Can You Get Traceloans.com Business Loans Efficiently?

30 October 2025

6 Mins Read

- What Is Traceloans.com Business Loans?

- What Are The Different Loans Available In Traceloans.com Business Loans?

- 1. Personal Loans

- 2. Business Loans

- 3. Home Loans And Mortgages

- 4. Auto Loans

- 5. Student Loans

- 6. Emergency Loans

- How To Apply For A Loan On Traceloans.com Business Loans?

- What Are Some Common Drawbacks Of Using Traceloans.com Business Loans?

- 1. High Interest Rates

- 2. Mixed Reviews

- 3. Risk Of Scams

- Does The Traceloans.com Business Loans Have A Bright Future?

Finding funding for a business in the United States can be quite a challenge. Many aspiring entrepreneurs have great ideas but struggle to secure the necessary funds.

They often turn to the internet for solutions, as it seems quicker and less complicated than the traditional bank route.

One name that pops up frequently is Traceloans.com Business Loans. But what exactly is this site?

Is it a lender, a resource, or just a platform that connects borrowers with lenders?

In this blog, I’ll break it down in simple terms. You’ll discover what traceloans.com business loans offer, how the loan process works in the US, what paperwork you’ll need, and tips on how to borrow money safely.

What Is Traceloans.com Business Loans?

Traceloans.com seems to be a platform focused on business and mortgage loans.

However, it’s not entirely clear if they provide loans directly or if they simply connect borrowers with actual lenders.

For those in the U.S., it’s crucial to do some homework before moving forward with an application.

Every lender here needs to have the proper licenses and adhere to state and federal regulations.

If Traceloans is just a middleman, make sure to identify the lender who will be managing your loan before you share any personal or financial information.

This extra step can help protect your sensitive data and ensure you’re working with a legitimate lender.

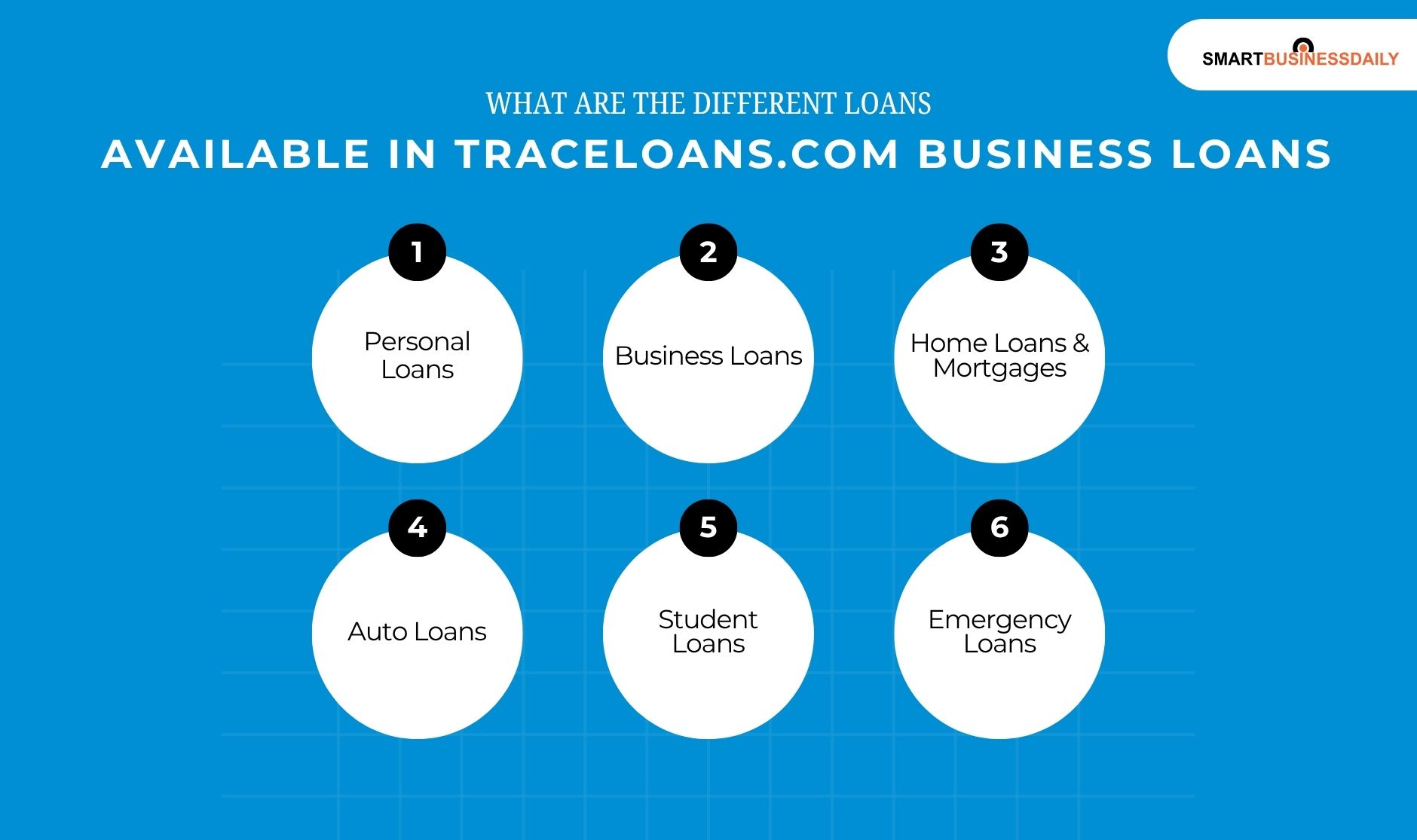

What Are The Different Loans Available In Traceloans.com Business Loans?

