How to Secure a High Risk Merchant Account At HighRiskPay.com: Essential Steps and Tips

8 Mins Read

Published on: 11 June 2025

Last Updated on: 02 January 2026

- What Is The Concept Behind High Risk Merchant Account?

- The List Of High Risk Businesses

- High Risk Merchant Account At Highriskpay.com: The Benefits And Key Features

- 1. Rolling Reserves

- 2. Early Termination Fees (ETF)

- 3. High Chargeback Fees

- 4. Currency Conversion Fees

- Can You Mitigate Risks With High Risk Merchant Account?

- 1. Chargeback Prevention

- 2. Fraud Detection

- 3. Reliability

- Can The High Risk Merchant Account At Highriskpay.com Freeze Your Funds?

- 1. Monitor The Chargebacks Carefully

- 2. Implement Robust Fraud Prevention

- 3. Improve Transparency In Customer Service

- 4. Promote Documentation And Compliance

- 5. Enhance Processor Relationships

- Here Are The Success Stories That You Must Know About!

- How To Apply For A High Risk Merchant Account: A Step-by-Step Guide

- Step 1: Provide All The Basic Information

- Step 2: Now You Can Fill Out The Full Application

- Step 3: Sign And Submit Via DocuSign

- Step 4: Approval And Account Setup

- How To Handle A High Risk Merchant Account At Highriskpay.com Explained

Have you ever wondered what a high risk merchant account is and why so many businesses are turning to platforms like highriskpay.com for payment solutions?

If you run a business that’s considered “risky” by traditional banks—think online gambling, adult content, CBD, or travel—you probably already know how tough it can be to get reliable payment processing. That’s where high risk merchant accounts come into play.

In this blog, we’re going to break down what these accounts are, which industries need them, and why a high risk merchant account at highriskpay.com is one of the best options out there. Let’s dive right in!

What Is The Concept Behind High Risk Merchant Account?

Do you run a B2C business? Then you collect from your customers as well? In that case, you have heard the term merchant account multiple times.

If you are new to this business field, you may not be familiar with the term yet. But, yes! You do need one once your business is established.

A merchant account is similar to a bank account, specifically designed to accept customer payments. It can be made through your credit or debit card, or via any electronic transfer.

This is not just any kind of standard business bank account. Let’s say you are the merchant here!

Therefore, the merchant account will retain the funds until you transfer them to your primary business account.

The List Of High Risk Businesses

Let’s say you have started an online casino business. Now, you may face issues like fraud, chargebacks, and even regulatory scrutiny. Such companies are counted as high risk businesses.

Some common examples of high risk businesses include adult entertainment, gambling, pharmaceuticals, telemarketing, and cryptocurrency.

These kind of businesses often requires a high rate of money transfer and can be vulnerable to fraud or money laundering.

On top of that, the high risk businesses even require you to follow a specific type of business regulations.

- Adult Entertainment

- Gambling and Online Casinos

- Cryptocurrency and Forex

- CBD and E-cigarettes

- Subscription-based Services

- Debt Collections

- Nutraceuticals

- Airlines and Booking

- Coaching

- Auto Warranties

High Risk Merchant Account At Highriskpay.com: The Benefits And Key Features

Wait! Before you even decide on choosing highriskpay.com, let me take you through the key benefits and features of it. Here’s what sets them apart!

First comes simple and fast approvals. Trust me! HighRiskPay’s approval rate is something beyond crazy! Are you eager to know about it? It’s around 99%, and that too within 24-48 hours.

This helps them to ensure that your business is up and running quickly. Doesn’t matter what your credit history is!

Second comes competitive rates. Now, you may find some providers who can offer you a reasonably high price. However, highriskpay.com follows a pricing structure similar to that of traditional card processors.

The best part? There are no setup or cancellation fees!

We cannot simply ignore the comprehensive features of the course. HighRiskPay provides advanced tools and services.

Therefore, you can utilize services and tools to prevent fraud, manage chargebacks, and facilitate next-day funding, among other benefits. This can ensure a great payment operation.

