You Can Learn From The Daily Investors?

- Always Trying To Keep It Simple

- Up Next..

Navigating the financial world is no less than going through a bewildering maze. You have a lot of companies, regulations, and risks, and it’s difficult to find out who you can trust. That’s why it’s necessary to study previous instances in which companies got into trouble.

One example is Financeville CraigScottCapital. The brokerage firm once promised big dreams to investors, but it all ended in a scandal and was forced to close shop.

In this article, we shall demystify what the company was, what went wrong, the sanctions it faced, and what lessons we, as average investors, can take from it.

What was Financeville CraigScottCapital?

Financeville CraigScottCapital was a financial services company in the form of a broker-dealer.

This means that they facilitated the buying and selling of financial securities, such as stocks, for businesses and individuals.

The business provided trading strategies in foreign currencies, among others, and aimed to be a respectable company providing fair investment opportunities.

They brought along a few basic necessities:

- Brokerage Services: Assisting clients in trading stocks and other financial instruments.

- Investing Strategies: Providing trading ideas and advice, more so in the foreign exchange market.

- Client Education: Giving tools to help investors learn how markets operate.

Initially, the business was on the up. It made waves in the market and appeared as a rising force in finance.

Unfortunately, massive issues were going on in the background that later contributed to its collapse.

Why did Financeville CraigScottCapital cease?

The firm didn’t fail overnight. Instead, many issues arose over time, and officials were implicated in the end. Let’s examine the main reasons.

1. Excessive Trading (Churning)

They were involved in something questionable called “churning.” This is when the brokers trade all the time, but it’s not on behalf of the client; it’s just to make a buck on their own part.

The brokers get paid, but the investors are paying high fees and ultimately getting taken advantage of.

This practice raised significant concerns for regulators and eroded trust between the firm and its clients.

2. Poor Supervision

The management in the firm did not pay close attention to its trading business. Through negligence, improper actions, such as churning, to thrive without strict supervision.

Lacking a sense of responsibility is generally a quick path for a financial firm into financial woes, and that is what took place in this scenario.

3. Misleading Information and Records

Another problem was the improper maintenance of records. Financeville CraigScottCapital was accused of having made false or misleading presentations.

That is a big deal among investors and regulators, as trust and transparency are essential in the financial industry.