1. Personal Loans

Life can throw us some unexpected curveballs, and financial emergencies often seem to pop up out of nowhere.

In times like these, finding a reliable financial solution is essential.

That’s where Traceloans.com comes in. They offer personal loans designed with your needs in mind.

With flexible terms that can be tailored to your situation and a straightforward approval process, Traceloans.com makes it easier to access the funds you need when you need them most.

It’s all about getting you back on track without the stress of complicated procedures or hidden fees.

So when life unexpectedly challenges your finances, you can turn to Traceloans.com for a helping hand.

2. Business Loans

Starting or expanding a business is an exciting yet challenging journey, and it often requires substantial capital to turn your vision into reality.

At Traceloans.com, we understand the unique needs of entrepreneurs and offer tailored business loans that fit those specific requirements.

Our goal is to help you maintain a steady cash flow, so you can focus on what truly matters. You must grow your business and seize new opportunities.

With the right financial support, you won’t have to worry about missing out on potential growth; instead, you can pursue your ambitions with confidence and enthusiasm.

Let us help you take the next step in your entrepreneurial journey!

3. Home Loans And Mortgages

Owning a home is more than just a milestone. It’s a cherished dream for many people.

Traceloans.com understands the significance of this journey, which is why they make the process of securing a mortgage as smooth and accessible as possible.

Additionally, they offer a range of mortgage loans with competitive interest rates. These are tailored to fit your unique financial situation.

Whether you’re stepping into the world of homeownership for the first time or considering refinancing your current mortgage to take advantage of better terms, Traceloans.com has options that can accommodate your needs.

They have a dedicated team here to guide you through every step of the process.

Additionally, they ensure that you feel confident and informed. Trust me, you can turn that dream of owning a home into a reality!

4. Auto Loans

If someone is looking to buy a new car, Traceloans.com could be the ideal solution.

This platform specializes in providing auto loans that come with a user-friendly payment gateway.

So, it makes it easy for potential buyers to find an option that fits their budget.

With Traceloans.com, individuals can confidently drive away in their dream vehicle without the worry of financial strain hanging over them.

The company understands that purchasing a car is a significant investment, and they strive to simplify the process.

Additionally, it ensures a smooth and stress-free experience for their customers.

5. Student Loans

Education is an important investment in your future, and Traceloans.com is here to help students access the funds they need for

- Tuition

- Books

- Living expenses

With flexible repayment options available, students can concentrate on their studies without the constant stress of financial worries.

And once graduates start their careers, refinancing a portion of their student loans can provide an opportunity to lower interest rates or consolidate payments.

Also, this makes it easier and more affordable to pay off their debts over time.

6. Emergency Loans

Life can throw some unexpected curveballs our way, like medical emergencies or urgent repairs that can catch us off guard.

When these situations arise, it’s important to find quick financial solutions to ease the burden.

That’s where Traceloans.com comes in. They offer instant approval for emergency loans.

Additionally, this allows you to access the funds you need right when you need them, helping to provide that much-needed relief during tough times.

How To Apply For A Loan On Traceloans.com Business Loans?

Getting a loan on Traceloans.com is simple. Just follow these easy steps:

1. Start by heading to Traceloans.com. Take a look around and choose the type of loan that suits your needs best.

2. You’ll need to share some basic information like your name, income, credit score, and how much you want to borrow. It’s straightforward and shouldn’t take too long.

3. Next, you’ll upload a few important documents such as your ID, proof of income, and bank statements. Make sure everything is clear and legible.

4. After you submit everything, your application will be reviewed. You can usually expect to hear back pretty quickly about whether you’re approved.

5. If you’re approved, the money will be sent directly to your bank account, often within 24 hours. It’s a quick process to help you get the funds you need!

What Are Some Common Drawbacks Of Using Traceloans.com Business Loans?

These are the potential causes you must watch out for if you are taking a loan from Traceloans.com:

1. High Interest Rates

For someone with a challenging credit history, finding affordable financing options can feel daunting.

These high costs can make it even harder for them to secure necessary funds, such as for an unexpected expense or a large purchase.

It’s important for borrowers to carefully compare different lenders and seek out options that offer fair rates to ensure they aren’t overwhelmed by the costs.

This situation highlights the need for greater transparency in lending practices and more accessible resources for those who may be struggling financially.

2. Mixed Reviews

It seems like some users have had a positive experience, but there are definitely others who feel frustrated due to confusing terms or unexpected fees.

It’s really important to take the time to read everything carefully before you sign anything to avoid surprises later on.

3. Risk Of Scams

It’s really important to stay vigilant with your emails and phone calls to steer clear of any fake offers that might come your way.

Always take a moment to verify the sender or caller. Stick to websites that you know and trust.

Additionally, you need to be cautious about sharing your personal information with strangers. A little diligence can go a long way in keeping you safe!

Does The Traceloans.com Business Loans Have A Bright Future?

When individuals seek to secure loans quickly and efficiently, Traceloans.com stands out as the ultimate solution.

With its user-friendly interface and a variety of loan options, the platform has become a preferred choice for many borrowers.

Whether someone is in need of a personal loan, business loan, mortgage, or emergency funds, Traceloans ensures that they receive the best loan offers tailored to their specific financial needs.

Comments Are Closed For This Article