HighRiskPay also works seamlessly with platforms such as Spotify, Magento, WordPress, and Wix. This flexibility in integration can make your payment process much easier.

Lastly, HighRiskPay also provides you with ongoing customer support of the utmost reliability. Their business team can efficiently tackle all kinds of challenges at every stage of the payment process.

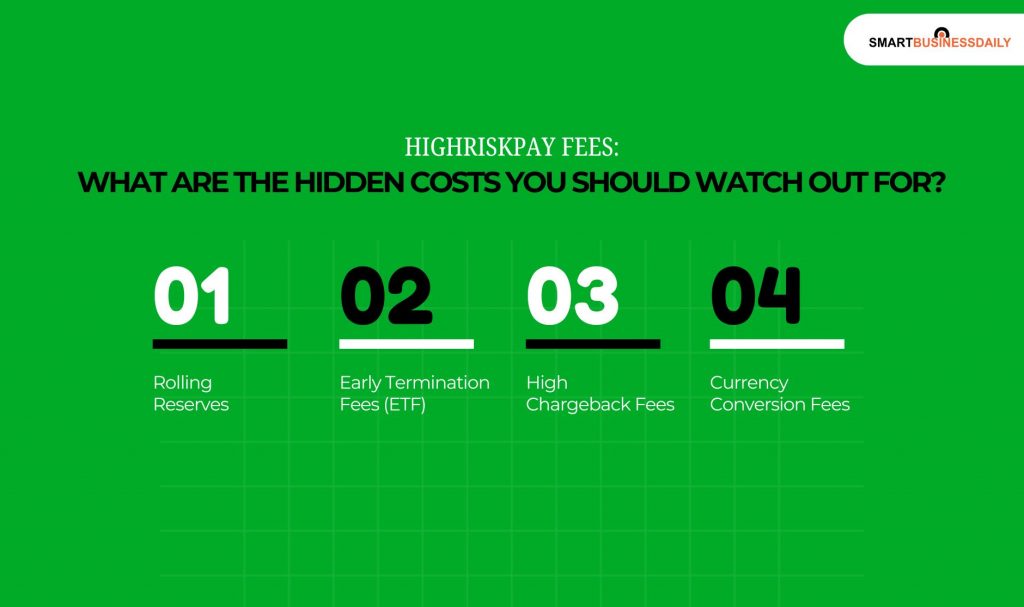

Highriskpay Fees: What Are The Hidden Costs You Should Watch Out For?

Of course, the high risk merchant account at Highriskpay.com will have certain hidden fees and costs that you must watch out for. Wanna know more about them? Read on.

1. Rolling Reserves

HighRiskPay, like other high-risk processors, may hold a part of your transaction volume in a reserve account.

This is usually around 5% to 10% and lasts for a set time, typically between 3 to 6 months.

They do this to cover possible chargebacks and financial losses. This can have a big impact on your cash flow.

2. Early Termination Fees (ETF)

Many high-risk processors require long contracts, usually between 12 to 36 months.

If you decide to switch providers or close your account early, you may have to pay high fees.

Sometimes, it amounts to hundreds or even thousands of dollars.

3. High Chargeback Fees

HighRiskPay provides basic tools to manage chargebacks. However, each chargeback can cost between $20 and $100.

If you have many chargebacks, you might also face extra monitoring fees or risk having your account suspended.

4. Currency Conversion Fees

If you’re dealing with international payments, it’s important to keep an eye out for things like currency conversion fees and cross-border transaction costs.

These extra charges can really add up, so it’s worth factoring them into your plans.