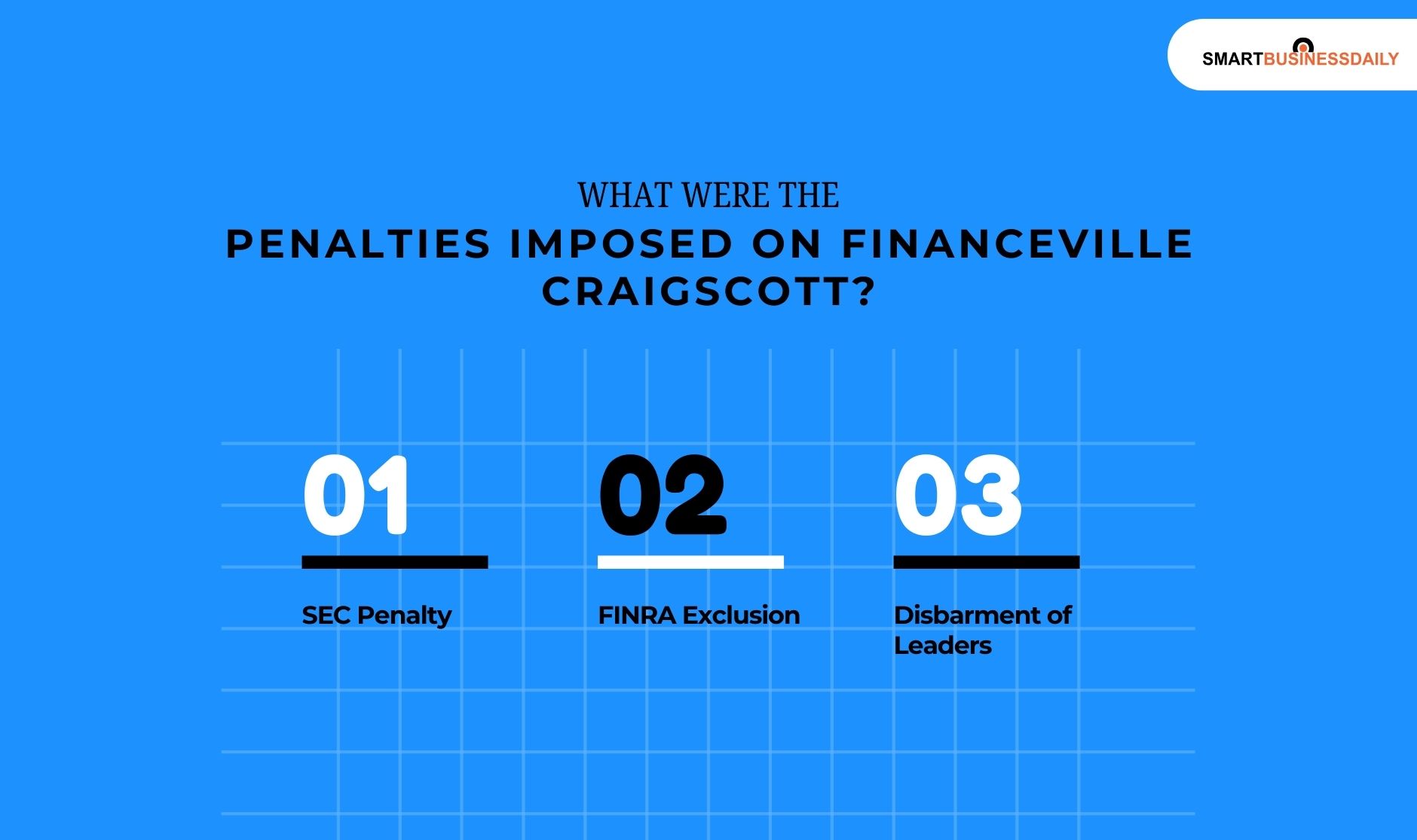

What Were The Penalties Imposed On Financeville Craigscott?

After the regulators investigated the company, the penalties were severe.

- SEC Penalty: The SEC, or U.S. Securities and Exchange Commission, penalized the company by $100,000. This indicated the company failed to abide by regulations.

- FINRA Exclusion: The Financial Industry Regulatory Authority, or FINRA, took a more stringent approach by banning the firm from trading. The firm without this license could not persist in the brokerage trade.

- Disbarment of Leaders: The top leaders, CEO Craig Scott Taddonio and Chief Operating Officer Brent M. Porges, were disbarred from practicing within the field of finance forever. Their careers in finance were basically over.

These penalties not only ended the company but also served as a warning to all others in business.

Why Does The Financeville Craigscottcapital Saga Matter?

At first glance, it would appear as if it were yet another case in which a fraudulent company has been revealed.

But the story of Financeville CraigScottCapital is something different. It holds important lessons for both investors and individuals in finance.

Investors’ Guide

It’s a cautionary tale that you need to check things out before entrusting a broker or investment firm with cash.

Learn about their background, if they are registered with authorities such as the SEC or FINRA, and be on the lookout for red flags such as excessive trading or murky details.

For the Industry

This example illustrates the need for regulatory organizations. Organizations like the SEC and FINRA protect investors and ensure that companies follow the rules.

Without regulating organizations, financial markets would soon become quite disorganized.

For Trust in Markets

These kinds of cases, unfortunately, hurt trust in financial markets. When there are wrongdoings, people are more likely to think twice before they invest.

That’s why corporations need to be clear and deal equitably—it’s not merely a question of missing fines but maintaining investor trust intact.

Current Position of Financeville CraigScottCapital

Now, CraigScottCapital in Financeville no longer exists as a business. Its trading license was revoked, its leaders are barred, and the company’s assets are likely frozen or liquidated.

That means, in essence, the company is finished, but we can all still learn from it.

Important People Who Caused The Downfall

Most were central to why and how the business failed and how it was run:

Craig Scott Taddonio (CEO): He is the head of the firm, who sets the tone and directs overall strategies.

His actions, or more accurately, his failure to ensure adequate monitoring, were significantly responsible for the firm’s bad conduct.

Brent M. Porges (COO): He was responsible for ensuring the adequacy and monitoring. But instead, the lack of controls contributed to the issues.

Beyn (Broker): Another broker who traded excessively, and as a result, there was a complaint and regulatory action.

How Was The Scam Discovered?

The collapse was no secret. Many sources cautioned the regulators:

- Whistleblower Reports: The employees reported what was going on in the company.

- Client Complaints: Investors who lost money were worried by excessive trading and inaccurate information.

- Regulatory Data Analysis: Through analysis of trading behaviors and complaints, the SEC and FINRA discovered unusual activities.

- FINRA Hearing: Following the investigation, a professional hearing verified the misconduct and penalties and announced them.

What Are The Lessons You Can Learn From The Daily Investors?

Then, how can ordinary investors like us draw lessons from Financeville CraigScottCapital?

First things first! Always Do Your Homework. Before working with a financial firm, research their background and whether they are registered with the regulators.

Secondly, you must watch out for red flags. If your broker is buying and selling a lot without a legitimate cause, it may be churning.

Thirdly, try to value Transparency. Here, you need a company that gives you precise and clear details, and not mixed-up or inaccurate data.

Lastly, I suggest that you learn the basics. Knowing fundamental ideas like brokerage fees, churning, and compliance can help you avoid getting taken advantage of.

Always Trying To Keep It Simple

Financeville CraigScottCapital was a brokerage firm that appeared good but was caught engaging in bad practices, such as trading excessively, not monitoring well, and providing inaccurate information.

The regulators intervened, penalizing them, shutting down their operations, and banning the executives.

The case shows that in finance, it is every bit as important to be ethical and follow rules as it is lucrative.

The most significant lesson learned by the investors is as follows: be informed, question, and never invest in a company without confirming it.

Comments Are Closed For This Article