How Is Gusto Payroll As A Service? – Let’s Find Out | Review, Pros & Cons, And Pricing

5 Mins Read

Published on: 29 May 2023

Last Updated on: 07 July 2025

- What Makes Gusto-Payroll A Really Great Product?

- How Does Gusto Payroll Work?

- Features Of Gusto Payroll Services

- Employee Benefits

- Onboarding

- Tax Compliances

- Time Tracking

- Analytics And Reporting

- User Accessibility

- Gusto Pros & Cons

- Pros

- Cons

- Gusto App Pricing

- How Long Does Gusto Payroll Take To Process Payments?

- Gusto Payroll: Your Ultimate Corporate Pay Tool

- Popular organizations rated Gusto #1 as payroll and HR software.

- It offers one single umbrella to keep your team happy and productive.

- And the pricing plans are easy to touch upon.

These are enough reasons for choosing the Gusto Payroll services. HR departments across different industries choose this tool for their payroll process and onboarding.

Even employees find the financial management app tailored for employee use quite efficient under Gusto.

The HR management and both local and federal tax filing become smooth using Gusto. But, users, including us, still believe that so many things can be better on this platform.

Go through this article to find out what is great about Gusto and why you should or should not consider this Payroll software.

What Makes Gusto-Payroll A Really Great Product?

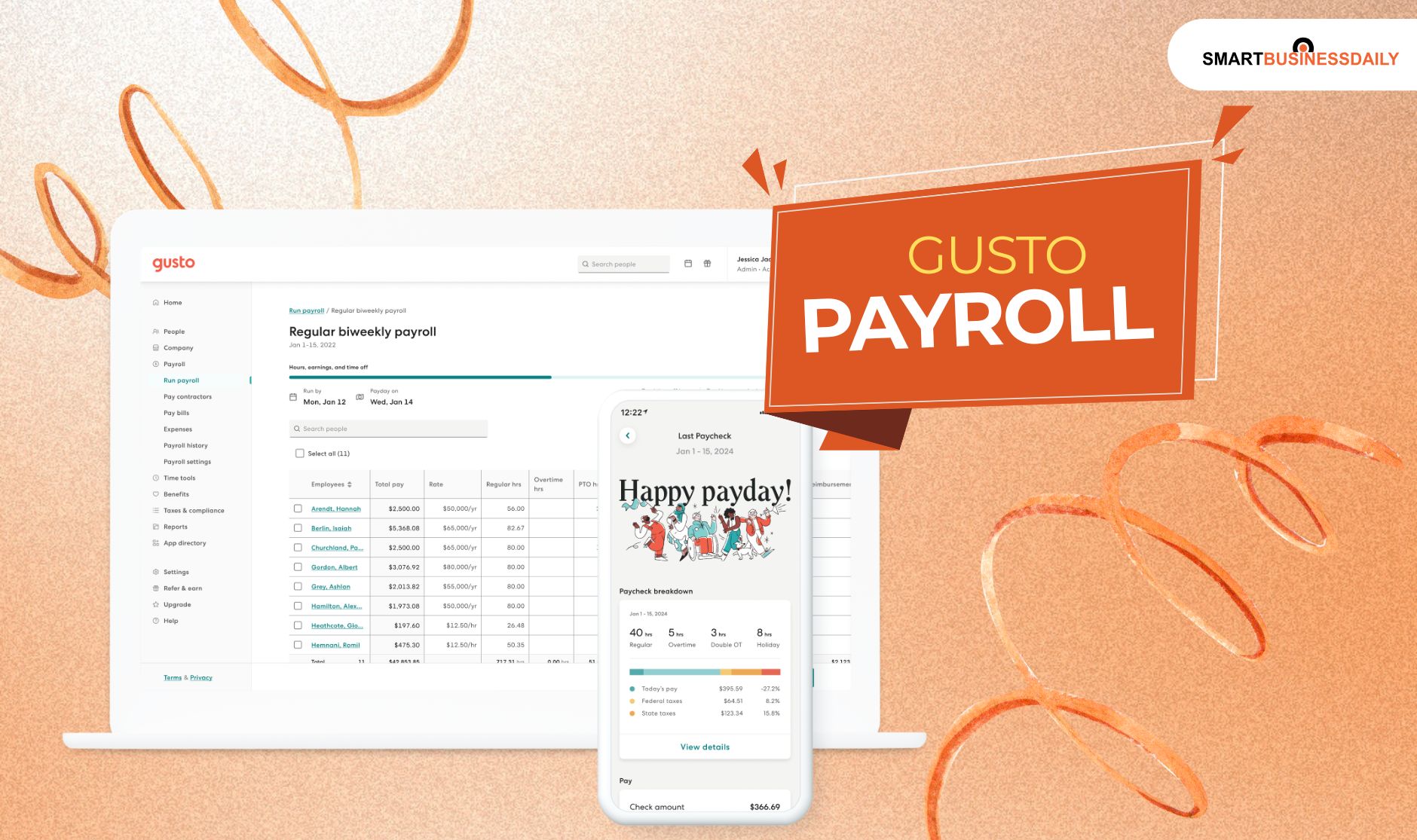

Gusto is one of the best payroll products available in the market. But what makes it great? For starters, its payroll processing and Payroll tax liability maintenance are noteworthy.