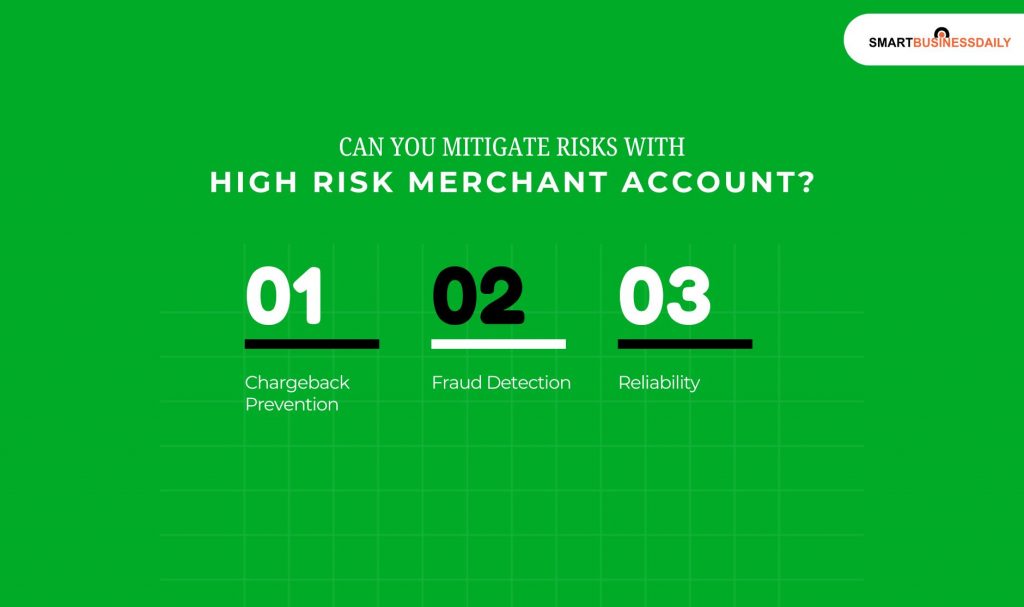

Can You Mitigate Risks With High Risk Merchant Account?

If you think HighRiskPay only provides you with the merchant account, then you are wrong. The platform can also help you mitigate all the potential risks associated with high-risk payment processing.

What are the most common risks you can mitigate? Let’s take a look:

1. Chargeback Prevention

First comes the chargeback prevention. This robust feature helps in managing chargebacks to minimize losses.

As a merchant, you can also prevent the merchant account from being terminated. Beneficial right?

2. Fraud Detection

Secondly, HighRiskPay also works on advanced fraud detection. They can help you with accurate detection tools to safeguard your transactions and all your liabilities.

3. Reliability

Last comes better reliability. HighRiskPay prefers maintaining long-term relationships with banks as well as financial institutions.

So, you can enjoy a stable and reliable service, even when your business operates in a challenging industry.

Can The High Risk Merchant Account At Highriskpay.com Freeze Your Funds?

Yes, it definitely can happen. HighRiskPay, like many payment processors that deal with high-risk businesses, might freeze your funds for a few reasons.

Some common ones are if there are too many chargebacks, signs of suspicious or fraudulent activity, or if your business isn’t following legal or regulatory guidelines.

They do this to protect themselves and ensure they’re following the rules set by card networks.

It’s all about managing financial risk while keeping everything in compliance.

These are a few ways you can avoid this:

1. Monitor The Chargebacks Carefully

Track daily dispute activity and aim to keep your chargeback ratio well below 1%.

Use pre-dispute alert tools (like Ethoca and Verifi) to resolve customer complaints with a direct refund before they escalate to a formal chargeback.

Auto-issue refunds for obvious refund requests to avoid a chargeback fee and hit to your ratio.

2. Implement Robust Fraud Prevention

Use security measures like Address Verification Service (AVS), CVV matching, and 3D Secure 2.2 to verify customer identity and reduce fraudulent transactions.

Be cautious of suspicious order patterns and set stricter fraud rules.

3. Improve Transparency In Customer Service

Provide clear and easy-to-understand refund, return, and cancellation policies on your website.

Ensure your billing descriptor is clear and recognizable to customers to prevent “unrecognized charge” disputes.

Address customer issues quickly and efficiently to minimize disputes.

4. Promote Documentation And Compliance

Keep all your business information, licenses, and KYC documentation current and accurate.

