The 8 Most Crucial Benefits of Taking Personal Loans for Home Maintenance

5 Mins Read

Published on: 11 April 2022

Last Updated on: 09 October 2024

toc impalement

It is no secret that even the smallest of home improvements can cost a lot of money. However, you can make your renovation project more affordable by taking a personal loan for home improvement, an unsecured personal loan explicitly tailored for renovation purposes.

According to your needs and the interest rate you can get, a personal loan may be a good choice for home improvement.

However, other alternatives might be more cost-effective in the long run. In contrast, using a personal loan is the best option for doing your home maintenance.

Firstly, compared to home improvement or renovation loans, these loans are relatively more straightforward to acquire. Your home’s renovations and repairs can be financed with a home improvement loan.

For example, you may be able to use it to remodel a bathroom or a kitchen, build a garage, refinish a basement, or install a swimming pool.

In addition, you can use loans for emergency repairs and smaller jobs like installing new windows or solar panels in your home.

However, acquiring home improvement or renovation loans is a bit more complicated than getting personal loans, especially if you live in the Oceania region, such as Australia & New Zealand.

Therefore, the safest and fastest way of getting loans to fund your home renovation is to apply for a personal loan.

Luckily, many online loaning facilities in the region will give you a personal loan almost instantly once you fulfill their criteria.

Websites such as nectar.co.nz are convenient in this regard. So, if you need to apply for a personal loan, check it out.

With that said, let’s look at some other reasons why acquiring a personal loan for home renovation is the wiser choice.

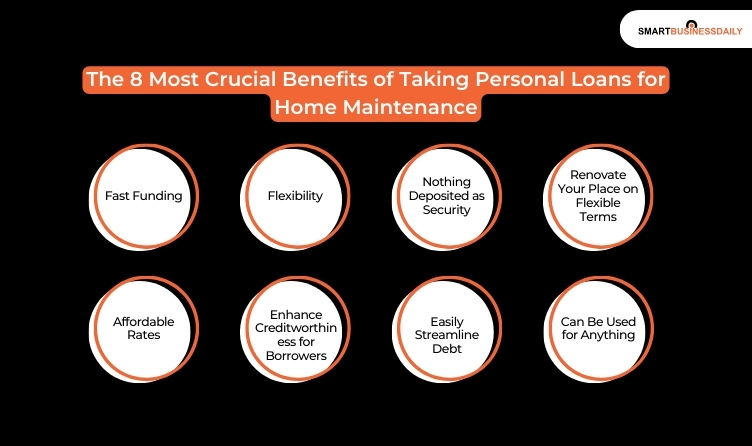

The 8 Most Crucial Benefits of Taking Personal Loans for Home Maintenance

Personal loans can really help you in a myriad of ways when it comes to home maintenance and improvement. However, having a generalized idea is never enough.

Hence, here are some of the most crucial benefits of taking out a personal loan for your home maintenance.

Let’s go!

1. Fast Funding

It is quick and easy to apply for a personal loan, and the approval process is fast. The entire process typically takes applicants a few hours or a day.

In addition, most banks in New Zealand offer online services to collect borrowers’ basic financial and personal information.

However, the application process is straightforward; you get your funds within a week or two after approval.

2. Flexibility

In addition to being versatile, personal loans can be used for any purpose. They are different from other, more restricted types of loans, such as mortgages, student loans, and auto loans.

Basically, you can use them to fix leaks, change your paint theme, or remodel your entire home.

3. Nothing Deposited as Security

Contrary to popular belief, loans are mostly unsecured. By utilizing this type of loan, the borrower does not have to use any assets as a guarantee; you do not have to worry about your lender repossessing your possessions if you cannot pay them back on time.

Unlike home loans, auto loans, and mortgages, a personal loan does not require a down payment. As far as collateral is concerned, personal loans for home improvements are the most secure option.

Related Guide: Types of Home Loan Interest Rate

4. Renovate Your Place on Flexible Terms

When you meet all the eligibility criteria for a personal loan as a salaried borrower, you can qualify for low interest rates. You can also extend the repayment period to make EMIs more affordable.

A typical loan can be repaid over 60 months. Therefore, this will give you ample time to make payments and be debt-free. To plan repayment for a personal loan, use an online EMI calculator.

5. Affordable Rates

The annual percentage rate (APR) on personal loans typically ranges from just 3% to 36%. Creditworthy applicants usually receive the best rates.

Despite the higher rate range, many applicants qualify for an APR that is lower than that of a standard credit card. Nevertheless, these rates are higher than secured loans, such as home equity loans.

So, weigh your options before choosing one.

Consider prequalifying with top lenders to see what kind of interest rate you’re likely to get when considering applying for a personal loan.

6. Enhance Creditworthiness for Borrowers

In the case of a personal loan, you must pay the outstanding balance regularly. Experian, Equifax, and TransUnion credit reporting agencies typically report your payment record to the lenders.

Payment history accounts for 35% of your FICO credit score, so consistently making on-time payments will improve your credit score. Late payments or defaults can hurt your credit score, which will make you suffer, making future credit more challenging.

7. Easily Streamline Debt

Borrowers can pay off their credit card and individual loan balances with a debt consolidation loan, streamlining their finances.

It will reduce your monthly payments, and if your credit score has improved since you took out your other loans, it may result in a lower overall interest rate.

Personal loan lenders specialize in debt consolidation and will pay off your other debts directly rather than sending you cash.

Related Guide: 5 Tips to Avoid Credit Card Debt

8. Can Be Used for Anything

You can use personal loans to cover various expenses, including auto repairs and home improvements, as well as event-related costs, such as weddings.

Loan funds can be used for various personal, household, and family purposes. Lending for illegal activity is prohibited.

You can also use private loan funds to purchase real estate, start a business, or pay for postsecondary education, depending on the lender.

Final Words

You know more about how a personal loan for home improvement can help you. However, we encourage you to consider your priorities and overall financial situation if you think of a personal loan for home improvements.

Consider your credit score, your overall financial picture, and the interest rates that would likely apply in light of your credit score and equity in your home before choosing secured or unsecured borrowing.

Always opt for a loan that you can quickly pay off. Don’t overburden yourself because doing so will only damage your eligibility and credibility. Keep following our page for more such financial content.

Read Also:

Comments Are Closed For This Article