It stands out from the market competition thanks to its HR solutions alongside the payroll processing power.

You get a full suite of robust HR solutions helping you with hiring, onboarding, employee benefits, health insurance benefits, attendance and time tracking, compliance, and more.

The software packs both power and features, making everything under one system. If your company needs a native HR integration alongside payroll services, you should not look anywhere but Gusto (just a recommendation).

How Does Gusto Payroll Work?

Gusto is an all-in-one platform that makes payroll simple, and also provides benefits and HR for businesses.

It automates payroll, handles tax filings, and integrates with accounting and other business tools.

Gusto offers various plans based on features such as direct deposit speed, time tracking, and HR support.

Features Of Gusto Payroll Services

Here are some of the features of the Gusto Payroll services that might interest you –

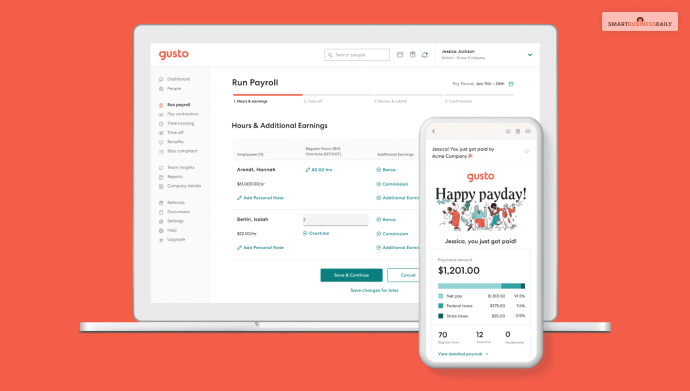

Gusto is the ideal payroll service for saving users’ time. It helps to calculate and file taxes with the appropriate government agencies in all the US states every time users run employee payroll. You can also use the AutoPilot feature to make Payroll run automatically.

Employee Benefits

Different payment option for different types of employment is supported on the platform. You can pay employees on an hourly basis or pay salaried employees through this payroll software.

You can also pay employees different rates based on their work and performance. The best thing is that you can use the platform from your smartphone or your tablet.

Gusto has been working to offer health insurance to more than 3500 small organizations that handle more than 100 carriers.

Their expert support is customized for vision, dental, retirement, HSAs, and FSAs. Employee benefits like workers’ compensation are also included in Gusto.

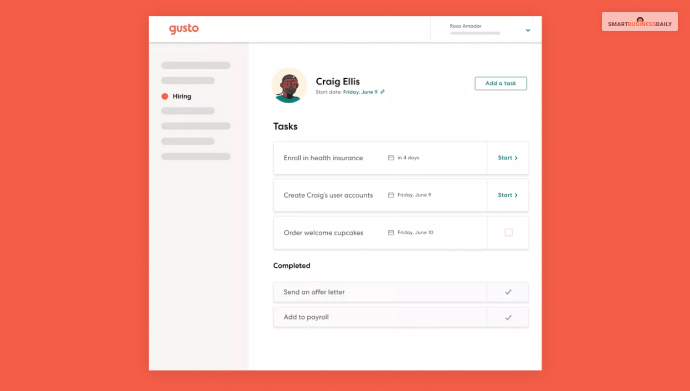

Onboarding

There are extensive and customizable tools for onboarding on Gusto. This is another useful feature of HR departments of different organizations.

You can get different necessary forms signed and get them stored online. Also, you can tailor offer letters for different employees.

You can also easily create software accounts for your employees on Gusto in Google Workspace, Zoom, Slack, Asana, GitHub, etc.

Tax Compliances

Gusto also files W-4s and contractor W-9s automatically. Each January, it creates W-2 and 1099 forms for tax returns. Payroll tax filing is made easy on the Gusto platform.

Time Tracking

The Gusto app lets Your contractors and employees track their time and hours. This helps with hourly payroll processing for different employees and contractors.