Additionally, you must always maintain meticulous transaction records. This includes customer communications and delivery confirmations. These will help you with evidence in case of a dispute.

Stay informed about industry regulations and ensure your practices are compliant

5. Enhance Processor Relationships

Choose a payment processor that focuses on high-risk businesses and understands your industry.

Additionally, you need to know how to communicate clearly. Whatever comes may, you must be honest about your business model.

Also, you must be clearly vocal about any challenges you might face.

It will show that you are actively managing risk. So, this will eventually build trust and possibly help you to negotiate better terms.

Here Are The Success Stories That You Must Know About!

HighRiskPay has become a go-to option for those operating in high-risk business fields. Reasons?

Better payment stability and high success! Let’s take a look at some of the success stories that can help you understand their impact.

A CBD retailer has been facing numerous issues because they were unable to find a suitable payment method. However, HighRiskPay solved the problems and approved their application in less than 48 hours.

This has been a great chance for them to carry on their operations significantly.

Now, you already know the adult entertainment business comes with a lot of risks. One of these providers faced a lot of issues with chargebacks and account terminations while working with the traditional processors.

However, the high risk merchant account at highriskpay.com and its efficient fraud prevention have been helpful for them to stabilize their transactions or maintain compliance with the credit card networks.

There has been a similar issue with a travel agency as well. Their high sales volume became tough to manage.

That’s when a high-risk merchant account at highriskpay.com came into play. This has been helpful for them to benefit from all kinds of competitive rates, along with reliable next-day funding.

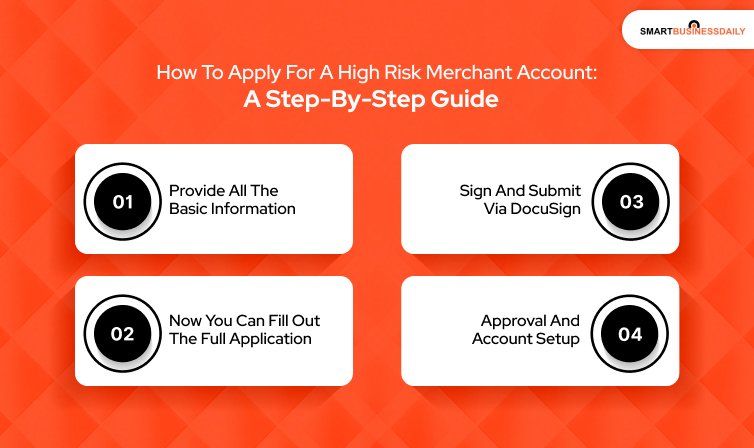

How To Apply For A High Risk Merchant Account: A Step-by-Step Guide

How to obtain a high risk merchant account with HighRiskPay merchant? Don’t worry! Here’s a straightforward and hassle-free guide for you!

Step 1: Provide All The Basic Information

You have to complete a short form. This would require your name, email address, phone number, and website details.

Step 2: Now You Can Fill Out The Full Application

After filling out the form, you will be required to provide additional business information. Here, you would have to talk about your industry, sales volume, and transaction history.

Step 3: Sign And Submit Via DocuSign

Once you are done filling out the application, you can just submit your completed application through the electronic medium.

Step 4: Approval And Account Setup

HighRiskPay usually approves an application in 24 to 48 hours. Once the approval is done, they set up your merchant account. And there you go! You can start processing your payments.

How To Handle A High Risk Merchant Account At Highriskpay.com Explained

If you’re in an industry that falls under the “high risk” category, getting the right merchant account isn’t just important—it’s essential.

A high risk merchant account at highriskpay.com offers simple approvals, fraud protection, and next-day funding, making running your business a whole lot smoother.

You don’t need to stress about chargebacks, delayed payments, or system compatibility. Whether you’re just starting out or already up and running, HighRiskPay gives you the tools and support to keep growing with confidence.

Ready to simplify your payments? High risk merchant account at HighRiskPay might just be your next smart move.

Comments Are Closed For This Article