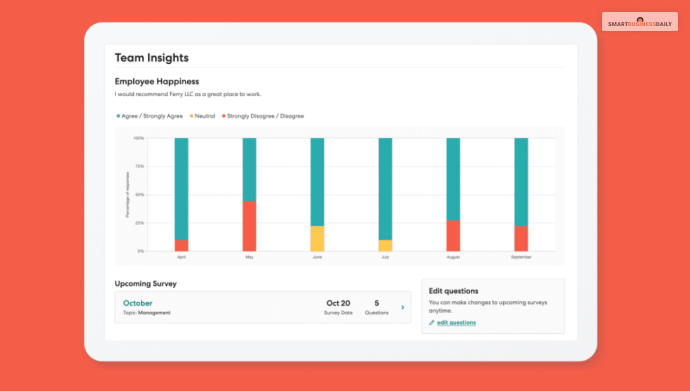

Analytics And Reporting

The Gusto Platform also allows users to access analytics and reporting. There are automatic compliance alerts, customized report templates, and numerous tasks that employers typically have to put manual effort into accomplishing. The customized software provides a comprehensive overview of your business’s health.

User Accessibility

Employers can let employees create individual accounts and track their information on Gusto. They can create their profiles and use them through the Gusto mobile app they can download on their phones.

They can also sign into the platform on the web and view and edit tax details, payroll data, see available PTO, and even clock in and out.

Users can also see income insights and personal tax documents like W-2s and Paycheck splitter through the Gusto mobile application.

Gusto Pros & Cons

But everything has a flip side. Some features of Gusto are very reliable, while some might need some work.

Based on customer requirements, here is a set of both pros and cons of the Gusto Payroll services –

Pros

- Now, there is no need to use different payment processing software for paying your independent contractors and employees. You do not need multiple platforms for processing payments.

- No matter which plans you are using, you can do unlimited payroll runs on all of them for different plans.

- New customers find the onboarding process very efficient and easy to use.

Cons

- It might be difficult for employers with staff members residing in different states to pay for the higher Premium package or the mid-tier Plus service of Gusto.

- You can only use the platform to process payrolls for employees living in the US. It is impossible to process employee payments from abroad using Gusto payroll software.

Gusto App Pricing

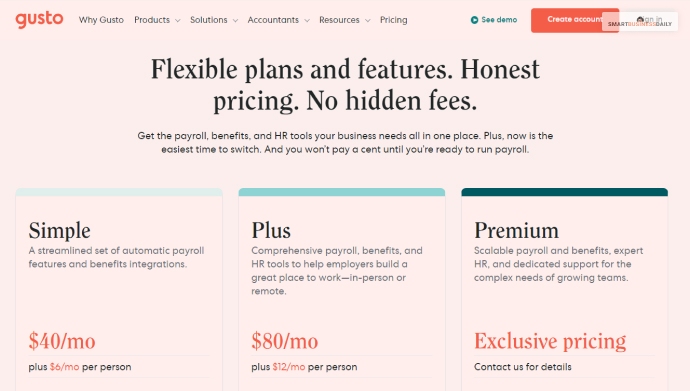

Users will have three different pricing plans for the Gusto payroll software – Simple, Plus, and Premium.

| Simple | Plus | Premium | |

|---|---|---|---|

| Price | $40 /month + $6 /person paid | $80 / month + $12 / person paid | Customize based on your business size |

| Features | ✔ Full-service single-state payroll. ✔ Health benefits administration. ✔ Employee’s financial benefits. ✔ Tools for onboarding and hiring. ✔ Custom admin permission. ✔ Limited customer support. | Al the features of a simple plan. In addition – ✔ Full-service multi-state payroll. ✔ Custom templates for onboarding. ✔ PTO management. ✔ Next-day direct deposit. ✔ Org charts and directories. ✔ Time tracking. | Every feature of the Plus membership. In addition – ✔ Dedicated HR support. ✔ HR Experts on Call performance review. ✔ Automated alerts for compliance. ✔ White glove migration for payroll and account setup. |

How Long Does Gusto Payroll Take To Process Payments?

Gusto Embedded offers next-day, 2-day, and standard 4-day payroll options. You can set these preferences using the “Update a company’s payment configs” feature.

When you use the with next-day payroll, you can process payments one business day before the check date.

Gusto Payroll: Your Ultimate Corporate Pay Tool

Users such as dynamic startup businesses and growing organizations with a medium to large size can use Gusto.

The platform offers various features with a pro-level of efficiency. The software is particularly well-suited for business owners and employers seeking to automate their operations.

The easy payroll and automatic tax filing make it very helpful for different organizations.

However, there are other alternatives in the market that you can consider. Hopefully, this article was able to answer your queries. For more info, please contact us through the comment section.

Comments Are Closed For This Article